Illustration: Chen Xia/Global Times

For Apple, India overtook Germany and France for iPhone sales in the second quarter, and it's now behind the UK and three other countries, US financial network CNBC reported on Tuesday, citing Counterpoint Research. It is the first time India has been one of Apple's top five markets for iPhone sales.India is a booming market for smartphones. While there are plenty of looming obstacles down the road, it's clear that Apple has become a believer in India's market growth. In April, Apple opened its first physical store in India at Mumbai's Bandra Kurla Complex, underscoring its ambitious expansion drive in the country.

Morgan Stanley analysts forecast that over the next five years, India could account for 15 percent of Apple's revenue growth - in contrast to 2 percent in the past five years, according to CNBC.

As Apple focuses more on India, fierce competition will follow, but that's not necessarily bad news for Chinese smartphone manufacturers. Chinese companies do not fear competition. What they want is to be in a competition that is orderly and rules-based.

In 2022, four of the five top-selling smartphone brands in India were from China, according to the Economic Times, citing Canalys and Counterpoint research. South Korea's Samsung was the only non-Chinese brand in the top five by market share. Apple is aggressively looking at India from both a production and retail expansion over the coming years.

We believe this development can be regarded as a turning point, where India could make itself a real first-tier smartphone market in the world. We hope Apple can help unleash the potential of the market, promote and accelerate 5G infrastructure construction in India, and help build a truly internet-based ecosystem in the country.

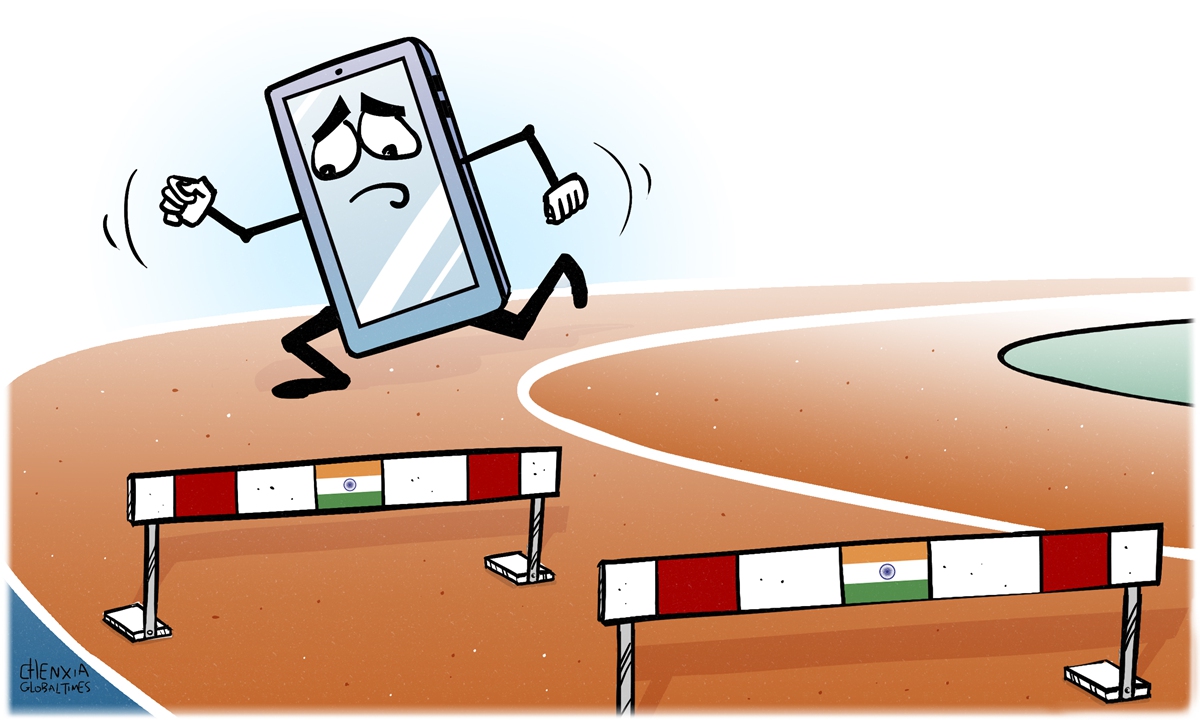

For India, the next few years will be a crucial time for the development of its smartphone industry. India has persuaded top global smartphone manufacturers to place their bets on the country. If India wants to get maximum dividends from fierce competition among global brands, it needs to provide a non-discriminatory and rules-based business environment and ensure fair competition among mobile phone manufacturers.

Apple commanded a 5.1 percent share in India's total smartphone market in the second quarter, versus 3.4 percent a year earlier, CNBC reported. There's still a long way to go for Apple to conquer the Indian market. As long as India can provide a fair business environment for Chinese firms, we believe Chinese brands are competitive in the Indian market, especially in the low and middle segments of the market.

In recent years, India has stepped up a crackdown on Chinese firms, most prominently in the smartphone sector. However, by cracking down on Chinese companies like Xiaomi, India would harm its own economic diversity and restrain market competition, thus decreasing its economic vitality and stranding the development of its smartphone industry. We hope there will be a change of thinking in India.

India is becoming an increasingly important market for global smartphone brands. It has more than 600 million smartphone users, according to reports, a number that's expected to grow as more users migrate to smartphones. If Chinese companies don't want to lose the Indian market, they have to learn how to cope with and withstand the pressure from India.

Facing a crackdown by the Indian government, Xiaomi, one of India's top phone brands, has lost market share, but we believe that Chinese smartphone makers cannot be defeated. Compared with iPhones, it is generally believed that Xiaomi smartphones are price-competitive. Healthy competition should be encouraged between Xiaomi and Apple, as the ultimate beneficiaries will be Indian consumers.

We should be wary of any possible scenario in which the government or rising nationalism gives Apple an unreasonable competitive advantage, and if this is the case, then it is really regrettable that Indian consumers will bear the losses.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn