Illustration: Chen Xia/Global Times

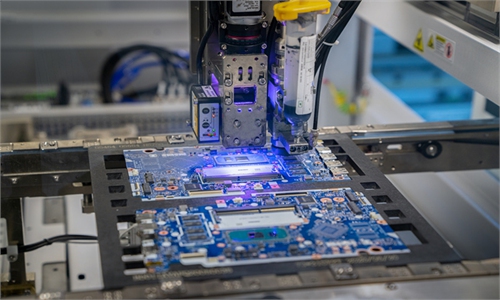

The US decision to grant indefinite waivers for Samsung Electronics and SK Hynix to supply US chip equipment to their China factories may be a milestone, but for South Korean chipmakers, this is far from enough. Seoul has to continue its efforts to find survival opportunities for South Korean companies in the high-end semiconductor market.As reported by Reuters, Samsung and SK Hynix, the world's largest and second-largest memory chipmakers, have invested billions of dollars in their chip production facilities in China. Samsung makes about 40 percent of its NAND flash chips at its plant in Xi'an, Northwest China's Shaanxi Province, while SK Hynix makes about 40 percent of its DRAM chips in Wuxi, East China's Jiangsu Province, and 20 percent of its NAND flash chips in Dalian, Northeast China's Liaoning Province, according to media reports.

If Samsung and SK Hynix are allowed to supply US chip equipment to their China factories indefinitely without separate US approvals, this will have significant implications for them, which means their production in China can be sustainable. While the US imposes tough rules to limit China's access to chip technologies, it is forced to consider the interests of its own companies and those of allied nations, in the face of lobbying from American companies and its allies, which forces it to compromise in its chip war against China.

However, two points should be emphasized about Washington's indefinite waivers. First, the US has always held a cautious attitude about high-tech exports to the global market, even to its allies. Exports of chip equipment are usually concentrated in mid- to low-end devices, while cutting-edge core technologies will be retained in the US. Even though South Korean chipmakers can be allowed to supply US chip equipment to their China factories, it is still unclear to what extent these American devices can play a role in fierce technological competition.

Second, as for NAND flash chips and DRAM chips, the technological gap between China and South Korea is limited. As reported by Business Korea, the Overseas Economic Research Institute of the Export-Import Bank of Korea estimated in 2022 that the technological gaps between China and South Korea in the memory semiconductor sector are five years for DRAMs and two years for NAND flash chips.

More important is that Huawei's Mate 60 Pro smartphone, which has a chip that appears to support 5G, makes the Chinese semiconductor industry look resilient in the face of Western sanctions. It is widely believed that China's chip technology and manufacturing capabilities have improved with independent innovation. In the mid- to low-end chip market, the necessity of a technological blockade against China is decreasing. If Japanese and South Korean companies become the biggest victims of US sanctions, their market share will be partially transferred to Chinese chipmakers.

Against this backdrop, Washington's chip strategy is also constantly shifting, and the US is bound to strengthen export controls on high-end chip technology. Next, the real competition will focus on the high-end chip field. This means China must accelerate its breakthroughs in high-end chip technology, and Japan and South Korea should continue their efforts to help their companies survive the US-initiated chip war, which has disrupted global supply chains. The obstacles set by the US will not decrease but will only increase, and they are more concentrated in the high-end chip field. Japanese and South Korean companies need to recognize this.

China, Japan and South Korea should deepen cooperation, which will help consolidate the industry chain and ensure supply chain stability. If the industry chain breaks, China will suffer. South Korea will suffer too, maybe even more. Electronic products made in China, such as smartphones and electric vehicles, continue to gain share in the international market, thereby expanding demand for chips, which helps lay the foundation for strengthening cooperation among chipmakers in China, Japan and South Korea.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn