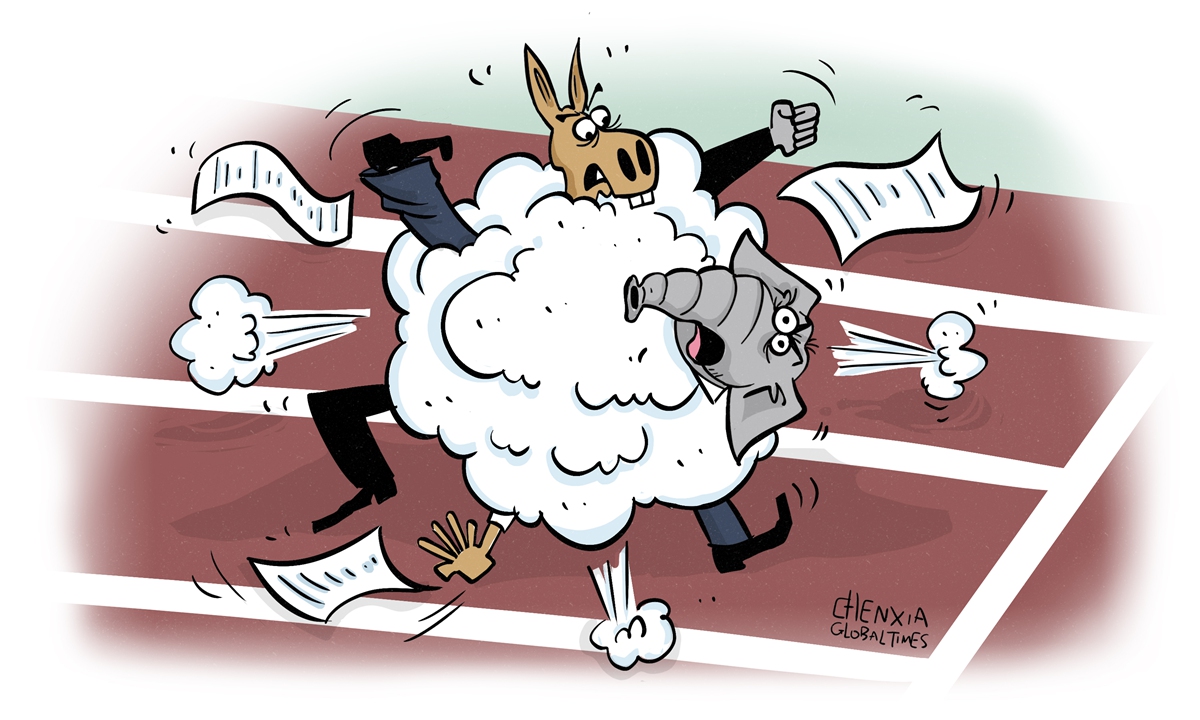

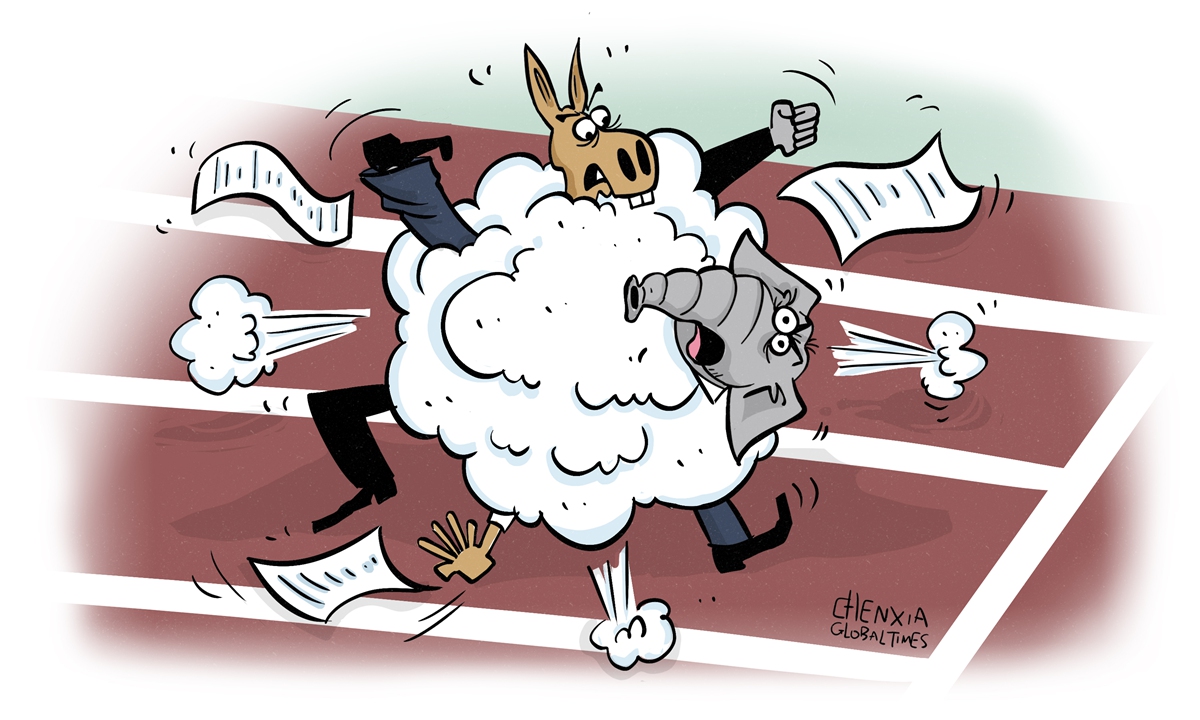

Illustration: Chen Xia/Global Times

There are a range of diverse voices in the US on how to read and treat China's rapid economic progress since 2008 when the US slipped into a financial debacle and a subsequent Great Recession. Some say that China's impressive economic rise, fueled by its opening-up to global trade and pursuit of market reforms, is reshaping the economic landscape in the Asia-Pacific, while a rising group of US elites fret and fear that China's rise might displace regional and global order dominated by the US.

US President Joe Biden defined in January in his State of the Union address that the relationship between the two global powers is that of strategic competitors, claiming that his country stands "in strongest position" to compete with China. His signature "decoupling" or "de-risking" from China is a departure from US' previous policy of constructive engagement.

Not everybody in the US shares Biden's thinking and policy orientation, with a growing number of renowned scholars and essayists warning that the US doesn't have a lock on any systematic advantage and whole-society cultural mandate to compete with China. Indeed, the US is divided and increasingly polarized. The US' highly partisan and often confrontational politics involving the Republicans and Democrats, and the widening gap and feud between the haves and have-nots, mean the country faces an insurmountable obstacle and difficulty to take on China in future competition.

The scholars, well informed and far sighted as they are, advocate good-willed cooperation with China to pursue mutual benefit and co-prosperity by the largest possible magnitude, because they are increasingly convinced that the US is not able to deter China's growth. For example, from the beginning of 2020 until the end of last year, China's economy expanded a cumulative 14 percent after adjusting for inflation, while the US economy grew by less than 6 percent.

The IMF forecasts that China's GDP growth will reach 5.2 percent this year, compared with 1.6 percent projected for the US. In the first three months, real GDP rose 4.5 percent in China, while the US GDP increased only 1.3 percent. Meanwhile, China's consumer price levels have been aptly controlled at below 2 percent, while the US inflation rate stubbornly persists at around 5 percent at current stage - meaning the US Federal Reserve will have to maintain longer its benchmark interest rate at the elevated 5-5.25 percent, which significantly drives up borrowing cost and discourage investment.

Despite the naysayers across the mainstream US media who always disparage China's economy by drumming up China's economic challenges such as an aging population and growing youth unemployment, global business titans from Asia, Europe, the Middle East and America are now thronging to China to obtain their first-hand gauge of the Chinese market post-pandemic.

Many businessmen are just elated with the rapid recovery and vow to invest more, ramp up their production capacity and explore new opportunities in China. Steven Rattner, a former US official, recently wrote an essay in the New York Times depicting China's growth as "formidable," warning fellow Americans not to believe some US media's opinionated narrative that China's economy is to crash.

Green renewable energy development and electric-battery powered vehicles are considered one of the new-generation drivers of economic growth - which also help counter global climate change by improving the earth's atmosphere. Although global competition in this new sector will go on and may accelerate, China has already taken a leading position.

According to statistics, China is home to 75 percent of the world's battery manufacturing capacity, and last year nearly 60 percent of global sales of electric cars, buses and trucks were in China. The country manufactures about 80 percent of the world's solar panels, and it accounts for nearly half of the world's onshore and offshore wind turbine capacity.

Energy policy plays a crucial role in shaping a country's economic competitiveness. Sadly, the previous Obama and Trump administrations, representing two different political ideologies, had distinct approaches to energy policy, which had profound complications - proof that the political detachment of the Democratic and Republican parties is hamstringing the country's core interests and global competitiveness.

Obama's American Recovery and Reinvestment Act of 2009 appropriated $70 billion in tax credits and direct spending for programs involving clean energy. One year after Obama took office in 2010, Tesla received a $465 million federal loan. When Trump came into power in 2016, he prioritized expansion of fossil fuel production, including oil, gas and coal. He rolled back on Obama's Clean Power Plan, withdrew from the Paris Climate Agreement, citing concerns about the impact on US economic sovereignty.

Meanwhile, inflation has been inhibiting the US economy since the second half of 2021 and continues to eat into the pocketbooks of US families. The Federal Reserve could do little but tighten its monetary policy by raising rates. Kristalina Georgieva, head of the IMF, on Friday warned that US interest rates would need to stay higher for longer to tame inflation that had been more persistent and entrenched in the US economic system than anticipated.

What caused this high inflation in the first place? US politicians are reluctant to admit that it is Trump's unprecedented tariffs war with China triggered the price level to rise in the inception phase, which was later exacerbated by Biden's senseless fiscal splurge of $1.9 trillion stimulus spending in 2021.

US Secretary of Treasury Janet Yellen said the US' current top economic priority "is to rein in inflation" and protect public confidence in the US banking system after the failures of three regional banks. She has intermittently called for lifting of Trump's tariffs on Chinese goods. But till today, her voice was inundated in oppositions in the Biden administration who wrongly believes trade war will pummel China's economy, while America's inflation will resolve on its own. It will not.

Further, in a recent development, the US government and market traders are euphoric that Biden and his Republican opponents avoided a federal default by approving the raising of the nation's $31.4 trillion debt limit. Almost everyone is happy with the debt ceiling increase, but nobody has shown any interest in reducing the surging debt, which is poised to top $50 trillion by the end of this decade. Won't the bulging fiscal arrears act like a ticking time-bomb that will one day detonate and upend the US' avowed contest with China?

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn