Japan's ambitious chip plan faces serious risks amid fierce competition, geopolitics

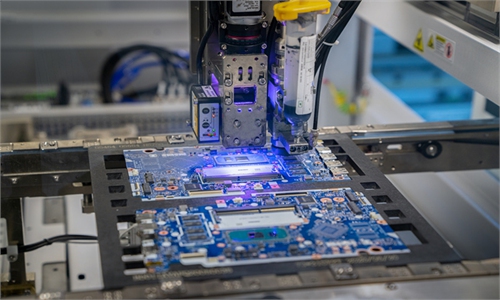

A worker tests semiconductor chips in a factory in Yancheng, East China's Jiangsu Province, on April 14, 2023. Photo: VCG

Japan on Tuesday released a revised strategy for its semiconductor industry, which includes an ambitious sales goal, but there are serious challenges amid geopolitical tension and increasingly fierce competition in the industry, Chinese analysts said.The plan will intensify the stiff competition among major chip production hubs, including South Korea and the island of Taiwan, underscoring mounting hurdles for Washington's attempt to form a "Chip 4" alliance in an attempt to contain the technological rise of China, analysts noted.

According to the plan, the country aims to increase sales of semiconductors to more than 15 trillion yen ($108 billion) by 2030, tripling the 2020 figure. The plan is part of Japan's strategy to put chips at the center of its economic security policy, according to Japanese media outlets.

However, the ambitious plan faces risks and challenges, analysts noted. First and foremost, even if Japan, with its existing advantages and ongoing efforts, can produce such a volume of chips, it could face a serious challenge in finding buyers, due to Japan's own restrictions on relevant exports.

"China is one of the most important buyers of chips globally. Any country that moves to restrict exports of chip products to China will hurt its own chip manufacturing industry," Liang Zhenpeng, an independent technology industry analyst, told the Global Times on Tuesday, pointing to Japan's recent restrictions.

On May 23, the Japanese government announced that it will include 23 items, including advanced equipment for semiconductor manufacturing, to a list of regulated exports. The move, which was scheduled to take effect in late July, followed similar steps taken by the US government.

While Japanese officials said that the move was not targeting any specific country, the move is widely seen as being aimed at China. Chinese officials have harshly criticized the move and warned that it could put bilateral trade in the field as well as the global chip supply chain at risk.

"If Japan insists on imposing restrictions on China-Japan semiconductor cooperation, it will lose not only China's huge market, but also Japan's own business reputation and the future of the semiconductor industry," China's Ambassador to Japan Wu Jianghao said in a speech to Japanese business leaders on Friday, according to an official transcript released on Sunday.

Semiconductors are Japan's second-largest export product after vehicles, and also the largest export commodity to China. Japan was the top exporter of semiconductor manufacturing equipment to China in 2022, according to media reports. However, amid rising tension, Japan's exports to China plunged 20 percent in the first quarter of 2023, bringing total bilateral trade down by 11.5 percent.

Wu said such a trend calls for reflection and should be reversed. He pointed out that the plan is seeking to reestablish Japan's semiconductor hegemony, and continuing on the path designed by the US means "lose-lose" for both China and Japan and victory for only the US.

Beyond growing tension with China, Japan's chip ambitions also face fierce competition from many economies in the Asia-Pacific region and around the world, including the US, South Korea and China's Taiwan region, despite Washington's attempt to form a chip "alliance" against the Chinese mainland, analysts noted.

The US, in particular, has been moving swiftly to bolster its chip industry both through protectionist domestic industry policies as well as geopolitical maneuvers globally. For example, the so-called CHIPS and Science Act passed in late 2022 includes 25 percent tax credits for new chip investments and some $50 billion in additional public investment.

Amid rising concerns of a hollowing-out of their chip industries, South Korea and China's Taiwan region have introduced similar policies to boost local chip manufacturing. Addressing these concerns, Taiwan Semiconductor Manufacturing Co said on Tuesday that its production of the most advanced microchips will remain on the island, despite its overseas expansion, including in the US.

While Japan's chip industry dominated the global market in the 1980s, it has been on a downtrend since the US cracked down on the Japanese industry by forcing it to sign a deal detrimental to the sector. Japan's plan to revive its chip industry against such fierce competition will face great uncertainty and challenges, analysts noted.

"There aren't many [semiconductor companies in Japan] that develop particularly well, many are in the mode of 'resting on their laurels'," a chip industry insider surnamed Liu told the Global Times, adding that Japan is no longer an ideal hub for manufacturing but instead a supplier of upstream materials.