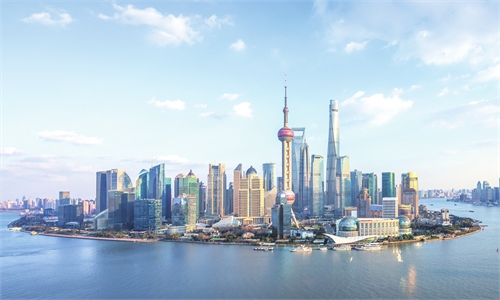

A view of the skyline of Lujiazui in Shanghai on January 24, 2024 Photo: VCG

China's securities regulator recently sent feedback to Citi regarding its application to establish a wholly foreign-owned securities unit in China. Analysts said that judging from the recently disclosed approval progress, such an entity may be approved.As shown on the website of the China Securities Regulatory Commission (CSRC), Citi is required to submit more detailed documents and additional explanatory materials within 30 days for its intended wholly owned securities unit - Citigroup Global Markets Holdings Inc - including an explanation of its net profit decline in 2022.

The company was also asked to update its long-term credit rating and outlook for the past three years and explain why Fitch's credit rating outlook for 2021 was negative.

The CSRC asked Citigroup Global Markets Holdings Inc to prepare to connect the design of internal governance mechanism and articles of incorporation with the revised Company Law of the People's Republic of China, which will come into force from July 1, 2024.

In recent years, the presence of foreign securities firms in China has continued to expand. More foreign institutions are seeking to enter China's financial market to seize opportunities, analysts said.

At present, foreign securities companies, including Mizuho Securities, BNP Paribas Securities Services, SMBC Nikko Securities and other brokerages are waiting for a license to set up wholly foreign-owned securities units in China, Shanghai Securities News reported.

China has been continuously opening up its markets to foreign investment, including in the financial sector, and many international financial institutions have actually entered or expanded their presence in the Chinese market recently, Li Yong, a senior research fellow at the China Association of International Trade, told the Global Times.

For example, in January 2023, Standard Chartered Securities was granted a license by the CSRC to commence securities business, becoming the first wholly foreign-owned securities company in the Chinese mainland, the company announced.

According to the Shanghai Securities News, Standard Chartered Securities is expected to officially start operations in the first half of 2024.

US asset management firm AllianceBernstein announced on January 2 that its wholly foreign-owned enterprise, AllianceBernstein Fund Management Co (AB China), had been granted a license to conduct securities and futures business in China by the CSRC.

Some other securities companies have changed their status from foreign-owned to wholly foreign-owned, including Goldman Sachs (China) Securities Co and J.P. Morgan Securities (China) Co.

The potential of China's stock and capital markets remains enormous, which should be attributed to China's overall leading position in global economic growth, providing plenty of investment opportunities. In addition to the sheer size of the market itself, there is substantial room for growth, Yang Delong, chief economist at Shenzhen-based First Seafront Fund Management Co, told the Global Times on Sunday.

"With deepened financial opening-up, the increased participation of foreign capital in China's financial markets is an inevitable outcome," Yang said.

The net inflow of foreign direct investment in 2023 stood at $62.1 billion, with the net inflow in the fourth quarter reaching a two-year high, showing that more foreign investors have invested in China and allocated yuan assets, the State Administration of Foreign Exchange (SAFE) said on Sunday.

The favorable conditions for China's development are stronger than the unfavorable factors, and the basic trends of economic recovery and long-term improvement have not changed, Wang Chunying, spokesperson for the SAFE, said on Sunday.

It is widely expected that central banks in major developed economies will start a cycle of interest rate cuts, and external financial conditions will ease, said Wang.

Analysts said that China's economic recovery is expected to see stronger momentum in 2024, especially with the introduction of further pro-growth policies, and the recovery may exceed many expectations. Capital markets, a reliable indicator of economic trends, are expected to strengthen.