China's move on niche metals export control 'not targeting' any country, aimed at protecting its interests amid 'chip war'

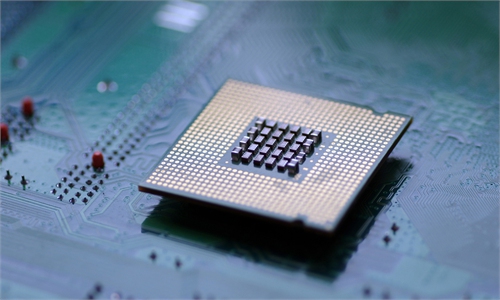

An engineer analyzes chips at a chip factory in Nantong, East China's Jiangsu Province in February. Photo: VCG

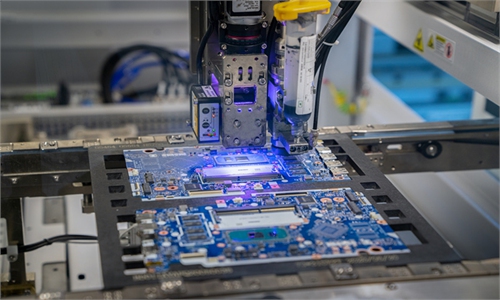

China's move to impose export controls on two niche materials widely used in the manufacturing of semiconductors and other high-tech components has put many in the West on notice as they continue to escalate a chip war against China, with officials and companies in countries such as the US and Japan scrambling to gauge potential impacts.

In China, officials have maintained that the export controls on gallium and germanium are not targeted at any specific country, but intended to protect China's national security and interests. While analysts stressed that the move is necessary as the West seeks to crack down on China by restricting exports of chips and other products that are made with Chinese materials and metals.

In a notice issued on Monday night, China's Ministry of Commerce (MOFCOM) and General Administration of Customs (GAC) said that starting on August 1, exporters are required to apply for permission before exporting items related to gallium and germanium. In the application, exporters must provide relevant export contracts, proof of the end users and end uses, as well as information on the importers and the end users.

Noting the move is aimed at safeguarding China's national security and interests, MOFCOM and the GAC notice said that for exports of listed items that have a major impact on national security, MOFCOM and other departments will report to the State Council for approval.

Asked about the move at a regular press conference on Tuesday, Mao Ning, a spokesperson for the Chinese Foreign Ministry, said that it is an international common practice for the Chinese government to implement export controls on relevant items in accordance with the law, and it does not target any specific country.

While the notice did not mention an outright ban on the export of the two materials, the move already sent a shockwave across the global tech industry, with many foreign media outlets portraying the move as China's retaliation against the West's bans on chip and other high-tech supplies to China.

Both gallium and germanium are widely used in the manufacturing of chips, communication and defense equipment, and other high-tech components. Gallium for example is used in compound semiconductors, while germanium is widely used in fiber-optic communication and night-vision goggles. China is the top supplier of both materials, with its exports of gallium accounting for 94 percent of global supply and that of germanium accounting for 83 percent, according to Bloomberg.

"China has hit the American trade restrictions where it hurts," said Peter Arkell, chairman of the Global Mining Association of China, according to Reuters. "Gallium and germanium are just a couple of the minor metals that are so important for the range of tech products, and China is the dominant producer of most of these metals. It is a fantasy to suggest that another country can replace China in the short or even medium term," he said.

An investor relations representative from Yunnan Lincang Xinyuan Germanium Industry, one of the biggest suppliers of germanium in China, told the Global Times on Tuesday that the firm was studying the potential impact, noting that more details remain to be seen. "In the short term, it may have a certain impact on foreign prices," the representative said. The company's shares surged by 10 percent on Tuesday, while shares of other major suppliers of the two materials also soared.

Some US and European companies have been moving swiftly to make inquiries with Chinese firms and even apply for export permits, according to media reports. Meanwhile, Japan has threatened to oppose any violation of WTO rules and other international agreements, according to Reuters.

"If anyone thinks there is an issue with China's move, then I suggest he or she should first answer how he or she feels about the US-led West's restrictions on the exports of chips, lithography machines and semiconductor materials," Bai Ming, a research fellow at the Chinese Academy of International Trade and Economic Cooperation under MOFCOM, told the Global Times on Tuesday.

Bai pointed out that almost all countries impose export controls on key materials, and China's move is not an outright ban or is aimed at a specific country, in stark contrast the Western countries' blatant actions of restricting chips and other exports to China. "Export control is not to ban exports, but instead to regulate exports. As long as the uses are reasonable, management is appropriate, the trade is fair, and it is not used for decoupling or breaking supply chains, there should be no worry," Bai said.

Analysts also pointed out that as the US continues to intensify its containment of China, key materials have become a major point of competition and China must also take necessary measures to protect its own security and interests.

"Many rare key metals in the world are supplied by China. Why should China supply some Western countries these metals to make chips, which in turn are used by them to contain China," Chen Fengying, a research fellow at China Institutes of Contemporary International Relations, told the Global Times.