Foreign capital roots for Chinese economy amid Western smears

Nation still powerful magnet for multinationals despite Western hype

Staff members work at a production line of SAIC Volkswagen in east China's Shanghai, Oct. 29, 2019. (Xinhua/Ding Ting)

Foreign capital, which has contributed enormously to the growth of the world's second-largest economy and made remarkable returns over the past decades, has voiced its firm and clear strategy to root for the economy amid noises stirred up by some Western politicians and media outlets against China's economic recovery.

Despite current challenges as reflected by some recent economic data, China will maintain its strategic focus and advance with targeted stimulus measures in a continuous effort to bolster market confidence. For foreign-funded firms operating in the country, in particular multinationals, the Chinese market is never an optional choice but a must-have, experts told the Global Times.

Ren Hongbin, chairman of the China Council for the Promotion of International Trade, met with World Economic Forum (WEF) President Borge Brende in Beijing on Tuesday. They exchanged views on issues such as the international economic situation, deepening exchanges and cooperation in the global business community, and promoting the recovery of the global economy and trade.

Separately, in a meeting with Vice Commerce Minister Ling Ji on Monday, Ralf Brandstaetter, chairman and CEO of Volkswagen Group China, said that China is the world's largest single market and an important strategic market for Volkswagen.

The German auto giant is excited to see the Chinese government's latest measures to optimize the foreign investment environment. Full of confidence in the development of the Chinese market, Brandstaetter said the company will continue to expand investment in China, according to the official WeChat account of the Ministry of Commerce (MOFCOM).

Volkswagen announced at this year's Auto Shanghai 2023 held in April that the automaker will invest about 1 billion euros ($1.1 billion) to establish a new development, innovation and procurement center in in Hefei, capital of East China's Anhui Province.

The move marked an important step in the company's "in China, for China" strategy, according to Brandstaetter.

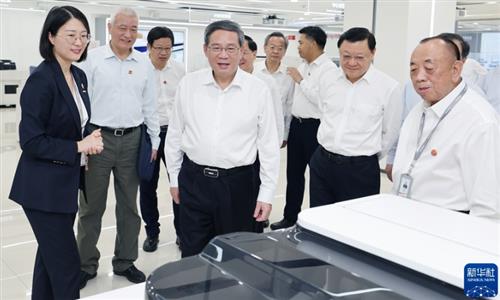

Also on Monday, Shanghai Mayor Gong Zheng met with Deloitte Global CEO Joe Ucuzoglu and his delegation.

Ucuzoglu said the accounting firm will continue to invest in Shanghai and support its high-quality development.

Deloitte has invested in institutions such as the Digital Innovation Center and the Global Excellence Center for Electric Vehicles in the city.

The latest rooting-for-China comments by foreign firms' senior executives follow a move by the State Council, the cabinet, which earlier this month unveiled guidelines containing 24 points to further optimize China's foreign investment environment and beef up foreign investment inflows.

The specific measures included the expansion of pilot areas to open wider in terms of services, as well as encouraging foreign firms and their research and development (R&D) centers to undertake major sci-tech projects, facilitating the travel of senior executives, technicians and their families, and enhancing the expertise of personnel in local government offices handling foreign investment.

All these moves sent clear signals of the country's unwavering commitment to further opening-up.

Notably, prior to the release of the targeted measures to attract and utilize foreign investment, many multinational executives had beaten a path to China's door this year, including Tesla's founder Elon Musk and JPMorgan Chase CEO Jamie Dimon.

The list will grow in the second half of the year with China's economic recovery picking up momentum as previous stimulus measures unleash a beneficial effect, and more are expected to be in the pipeline, Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at the Renmin University of China, told the Global Times on Tuesday, underscoring that China still retains an attraction for foreign investment.

The frequent meetings between Chinese officials and senior executives of multinationals and international institutions came amid recent rhetoric from Western politicians and media outlets, which have launched a round of smears against the economic growth of the world's second-largest economy.

"For smart foreign capital, it will stay detached from this political chaos stirred up by the West, because it knows clearly that China, one of the world's most appealing consumer and manufacturing markets, is never an optional choice but a must-have," Dong noted, adding that 2023 is a crucial year for foreign firms to revive their business in the post-COVID era.

China is undoubtedly an economic growth engine for the world, which is grappling with a sluggish recovery. Taking the major economies' growth in the second quarter as an example, China far outpaced others with a 6.3 percent growth rate. US GDP grew 2.4 percent in the same period, while the UK economy expanded by 0.4 percent and that of France by 0.9 percent, while Germany's economy contracted 0.1 percent.

Zhou Maohua, an economist at Everbright Bank, told the Global Times on Tuesday that under the current complex and ever-changing global political and economic situation, China's long-term economic growth, huge market potential, stable development environment, and continuous optimization of the business environment provide foreign capital with more predictable returns on investment.

A recent report released by the China Council for the Promotion of International Trade showed that nearly 70 percent of surveyed foreign-funded enterprises are optimistic about the prospects of the Chinese market over the next five years.

More than 90 percent believed that the attractiveness of the Chinese market will increase or stay the same, and more than 80 percent expected profit margins on investment in China to remain the same or increase this year.

Foreign investment in China remained stable in the first half of this year, with 24,000 newly established foreign-invested firms, up 35.7 percent year-on-year, MOFCOM data showed.