Summer Davos showcases China’s high-quality development drive

Attendees confident China will remain world’s growth engine

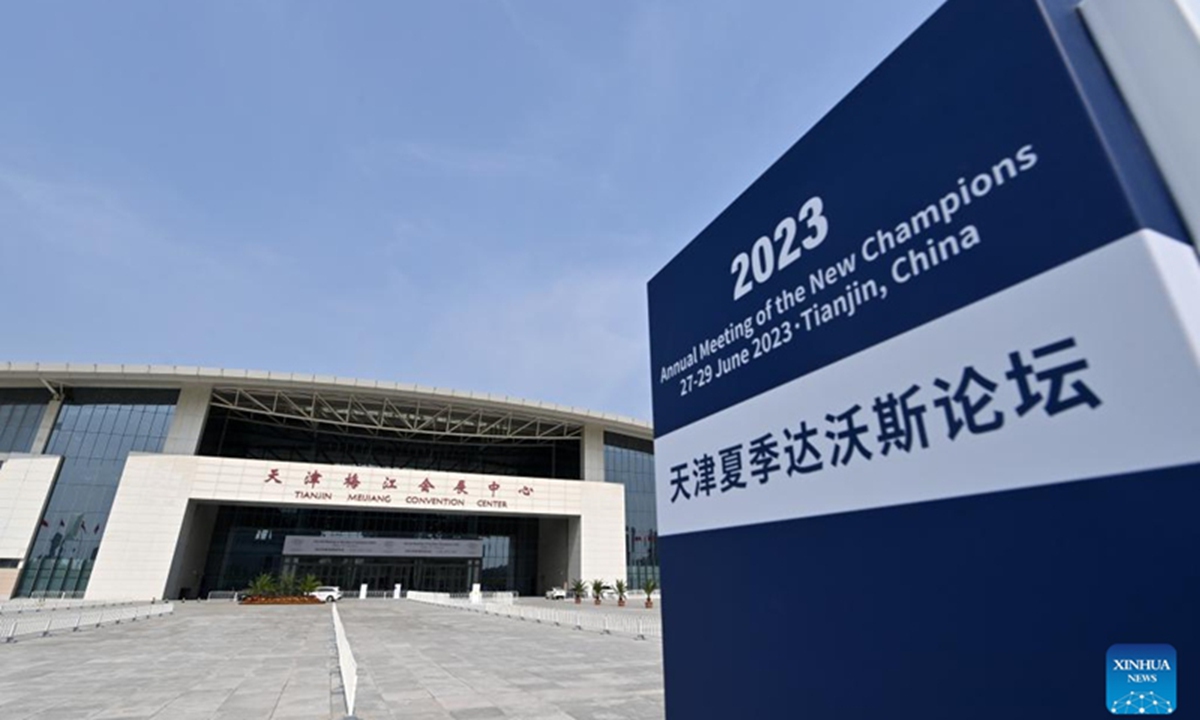

This photo taken on June 25, 2023 shows a view of the Tianjin Meijiang Convention Center, the venue for the 14th Annual Meeting of the New Champions, also known as the Summer Davos Forum, in north China's Tianjin Municipality. Photo: Xinhua

Officials, economists and entrepreneurs attending the Summer Davos in North China's Tianjin have expressed full confidence in China being able to achieve its growth target of around 5 percent for 2023, with some putting an even higher forecast, as the global gathering of business elites acknowledged China's continued role as the driving force for the global economic recovery.

They also noted that China could roll out more policies due to the current downward pressures caused by an uneven recovery in order to tap the vast potential of high-quality development.

The World Economic Forum's 14th Annual Meeting of the New Champions (AMNC) concluded on Thursday, having drawn the attendance of 1,500 participants from business, government, civil society, international organizations and academia.

"The world is relying on the great growth engine of the Asia-Pacific," WEF President Børge Brende said at the closing ceremony, noting that China will contribute 36 percent of global growth this year.

Observers noted that the successful holding of the Summer Davos became a confidence booster for China as it allowed people from all over the world to gain a closer look into the vitality of the Chinese society and economy after a hiatus of four years. Prime ministers of four countries including Barbados, New Zealand, Mongolia and Vietnam took part in the event.

China will continue to provide strong dynamism to the world's economic recovery and growth, Chinese Premier Li Qiang said when addressing the opening of the 14th AMNC.

"Our development remains unbalanced and inadequate. Yet such a situation is also where China's development potential and space lie," Li said.

China is expected to achieve this year's economic growth target of around 5 percent, with the growth in the second quarter expected to surpass that in the first quarter, the premier said, stressing that China has full confidence and the capability to achieve steady and sustained high-quality development of its economy in a long time to come.

Attendees and observers following the Summer Davos said the premier's remarks helped shaped opinions of the outside world, fostering confidence at a time when the Chinese economy is facing pressure.

"I have confidence that China can do whatever they put their mind to. They have an amazing total addressable market. They have 1.4 billion people, they have the second largest economy in the world. They have some of the greatest entrepreneurs that have ever set foot on the face of the earth. So I've no doubt that China will continue to grow and can reach targets in this year and years in the future," Robert H. McCooey, vice chairman of NASDAQ, told Global Times on the sidelines of the forum.

As Chinese economy faces multiple downward pressures ranging from a complex global geopolitical situation, weakening demand due to the spillover effect of US monetary policy shockwaves, some financial institutions have recently downgraded China's growth outlook for 2023, but more institutions and economists lean toward an uptick.

"After the impact of the epidemic gradually faded, China's economy and society have resumed normal operations and demonstrated a resilient recovery so far this year. We see 2023 growth at above 5.5 percent considering the low base effects and a ferocious recovery of both exports and retail sales shown in the January-March quarter," Patrick Tsang, CEO of Deloitte China told the Global Times on the sidelines of the Summer Davos on Thursday.

On June 21, Fitch Ratings raised China's 2023 forecast to 5.6 percent from 5.2 percent after a swifter-than-expected reopening rebound in the first quarter of 2023.

The recovery has faltered somewhat in recent months but consumption continues to normalize and macro-policy is starting to be eased, according to Fitch.

Experts attending the Summer Davos also suggested how China should better shape its transition toward high-quality development.

"The [economic] growth can't just come from infrastructure spending and more government spending. It has to come from the private sector as well. And that's the only way to sustain long-term growth, but also provide enough employment for the future," Jin Keyu, a professor from the London School of Economics and Political Science, told reporters on the sidelines of the forum on Wednesday.

A fiscal stimulus is needed and, and it could be more government spending, but could also involve cutting the interest rate for small and medium-sized companies, reducing their cost of capital burdens and providing more financing, Jin noted.

Zhu Min, vice-chairman of the China Center for International Economic Exchanges, said at a session of the economic forum on Thursday that high-quality growth needs a paradigm change. "High-quality growth means a few things: digital, green and inclusive [development], which will not be led by specific sectors but the paradigm shift of the whole society," Zhu said,noting that the country will be able to reach the about 5 percent GDP growth target this year.

Li Yong, a senior research fellow at the China Association of International Trade, told the Global Times on Thursday that despite some downgrades, so far there has not been a single agency to put the forecast at below 5 percent, which means the consensus on the growth of the Chinese economy this year remains unchallenged. And should China grow at 5 percent, it will still be a major contributor to the world's economic growth, Li said.

Li predicted Chinese economy will see stronger growth momentum in the second half, fueled by the pursuit of high-quality development by China, and the implementation of more supportive policies.

"It is clear policymakers are pursuing a higher quality growth and a more balanced approach in light of increasing external uncertainties. Advanced manufacturing and alternative energy will be the backbone of China's already competitive manufacturing sector," noted Tsang from Deloitte China.