China’s manufacturing activity softens for first time in three months: private survey

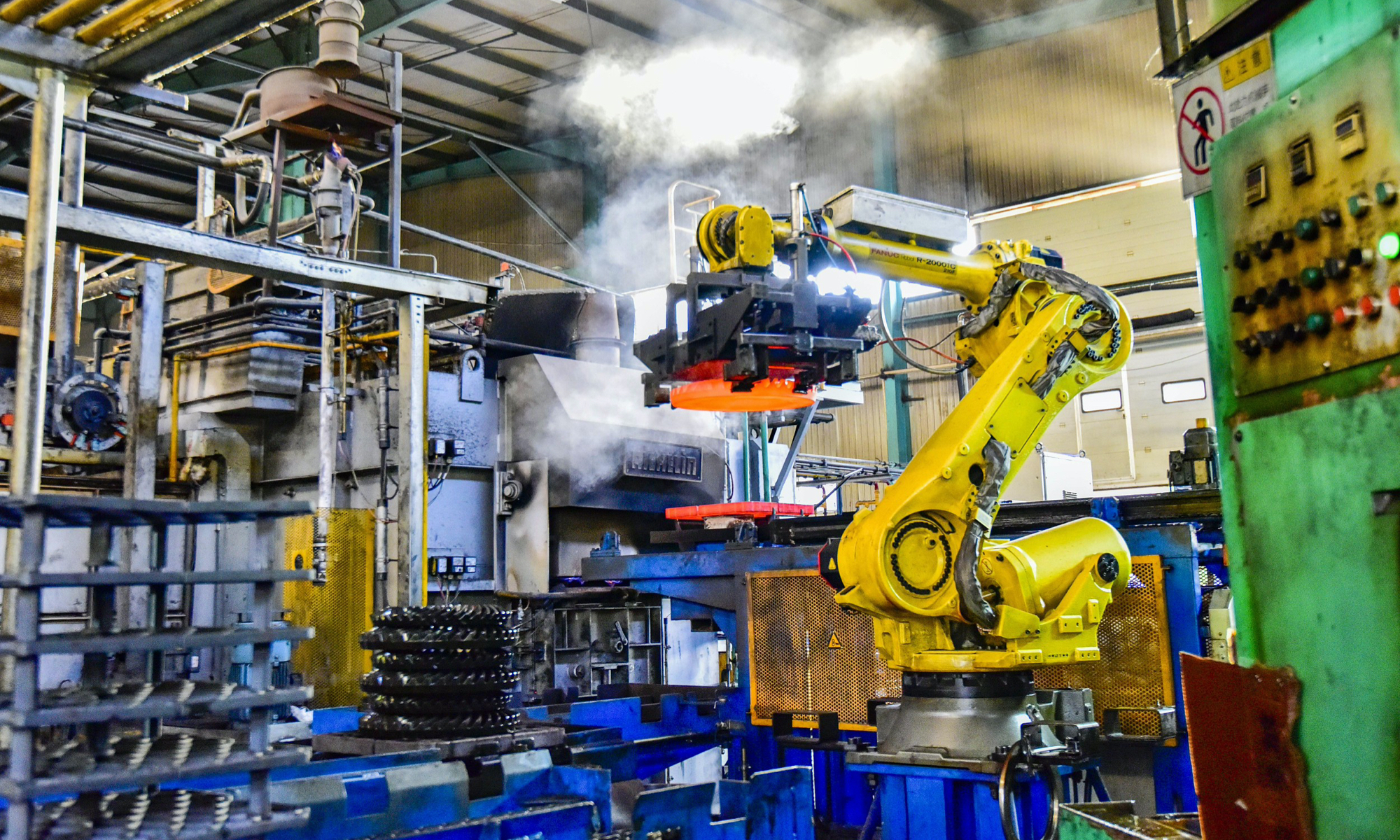

A staffer works in a textile factory in Bozhou, East China's Anhui Province on October 12, 2023. The efficiency of manufacturing and industrial chain coordination is significantly improving, bringing more competitive advantages to enterprises. Photo: cnsphoto

China's factory activity dipped back into contraction territory in October with new manufacturing output shrinking on subdued external demand, data from a private survey showed, as the economy needs more targeted stimulus measures to reinforce recovery, experts say.

The Caixin China General Manufacturing Purchasing Managers' Index (PMI) fell to 49.5 in October from 50.6 in September, the first time that deterioration has been recorded since July. A reading below 50 indicates a contraction in the manufacturing sector, while above 50 indicates expansion.

The figure is in alignment with the official statistics released by the National Bureau of Statistics (NBS) on Tuesday showing the manufacturing PMI fell to 49.5 in October from 50.2 in the previous month.

Lower production and relatively muted client demand weighed on purchasing activity, according to the private survey report.

Overall new business expanded for a third straight month, but the rate of growth eased into marginal territory. Sluggish global economic conditions and high prices dampened consumer demand. Exports declined for the fourth straight month in October, albeit only slightly.

Meanwhile, manufacturers trimmed payrolls for a second straight month in October.

Business confidence regarding the 12-month outlook for production softened again in October. While some companies were hopeful that new product launches and improved client demand both at home and overseas would support growth, others expressed concerns over the sluggish global demand, the survey said.

"Overall, manufacturers were not in high spirits in October. Supply, employment and external demand all fell, while domestic demand expanded at a slower pace. Costs and output prices both rose, purchases fell, and inventories of finished goods increased. Business optimism continued to wane," Wang Zhe, senior economist at Caixin Insight Group, said.

Consumption, especially in the services sector, is resilient, and the economy has showed signs of bottoming out despite the recovery foundation not that solid, Wang said.

China's third-quarter GDP growth rate of 4.9 percent came in higher than the median 4.6 percent forecast by analysts, beating expectations. Recovery has been driven partly by the rebound of services and consumption seen in recent months.

Consumption contributed to 83.2 percent of economic expansion in the first three quarter of the year, rising 4.4 percentage points of GDP growth rate, NBS data showed.

Macroeconomic policies have been ramping up as the central government seeks to stabilize growth including the issuance of an additional 1 trillion yuan ($137 billion) in treasury bonds and passing a bill to allow local governments to frontload part of their 2024 bond quotas.

The treasury bond will facilitate infrastructure investment and help stabilize the economy, but its impact on improving household income, employment and expectations remains to be seen, Wang said.

Global Times