Illustration: Chen Xia/GT

During a recent White House meeting with the chief executive officers of American semiconductor giants, Intel, Nvidia and Qualcomm criticized the Biden administration's relentless approach to curb exports of advanced chips to Chinese customers, saying the restrictions will surely backfire on them, depleting them a big revenue source and endangering their ability to lead the sector in the future.

The blunt warning is an attestation that the US government's so-called "small yard and high fence" strategy to scupper China's technology sector progress is ill-willed in the first place and to no avail in the end. For an example, Nvidia CEO Jensen Huang told senior US officials that limiting sales of American chips in China had "just made alternatives more popular."

The undertone is if the American chip companies lose the market share in the world's largest semiconductor market, they will lose them permanently. All the more, the availability and quality of the software that Chinese companies are using more than compensates for any hardware restrictions by Washington, the CEOs said.

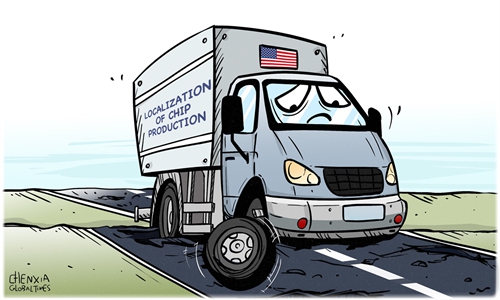

And, Intel chief executive officer Pat Gelsinger was even more straightforward at the meeting, warning the company's planned factory complex in Ohio won't be much necessary, if the White House does not pause before implementing alleged new tougher curbs on chip exports to Chinese customers.

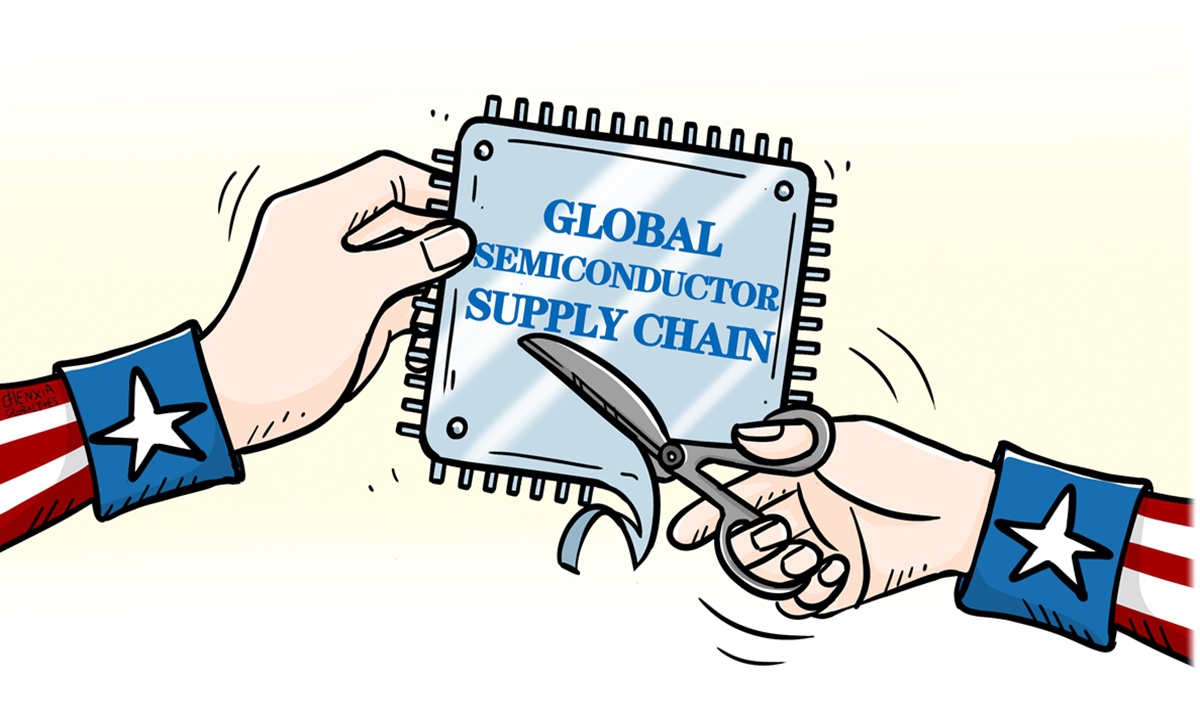

When the US started imposing chip restrictions on China and Chinese firms, many had warned that the measure could backfire, but the Biden administration did not back down. Instead, it added more layers to the export controls in order to drain the new economic powerhouse's ability to grow. Beijing has persistently warned that any man-made curbs on free trade gravely violate the law of the market economy and the principle of fair competition.

According to US media reports, senior Biden administration officials including US Secretary of State Antony Blinken, US National Security Advisor Jake Sullivan and others listened to the CEO's arguments but did not make any commitments, meaning in the short run they are unlikely to put down their intention to contain China's tech rise, though they orally reiterated that they won't seek "decoupling" from China, and try to ease tensions with Beijing.

During the face-to-face meeting, the CEOs warned that export controls risk harming US leadership of the industry. Since Last October, the American chipmakers have been forced to curb shipments to their largest market, citing so-called cliché to protect US national security. Nevertheless, Chinese companies have ramped up their efforts in turning out more advanced integrated circuits and semiconductor designing tools, in its bid to rid the dependence on US technology.

Seeing the Chinese efforts at building up semiconductor self-reliance, CEO Gelsinger of Intel said that further restricting what his company does in China puts at risk a key Biden administration policy of bringing back chip production to the US. Without huge orders from Chinese customers, Intel and other companies will reconsider their plans to open up new plants in the US, simply because they won't make any business sense. "Right now, China represents 25 percent to 30 percent of semiconductor exports. If I have 20 or 30 percent less market, I need to build less factories," he said.

It is true that the most prominent side-effect of reducing Chinese firms' access to cutting-edge US technology is it will directly deprives American chip players of significant revenue streams, that are needed to fund continuous research and development in the sector. Otherwise, that specific US industry will fall behind its rivals. In short, for the US, the alleged new curbs are categorically counterproductive, shortcutting the future capability of US industries.

So, it is in the interest of the US to allow its chip companies access to the Chinese market in general because revenue from China helps fuel research and development, Gelsinger said. And that is needed to maintain the US' lead in new technology such as quantum computing. Currently, Chinese market provides a quarter of its annual sales. For Nvidia and Qualcomm, China provides 20 percent and 60 percent of their annual sales, respectively.

For a time, the Biden administration has been exploring ways to further tighten existing curbs, for instance, by targeting chips made by Nvidia specifically for the Chinese market. But, industry experts say the hardline Biden government policy has failed to achieve the intended outcome of slowing China's AI development. China has been relying on itself, including exploring and developing peculiar software solutions to circumvent the US curbs. Therefore, it is high time for the Biden administration to carefully study the impact of the curbs as they are harming the US industry.

Washington considers itself to be like a dragon guarding its technology treasure, with Sullivan claiming that the administration is going to "continue to look at very targeted, very specific restrictions on technology with national security and military applications, and make judgments rigorously, carefully, methodically." But the curbs targeting China will only serve to make the US leading chipmakers the collateral damage in the end.

To put into context how significant the massive Chinese market is to large chip makers worldwide, China is the world's largest market for commodity semiconductor chips, as the country represents at least a bigger revenue share where most of the world's consumer electronic projects are made and shipped to the world.

Chinese companies are doubling down on homegrown innovation and supply chain with tens of billions of investment from the government, the private sector and other sources. Earlier, the country is suggested to leverage its super make size to promote re-globalization of the semiconductor industry chain, to avert the risks caused by the US government's tech attack.

After the Dutch government announced export control measures that will curb three models of ASML's chip-making machines from being shipped to China, the country decided to fight back. China fired a warning salvo at the US-led bullies by restricting exports of two critical minerals gallium and germanium, effective from August 1.

As two essential ingredients needed in making advanced semiconductor chips, mobile phones, electric cars and high-tech weapons like stealth fighter jets, the niche metals' storage and processing technology are believed to be comprehensively controlled by China, in addition to 17 other types of key rare-earth minerals.

According to an EU study, China accounts for 94 percent of gallium supply and 83 percent of germanium. It is not easy to find alternative supplies shortly. The forced tit-for-tat counterattack is overwhelming supported by Chinese people, for the measure will ensure a stable supply of gallium and germanium and other crucial metals for China's own chipmakers in the coming years, while cutting the competitiveness of the US, Japanese and Dutch chip-making industry.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn