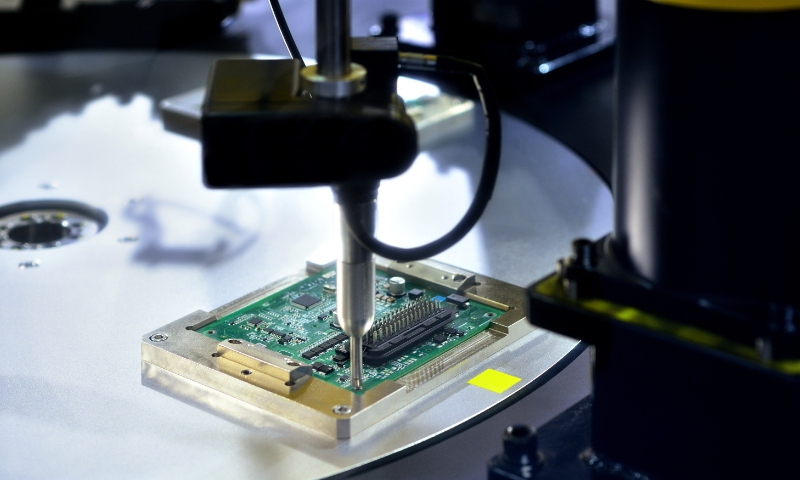

Production of semiconductor chip File photo: VCG

Major world semiconductor manufacturers are suffering from tightened US chip export controls on China, and industry observers said that Washington's intensified moves have seriously disrupted the global industry and supply chains, and the suppression will eventually backfire on major industry players in the US and the EU.

German chipmaking kit supplier Süss MicroTec has cut its sales forecasts for the second time in three months, blaming tightened government controls on exports to China, sending its shares tumbling by 11 percent, Reuters reported on Wednesday.

South Korean chipmaker SK Hynix reported third-quarter revenue of 9.066 trillion won ($6.68 billion), down 17 percent year-on-year, according to the company's financial results released on Thursday. It also reported an operating loss of 1.792 trillion won and a net loss of 2.185 trillion won.

Tighter US chip export restrictions on China have suppressed the development of global players especially from the EU and the US, as they have already encountered mounting losses, Xiang Ligang, a veteran telecom industry observer, told the Global Times on Thursday.

Washington has seriously broken the global semiconductor industry chain, as manufacturers and research and development (R&D) enterprises can't carry out production, R&D and relevant work, resulting in low market confidence, Ma Jihua, a Beijing-based industry analyst, said. He added that the continued US suppression will only cause further losses for global enterprises.

The ill-intentioned US moves, from the recent ban on exports of more advanced artificial intelligence (AI) chips to China announced on October 17 to restrictions on outbound investments aimed at China, have even raised global concerns from its allies.

"Unilaterally changing the rules during a contest where competitiveness and strategic autonomy are at stake is difficult to accept, even by a good ally," said Dutch Christian Democrat lawmaker Mustafa Amhaouch, Bloomberg reported on Wednesday, as a senior Dutch official confirmed that the Netherlands government was informed by the US about the measures announced on October 17.

Nvidia said that the new curbs came into effect on Monday as regulators advanced the deadline, while the restrictions were supposed to come into play 30 days from October 17, according to an earlier Reuters report.

The EU has told the Biden administration it's concerned that US restrictions on outbound investment to China could hit companies in the bloc, according to media reports.

The Chinese Foreign Ministry on Thursday responded to the EU's concerns, saying that China has consistently opposed the politicization of economic, trade and scientific and technological issues, and the frequent use of economic coercion, long-arm jurisdiction and other non-market behavior to interfere in exchanges and cooperation among other countries.

The Bloomberg report noted that China's Semiconductor Manufacturing International Corp (SMIC) used ASML's so-called immersion deep ultraviolet machines in combination with tools from other companies to make the 5G chip for Huawei's Mate 60 Pro, adding that there is no suggestion that the sales violated US export restrictions.

The report also noted that the chip demonstrated manufacturing capabilities well beyond where the US had sought to stop China's advance after a teardown of the device conducted by Bloomberg's TechInsights. "That prompted questions both about how SMIC was able to manufacture the chip, and the effectiveness of the Washington-led controls," the Bloomberg report said.

Observers said that the Mate 60 series proved that China's capabilities and breakthroughs have been achieved on a large scale covering the manufacturing process from materials to technology.

Rather than suppressing China's semiconductor development, Washington's restrictions have actually accelerated Chinese enterprises' efforts to push forward technological innovation, Xiang said, adding that multiple Chinese firms and manufacturers have seen significant growth in their performances.

Xiang said that China has been continuously working on launching new chip products, proving that China is capable of manufacturing chips at mature nodes as well as targeting advanced chips.

The number of imported chips in China has been declining with domestic players taking a growing market share, while China is able to further achieve self-reliance for more types of high-end chips, Ma told the Global Times on Thursday.

In the first nine months of 2023, China imported 355.9 billion integrated circuits, a year-on-year decrease of 14.6 percent, Chinese customs data showed.

Chinese authorities are bolstering the development of the semiconductor and relevant sectors.

Shanghai Mayor Gong Zheng met with Teruo Ninomiya and his delegation from Japan's Toppan Photomask Co on Wednesday. The company is the world's largest independent third-party photomask producer, accounting for around 32 percent of the global market.

Gong said that Shanghai will expand opening-up and create more opportunities for Chinese and foreign enterprises, and accelerate the creation of a world-class industry cluster of integrated circuits.