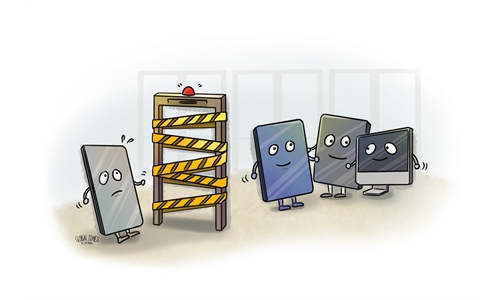

Illustration: Chen Xia/Global Times

Luxshare, one of Apple's largest Chinese component and finished product makers, is shifting its new investment of $330 million to Vietnam from India, where it failed to expand its business after several attempts over nearly three years, according to media reports. Luxshare's significant role in the Apple supply chain has led many Indian media outlets to lament the shift as a loss for India.Luxshare's frustration in the Indian market stands in stark contrast to its experience in the Vietnamese market. The license for the investment was cleared last week by the Vietnamese government, media reported. This raises its total investment in Vietnam to $504 million, Indian media outlet Business Standard reported in a report titled "India's loss, Vietnam's gain: Apple's Chinese vendor changes plan."

Luxshare's decision to cancel its investment plan in the Indian market was a difficult and painful one, which exemplifies the challenges faced by many Chinese and other foreign companies in the Indian market. Undoubtedly, this will greatly undermine the confidence of other companies in Apple's manufacturing chain and other suppliers in the Indian market's business environment.

It is no secret that the business environment in India has been a pain point for foreign companies. While India is implementing incentives to stimulate domestic production, it is also creating a tough business environment for foreign investors. India's poor record for attracting foreign companies to its market to boost related industries, only to later exploit and make exorbitant profits off those companies, has become widely known.

For Chinese companies, the probability of facing unfair treatment in the Indian market is even higher. In recent years, India has seen the intention of Western countries, such as the US, to reconstruct the global supply chain and squeeze China out of it. India has been catering to the West, attempting to replace China's core position in global supply chain cooperation.

Against this backdrop, in recent years, the Indian government has been intensifying crackdowns on Chinese companies. Chinese companies' confidence in the business environment in the Indian market has been significantly undermined. The latest example is that Indian tax authorities reportedly launched an investigation into 40 leading Chinese solar companies in the name of alleged tax evasion at the end of October.

As a result, Chinese investment in India has been limited in recent years, and there have been very few approvals from authorities in India. From fiscal 2021 to fiscal 2023, the Indian Ministry of Commerce and Industry rejected FDI applications from 58 Chinese companies.

India is seeking to attract foreign companies to shift their major manufacturing operations to the country, but from a supply chain perspective, it cannot do without Chinese companies. Luxshare's reported investment shift shows that India's unfavorable business environment and wrong policies toward Chinese companies hamper its own manufacturing ambitions.

Chinese companies like Luxshare are primarily playing a crucial role in supply chains. If key players in a particular supply chain cannot survive in the Indian market, India's plan to advance its manufacturing industry will be difficult to move forward, as all production in India, including iPhone assembly, still ultimately relies on Chinese supplies. To push Chinese companies like Luxshare out of the Indian market is a self-inflicted disruption for India.

In recent years, Apple's plan to shift its manufacturing and supply chains from China to India has encountered numerous difficulties and has been widely regarded as an "epic fail" by many US media outlets. Earlier this year, Financial Times, citing a person familiar with the matter, reported that at a casings factory in southern India run by conglomerate Tata Group, only about half of the components from the production line are in good enough shape to be sent to Apple's supplier.

For India, in order to develop its manufacturing industry, it must exclude geopolitical thinking from interfering with economic and trade cooperation and actively integrate into the existing supply chain with China as a key player in the Asia-Pacific region. If India continues to crack down on Chinese companies and tries to cooperate with Western countries to build the so-called value-based supply chain, it will only fail to boost its manufacturing.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn