China vows more vigorous policies to bolster economy

Increasing measures underscore nation’s determination to boost growth amid downward pressure

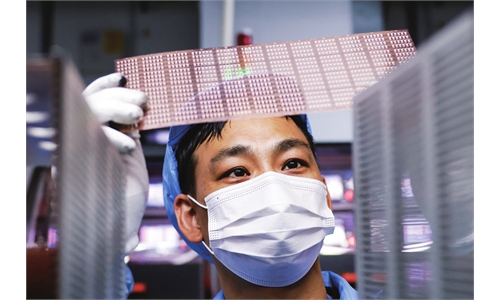

Photo:VCG

Several Chinese government agencies and the country's central bank on Friday vowed to promptly take further and more targeted and vigorous policy measures according to changes in economic operations to promote sustained economic recovery in the second half of 2023, sending another clear signal that more policy support is forthcoming, as the country moves swiftly to tackle challenges and boost growth.

Pledges of further policy support on Friday came after Chinese authorities in recent days ratcheted up "precise and forceful" macro-economic adjustments to tackle new difficulties and challenges and boost growth in various critical aspects of the economy, including the private sector and consumption, underscoring Chinese top policymakers' firm determination to ensure stable growth in the world's second-largest economy, experts noted.

The implementation of a raft of policies will drive up the recovery momentum of the Chinese economy, with a higher economic growth rate expected in the second half of the year on top of steady first-half growth, experts said, calling for patience and confidence in the Chinese economic rebound. Notably, experts said that the Chinese central bank may cut the reserve requirement ratio (RRR) in the second half of the year to boost liquidity, and more effective policies are expected to expand employment and increase residents' income.

Photo:Xinhua

Stronger policies

"We will place steady growth in a more prominent position, implement macro-economic policies in a more precise and forceful manner, and step up efforts to expand domestic demand, elevate confidence and prevent risks. In addition to extending the present interim policies, we will continue to study a series of more targeted and forceful policy options," Yuan Da, a deputy secretary-general of the National Development and Reform Commission (NDRC), said at a press conference, the third from the NDRC this week.

The follow-up policies will cover six aspects: better meeting people's needs to buy their first home or improve their housing situation, actively expanding effective investment, reducing enterprises' burdens, improving the business environment and stabilizing foreign trade, expanding the scale of the middle-income group and ensuring employment for key groups, according to the official.

Chinese stocks rallied on Friday, with the transaction volume in the Shanghai and Shenzhen bourses exceeding 1 trillion yuan ($140 billion), as investors' confidence continues to pick up thanks to the central government's firmer resolve to bolster the economy.

"The intensity, wide coverage and larger number of upcoming policy options indicate that the central government has the situation of the Chinese economy in hand, and has strong willingness to rev up an economic rebound," Yang Delong, chief economist at Shenzhen-based First Seafront Fund Management Co, told the Global Times on Friday.

Yang said that the central government is expected to step up efforts in various aspects in addition to boosting consumption, as stabilizing growth has become one of the most important policy targets right now.

For the next step, the People's Bank of China will coordinate and flexibly use RRR cuts, open market operations and medium-term lending facilities (MLF) and other structural monetary policy tools to ensure reasonably ample liquidity in the banking system, Zou Lan, director-general of the Monetary Policy Department of the central bank, said at the same conference.

In the first half of the year, the country's tax and fee cuts reached a total of 927.9 billion yuan, which greatly contributed to the sustained recovery and overall upward improvement of the national economy, Luo Tianshu, chief accountant of the State Taxation Administration (STA), said at the meeting.

He said the agency wasted no time in implementing favorable tax policies and introducing related policies to targeted groups by using big data. In addition, the STA is looking at rolling out a fifth batch of measures in 2023 to make it more convenient for citizens to pay tax, vowing to make the utmost efforts to reduce related processes, documents and their times and costs, Luo said.

Beijing Photo:VCG

Positive signs emerging

"The recently released macro-economic policies are stronger than expected, for example, easing purchase restrictions for people wanting to buy a second house, measures to support private firms and efforts to invigorate the capital market," Chen Fengying, an economist and former director of the Institute of World Economic Studies at the China Institutes of Contemporary International Relations, told the Global Times on Friday.

Cao Heping, an economist at Peking University, said two highlights of the recent macro-economic policies are continuity and swift actions at multiple levels.

The head of China's central bank on Thursday held a meeting with representatives from multiple private firms to hear suggestions and study policy measures to strengthen financial support for the private sector, signaling more support for private firms amid Chinese policymakers' swift actions to support various key aspects of the Chinese economy.

The Beijing Municipal Commission of Housing and Urban-Rural Development said on Friday that it's actively pushing the formation of details, in response to a question over upcoming policies to support people's need for buying their first home or improving their housing situation, domestic media outlet Thepaper reported.

Thanks to the implementation of various policies, market expectations have shown signs of improvement, macro-economic indexes showed. In July, the total electricity generated across the country increased by 5.9 percent year-on-year, 1.5 percentage points faster than June. China's manufacturing PMI stood at 49.3 in July, up for a second straight month, official data showed.

"People should have confidence in China's economic prospects. The country's economy in the second half will no doubt outperform that recorded in the first six months. The economy will also become more stable next year compared to this year," Chen said. She expressed optimism that China's economic growth will reach 5.5 percent year-on-year, or even stronger in 2023.

Cao projected that China's GDP may grow by 6.8 percent year-on-year in the third quarter and 7 percent in the fourth quarter along with manufacturing recovery and stable signs in China's property sector.

"China's economic growth rate of around 5 percent is healthy and sound, as the main task of the Chinese economy is carrying out industrial upgrades and structural reforms while maintaining stable economic growth," Cao told the Global Times on Friday.

Compared with general RRR cuts, it's more important for the authorities to come up with targeted measures for key groups, for example, favorable policies supporting people looking to buy their first home and giving money to low-income groups, Chen said.

A recent meeting of the Political Bureau of the Communist Party of China Central Committee stressed that stabilizing employment should be considered from a strategic and overall perspective, and that the scale of the middle-income group should be expanded.

"After consumption facilities are improved and consumption confidence boosted, forceful measures should be taken to sustainably expand employment and increase residents' incomes, which is an effective way of increasing people's consumption capacity," Yang said.

He urged efforts to continue improving the policy system for distribution based on factors of production, explore multiple avenues to enable low- and middle-income groups to earn more from production factors, and increase the property income of urban and rural residents through more channels.