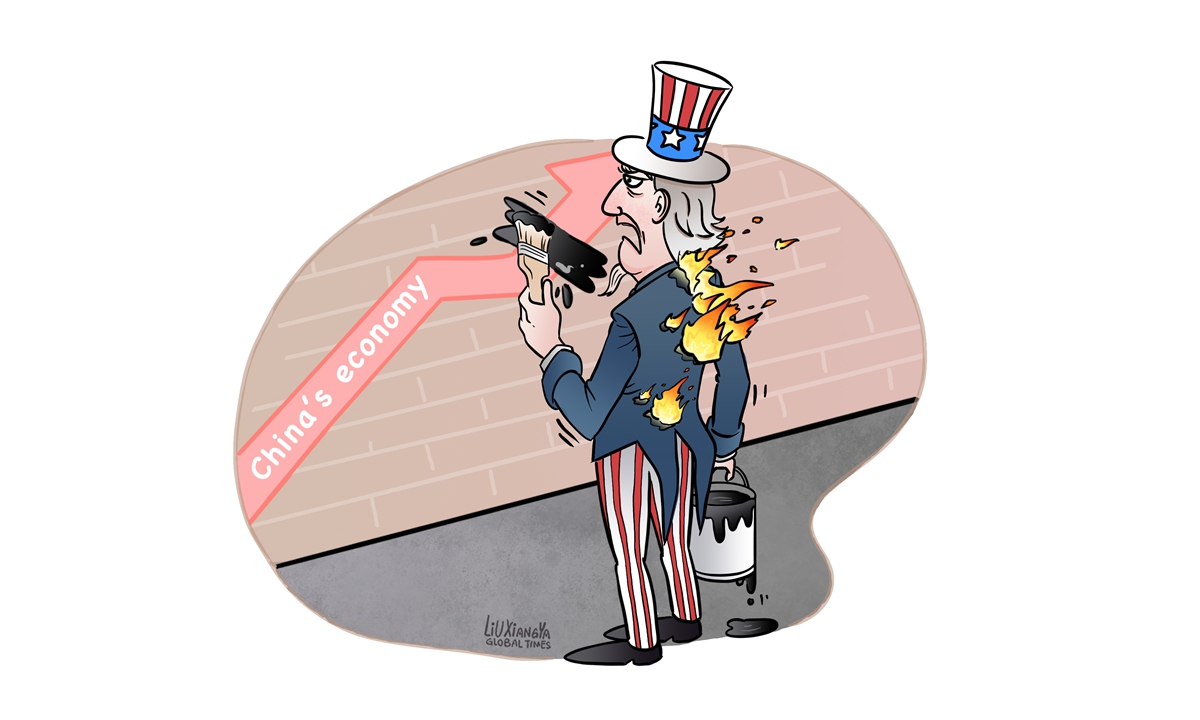

Illustration: Liu Xiangya/Global Times

The US is facing rising recession fears, but political elites in Washington seem unable to address deep-seated problems existing inside the US economy. When some politicians are under increasing pressure, their answer is quite simple: shift the blame to China.US Deputy Treasury Secretary Wally Adeyemo said on Wednesday that China's economic issues "are proving to be a headwind for the US and global economies." A few days ago, US President Joe Biden called China a "ticking time bomb," followed by Treasury Secretary Janet Yellen, who slammed China's economic situation as a "risk factor" for the US.

In the first half of 2023, China's GDP grew 5.5 percent year-on-year. Many of America's top business leaders, including Tesla CEO Elon Musk, JPMorgan Chase CEO Jamie Dimon and Starbucks CEO Laxman Narasimhan, visited China, a move which could be seen as a vote of confidence in the Chinese economy. American investors have a much better understanding of the Chinese economy than American politicians. They vote with their feet. They have proved through their actions that China's development is an opportunity, rather than a "risk factor" for the US.

Take a simple example. Starbucks achieved a strong recovery in China in the third quarter of fiscal 2023 (ended on July 1). Its China revenue rose 60 percent year-on-year to $821.9 million. Against such a backdrop, it is not much of a surprise when the US coffee shop chain said it hopes to "capture the limitless opportunities in China."

From a macroeconomic perspective, the IMF said in its World Economic Outlook updated last month that China's economy is expected to account for one-third of global growth this year. What is undeniable is that China will remain the biggest contributor to global growth, while the US, contrary to the superficial economic prosperity touted by US politicians, is facing a litany of risks, including stubborn inflation, debt ceiling crisis, and recession fears.

Most US Federal Reserve officials last month still regarded high inflation as an ongoing threat that could require further interest rate increases, the Associated Press reported, citing the minutes of their July 25-26 meeting released on Wednesday. At present, with the US' irresponsible monetary policy, especially continuous interest rate hikes, anger and dissatisfaction toward US dollar hegemony have been accumulating, but US policymakers do not have sufficient policy tools to address the contradiction of controlling inflation, maintaining US dollar hegemony, and at the same time stimulating economic growth. This can be taken as the epitome of today's economic policy dilemma the US government faces.

At a time when the US economy encounters multiple difficulties, it is regrettable to see that politicians in Washington are not offering good strategies in terms of economic governance, but focusing a lot on attacking each other and the Chinese economy. Without an effective solution within Washington to address economic problems, blaming China has become a convenient excuse to shift responsibility and whip up unity.

The Biden administration should now focus on boosting the US economy, rather than smearing China. Of course, we do not shy away from addressing challenges facing the Chinese economy, but it should be noted that many of the challenges currently facing the Chinese economy are caused by the US' irresponsible monetary policy, rising trade protectionism, unilateral and anti-market suppression and economic bullying, which is threatening not only China but also the global economy. We hope the US can manage its own affairs well and stop exporting economic risks to the world.

As the world has entered a period of turbulence and the global economy is facing a grim outlook, many economies face significant challenges. What the world needs is cooperation, not a new economic cold war. The Chinese economy enjoys strong resilience. It will continue to contribute to global growth.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn