Illustration: Chen Xia/GT

During the past several months, the word "de-risking" has been dominating newspaper headlines. From Brussels to Washington, and from Berlin to Hiroshima, it has become one of the most popular words in politicians' speeches or government statements, taking the spotlight from the once popular term - "decoupling."For example, US National Security Advisor Jake Sullivan said in April at the Brookings Institution that the Biden administration is working to "de-risk" not "decouple" from China, which means having resilient effective supply chains to ensure the US cannot be subject to coercion by any other country. However, people should know that, from "decoupling" to "de-risking," it is just another word game. It will not change the "ostrich mentality" of some countries to escape from the real world.

'De-risking' or rather 'de-China'?

What on earth does "de-risking" from China mean? Judging from statements made by some Western countries, it is a combined measure: On the one hand, reducing dependence on China in the field of economy and trade, seeking the so-called "diversification;" on the other, limiting specific economic and trade transactions with China, weakening China's high-tech and national security capabilities.

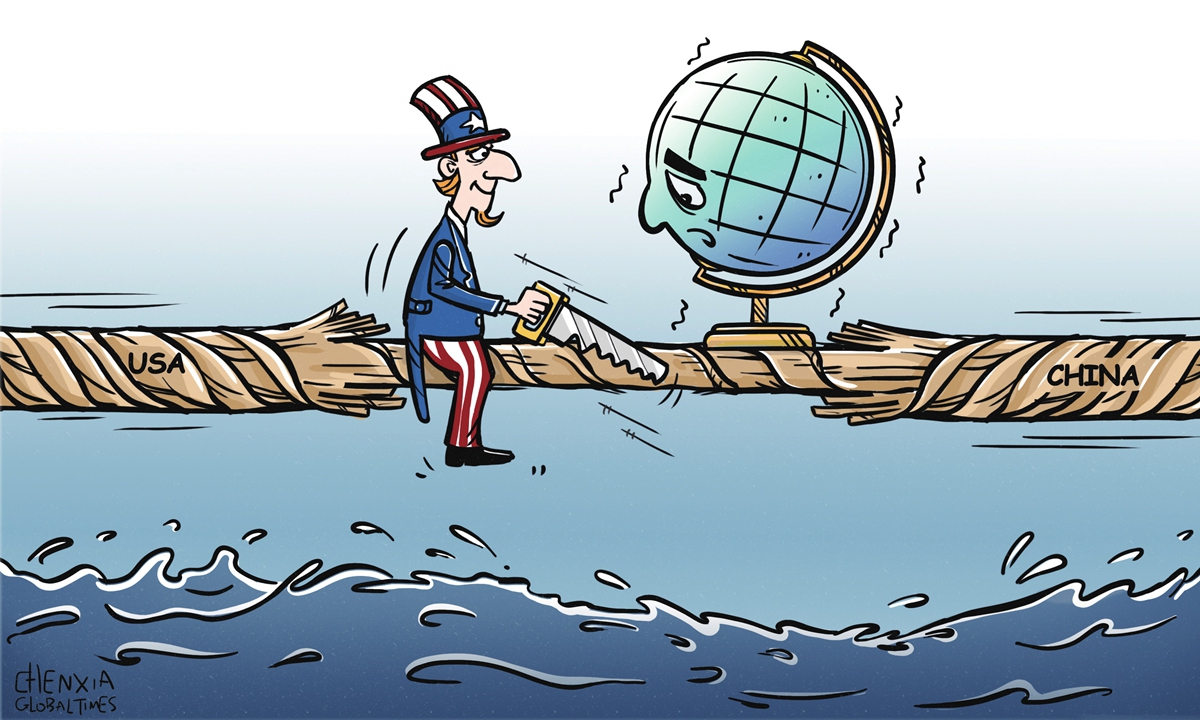

The nature of "de-risking" is actually "de-China" or even "de-globalization." As the world's second-largest economy, China is a major trading partner of more than 140 countries and regions. "De-risking" from China will not only seriously interfere with the normal functioning of the global market, but also exacerbate the chaos of the global economic system and bring confusion about international rules, causing a huge impact on economic globalization in the end.

'De-risking' is targeted decoupling

Unlike the frenzied and careless attempt of "decoupling," "de-risking" sounds more prudent and targeted. According to one op-ed by the Foreign Affairs magazine, the US will contain China in three areas: The first is to minimize the so-called "threat" from China on its national security by reducing the use of China-made hardware and software; the second is to prevent China from obtaining key raw materials such as lithium; the third is to limit the influence of the Chinese market in the world.

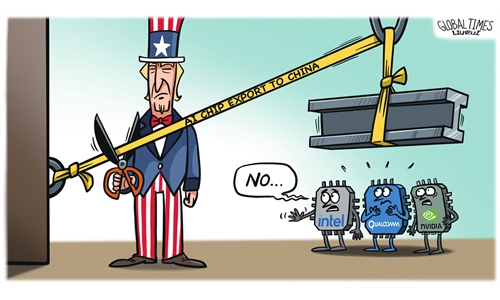

With the seemingly more benign narrative of "de-risking," companies could still trade with China with only some "safeguards" added. Daily necessities could still be obtained from China, where the cost of production is low. But neither the material needed to develop high-end products nor the finished high-end products are supposed to be exchanged with China. In this way, "small yards with high fences" will still be built up and a technology blockade against China will remain. China would always be held down in the downstream of the supply chain without the capacity to rival the US.

'De-risking' itself is the biggest risk

Risks always exist in the economic world, and the reasons vary a lot. It is rather unreasonable for the US to attribute most of the risks it encounters to China alone and attempt to get rid of them by containing China. The idea itself is a huge risk since it is not only against the law of economics but also inconsistent with the interests of all countries.

In a multi-polar world where every country is closely linked with each other, the cost of "de-risking" from China is actually much higher than some countries would expect and can afford. Disengagement or "de-risking" from China is the real risk. Just as Nvidia CEO Jensen Huang warned, "If we are deprived of the Chinese market, we don't have a contingency for that. There is no other China, there is only one China," adding that there would be "enormous damage to American companies" if they were unable to trade with Beijing.

If the propensity of "de-risking" from China spreads to other countries, this will lead to more fragmentation of the global economy. An Austrian think tank estimated that Germany's GDP would fall by 2 percent a year if it "cut off" from China, equivalent to a loss of 60 billion euros. In an era full of challenges and uncertainties, "de-risking" from China might be the most catastrophic risk for the global economy.

So it is natural to see that discontent and dispute appeared soon after the concept "de-risking" was introduced. CEOs of major enterprises, such as Apple, JP Morgan and General Motors have all visited China recently to explore the opportunity for further cooperation. Elon Musk joined them and expressed Tesla's opposition toward "breaking chains" as well as the willingness to expand its business in China.

For some countries, "decoupling" did not bring the elixir, nor will "de-risking."

The author is a commentator on international affairs, writing regularly for Xinhua News, Global Times, China Daily, CGTN etc. He can be reached at xinping604@gmail.com.