Production of semiconductor chip File photo: VCG

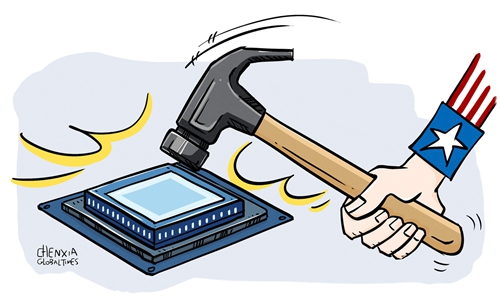

Semiconductor companies of US allies are still eyeing the Chinese market to increase sales despite Washington's reckless tech war against China, recent events show. China remains the world's largest chips market and no firms are willing to lose it, analysts said.

On Friday, a new base for semiconductor testing and measurement equipment manufacturing opened in Wuxi, East China's Jiangsu Province, with an investment of $200 million. The base is a cooperative project among the Wuxi High-Tech Industrial Development Zone, Wuxi Industry Development Group and South Korea's Nextin Inc., which distributes semiconductor devices.

US allies are experiencing huge losses from Washington's tech suppression of China. South Korean companies have set up production plants in China, and China is the largest export market for companies from South Korea, an industry observer surnamed Zhang told the Global Times on Sunday.

"South Korea is a neighbor of China and its semiconductor enterprises cannot afford losing the Chinese market. South Korean semiconductor firms have found it hard to withdraw from China because they have invested hugely in the market," said Zhang.

Samsung, the world's largest memory chip manufacturer, has invested $15 billion in Xi'an, Northwest China's Shaanxi Province, making Xi'an the world's largest flash memory chips manufacturing base. Its production of flash memory chips accounts for more than 15 percent of the world's capacity. South Korea's Hynix has also built production lines in many places in China.

Currently, 60 percent of South Korea's chip exports come to China, according to China's Ministry of Commerce.

"Although South Korean enterprises and those based in other US allies dare not confront the US directly, they could have many untold complaints. I would call it 'silent resentment'," said Zhang.

Apart from South Korea, China is also a big semiconductor market for Japan. Statistics from the Japanese Ministry of Finance showed that in 2022, Japan's chips manufacturing equipment exports exceeded 4 trillion yen ($27.3 billion), of which the Chinese mainland accounted for 30 percent.

And, most US chip companies derive more than one-fifth of their revenues from China too, Reuters reported. For example, China accounts for about 60 percent of Qualcomm's global sales.

US chip conglomerate Intel earned 27 percent of its 2022 revenue from China, its financial results showed. Intel recently built a new innovation center in Shenzhen city.

According to the US Semiconductor Industry Association, China's chip purchases totaled $180 billion in 2022, about one-third of the global total.

From the perspective of South Korean companies, they aspire to maintain stable business ties with China. But they face huge pressure from the US, a South Korean industry insider who declined to be identified told the Global Times.

The insider has worked for several telecommunication and chip enterprises in China and South Korea.

"South Korean companies are willing to promote their own development and exports, and actively seek to expand their markets. China is an indispensable market for South Korean semiconductor makers," said the insider.

Zhang noted that China is an important part of the global chip industrial and supply chain, and the US' tech suppression against China has actually increased the costs of all other enterprises to do business.