Illustration: Xia Qing/Global Times

As the new year of 2024 has begun, Chinese people are hopeful of a more substantive rise in family incomes than in 2023. But uncertainties will continue to engulf the world, including hot conflicts, cold economic wars, blockades of important waterways like the Red Sea, and possibly, another comical or farcical presidential election in the US.

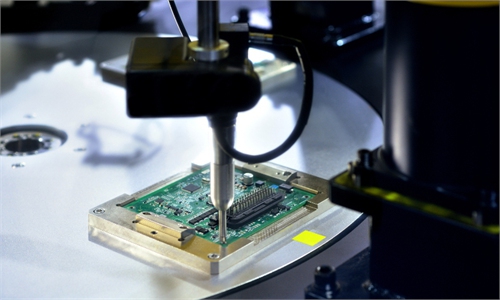

Facing these sources of volatility, China should still concentrate on developing the economy by consistently improving all infrastructure projects and comprehensively shoring up its basis for scientific research and technological innovation. Investment in public utilities and 21st century infrastructure facilities will expedite China's pace of modernization, while tech innovation will strengthen China's economic security and international competitiveness, so that it won't be blackmailed or strangled by any bully.

And, infrastructure construction and technological innovation will also help boost domestic consumption and foreign trade - two important levers for China's economic growth for many years.

For two examples, a booming travel and tourism market in the country cannot be realized without investment in the world's leading transportation network of highways, high-speed trains and airports. And, without China's years of advanced research and development in batteries, electric vehicles and autonomous driving systems, China could not surpass Japan to become the world's top auto exporter.

Many experts analyzing the annual Central Economic Work Conference convened in December 2023 noted that China should try to nurture a "benign and mutually reinforcing development loop" among infrastructure construction, technological advances, domestic consumption and overseas commerce. In 2024 and 2025, it is broadly expected that more high-tech Chinese machinery and electronic products will be exported or sold at home thanks to the country's manufacturing capability upgrading, such as 5G-wired autonomous mining excavators and Chinese cellphones and laptops loaded with homegrown operating systems and other features.

In 2024, China's domestic consumption and foreign trade are estimated to rise within a reasonable range, depending on how much the yuan will appreciate against the US dollar. At Friday's foreign exchange market close, the yuan rallied to about 7.08 versus the dollar. Last year, the yuan stayed at about 7.20 most of the time, and at one point softened to 7.35 against the dollar, which caused capital flight from China.

As to rejuvenating domestic consumption, the government ought to do its utmost in 2024 to rehabilitate the weakened real estate sector, and at the same time, take resolute measures to ramp up the domestic A-share market. The US Federal Reserve is anticipated to start reducing interest rates during the middle of this year, which will further firm up the yuan's value and help attract more overseas assets to buy Chinese equities and bonds.

Only after China's capital market and property trading are revived, will Chinese households feel their family net worth is rising and be willing to open their pocketbooks again. It is a wise decision by the policymakers to support the Chinese stock market's rebound and build up a "strong financial country."

During the last trading session of the A-share market, the Shanghai composite stock index gained 0.68 percent, as investors flocked back to the market, buoyed by the government's policy actions to propel the economy, including ramped-up fiscal spending on public works and social welfare, lowering savings interest rates to boost bank lending, and specific measures to cut payments and taxes to rev up the housing market. Improving data in China's retail sales and profits of its major industrial enterprises also bolstered investor morale.

Hopefully, in 2024, we will see a reviving capital market. Then, the financial market will have abundant liquidity to fundamentally back up domestic consumption, business expansion and employment, and eventually, warm up the real estate sector. Meanwhile, declining consumer prices could be stopped.

The property sector reportedly accounts for more than 60 percent of its household wealth, so it is of great importance to stabilize and rejuvenate the industry in 2024. It is true that the sector's correction affected last year's growth, as a number of developers faced default risks. From January to November 2023, China's commercial housing sales totaled about 1.0 billion square meters, down 8 percent year-on-year. To bolster the sector, it is necessary for major commercial banks to increase loans to assist the cash-strapped developers.

Entering a new year, China should not vacillate in its pursuit of deepening reform and widening opening-up. The efficacy of the country's reform and opening-up drive has been proved by the unprecedented economic achievements of the past four decades, while egalitarianism will only impede and stifle people's creativity and corporate productivity. So, it is crucial and imperative for the country to unswervingly support the private sector's innovation and growth.

If 2023 was the mirror, China is most likely to accelerate fiscal and monetary stimulus in order to achieve a comparatively higher economic growth rate in 2024, which should be adequate to help generate much-needed jobs for young people and the ranks of new college graduates. Given the government's proactive move of doling out special treasury bonds to ratchet up the country's disaster resistance ability and infrastructure investment, it is widely believed that stronger pro-growth measures will be worked out to prop up economic growth this year.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn