Information board showing foreign currency exchange rates in Moscow Photo: VCG

Editor's Note: As the world reflects on the Russia-Ukraine conflict on Saturday, its second anniversary, the long-term implications of the ongoing military conflict and the impact of Western countries' sanctions against Russia on the world economy and international market remain topics of great concern. What kind of medium- to long-term effects will the conflict and the sanctions have on the already struggling global economy? The Global Times invited Chinese expert Cui Hongjian to share his perspective.Long before the Russia-Ukraine conflict erupted, the West had already imposed unilateral sanctions against Russia. The sanctions were significantly escalated in a systemic way following the onset of the military conflict.

The West has now expanded the sanctions to almost all aspects of its relations with Russia. The most critical areas include energy imports from Russia, manufactured goods and technology imports, and Russian financial assets abroad. These three areas were also the closest points of contact between Russia and the West before the conflict. Looking at the sanctions, it is clear that this process has resulted in a lose-lose situation.

The sanctions have produced some negative effects on Russia, because in the short term, its traditional trade and energy connections have been altered. Russia will likely incur some additional costs.

However, the Western sanctions against Russia have not achieved the expected results. The goals of paralyzing Russia's financial and economic systems in the short term and weakening its economic capabilities in the long term have not been realized. The West had an overly optimistic estimation of the effects of their sanctioning measures before implementation.

At the same time, there has been a significant backlash. Due to the interruption of energy cooperation between Russia and Europe, we now see that the energy structure of many European countries has undergone significant changes. As a result, energy security has become a pressing issue for many countries.

Western sanctions against Russia are now damaging the commercial reputation of the US and Europe, including in the financial sector.

In addition to the impact on both parties, the Western sanctions against Russia are having a broader impact on the international market.

First, Western sanctions have largely altered the previous structure of the international market in terms of energy and resources, disrupting stable and mature supply chain cooperation. In the short term, these sanctions have caused market volatility, affecting energy and commodity prices.

Second, Western sanctions are forcing more and more economies to rethink the international currency market dominated by the US dollar, because the financial sanctions against Russia will also have a significant impact on the so-called financial reputation of the West itself.

Therefore, some countries raised the issue of de-dollarization some time ago. There is a growing concern in the international community about whether the financial and monetary system dominated by the US and the West still has credibility.

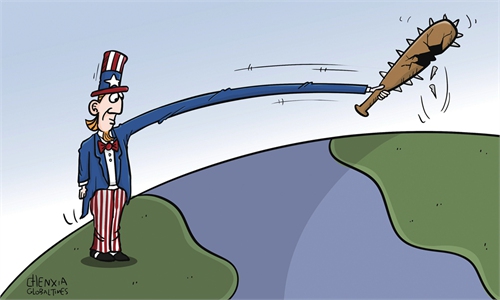

Targeting Russia with financial sanctions actually means that the US uses the international financial and monetary system dominated by the US dollar as a tool or weapon. Since the US still seeks financial hegemony through the dollar's dominance, the US could use its leverage to influence the financial stability of other countries.

If the US and the West will continue to unilaterally sanction Russia for a long time, in addition to exacerbating the Ukraine crisis, which will produce new spillover impacts on the global economy and the financial sector.

While high inflation in the West is just one negative impact, Europe's economy is undergoing structural adjustment and changing its policy priorities. Europe used to rely on stable energy supplies from Russia as its most reliable energy reserve during its energy transition. However, now that there are issues with energy supply, Europe's green energy transition plans must be adjusted, leading to a state of disorder in its economy.

In 2023, the German economy fell into recession, largely due to the disruptions caused by the planning and policy implementation of European countries, including significant disruptions in its natural economic transition process.

The confidence of the international market in Europe will be affected in the future, including investment confidence, economic stability in Europe and its security. This huge concern has already been reflected in some political and trade issues. Combined with the impacts of the Red Sea conflict in the Middle East, the investment and trade activities of Europe will experience medium- and long-term impacts.

The author is a professor with the Academy of Regional and Global Governance at Beijing Foreign Studies University. bizopinion@globaltimes.com.cn