Illustration: Chen Xia/Global Times

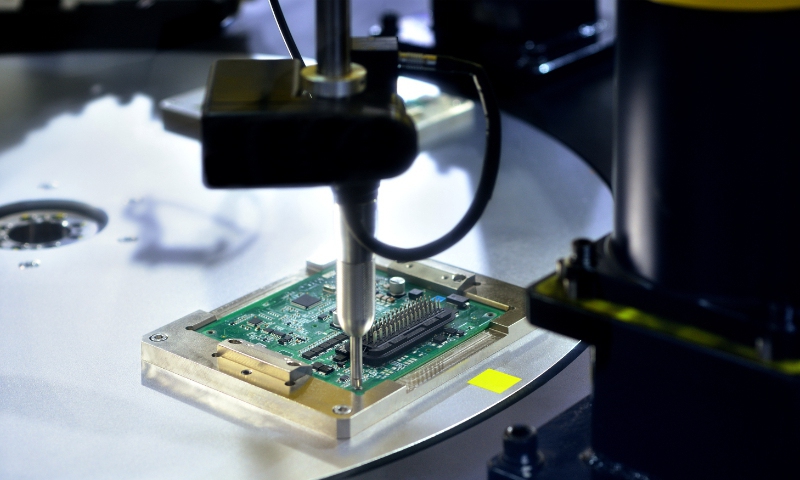

China's foreign trade in 2023, especially the imports of some key tradable commodities such as integrated circuits (IC), has drawn increasing attention. From January to November last year, China's IC imports fell 12.1 percent in terms of quantity, and that may show that China's dependence on IC imports has declined.There looks to be little short-term prospect of the US abandoning its suppression of the Chinese semiconductor industry. As a result, global supply chain restructuring is accelerating. What major changes are taking place in China, an indispensable market for global semiconductor makers? Two datasets deserve attention.

First, China's imports of ICs. That number reached 635.5 billion units in 2021, up by 16.9 percent year-on-year, according to data published by the General Administration of Customs. Subsequently, IC imports began to fall - the decline in 2022 was 15.3 percent, and in the first 11 months of last year, IC imports fell further 12.1 percent.

Second, there's the issue of China's sales of ICs. According to the China Semiconductor Industry Association, sales revenue for the IC industry exceeded 1 trillion yuan ($140.86 billion) for the first time in 2021, with year-on-year growth of 18 percent. In 2022, the reading saw double-digit growth again.

China's IC imports and sales are showing a sharp contrast. Many wonder if China's dependence on foreign-made chips has permanently decreased. It seems the answer is yes.

This raises another question: how much has China's dependence on foreign-made chips decreased, and can this trend continue? Some industry insiders predict that China's chip self-sufficiency rate will reach 70 percent by 2025, although in 2019, the rate was reportedly only about 30 percent.

Reaching 70 percent will be a challenge. To achieve that goal, Chinese chipmakers still have a lot of work to do. The bottleneck that affects China's semiconductor production is not just lithography machines but also raw materials such as photoresist. China must take much less time than Western countries to form a full industry chain in the chip sector and make technological breakthroughs.

The good news is that China has made progress on lower-end chips. As for NAND flash chips and DRAM chips, analysts believe the technological gaps between China and Western countries are narrowing.

There is no doubt Chinese companies will catch up eventually, although there are challenges ahead. China's government, and its investors and companies, are all actively promoting chip localization to secure the nation's supply chains. China will definitely increase investment in semiconductors and import more chipmaking machines to strengthen its capacity to produce ICs at home.

The increase in China's chip self-sufficiency rate is shaking the global semiconductor supply chain. If China can achieve a 70 percent chip self-sufficiency rate in the coming years, it will mean that the US chip blockade against China can only affect the remaining 30 percent, which is the high-end semiconductor field.

For some time to come, the real competition will focus on the high-end chip field.

Overall, Washington's ill-intentioned chip war will further increase China's chip self-sufficiency rate, encourage China to accelerate independent innovation, and further enhance our chip strength.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn