China's economic outlook rosy despite 'peak' slander

Higher GDP growth target conducive to tapping real potential

Intelligent robots on the production line operate rapidly, while human workers are busy assembling new-energy electric box-type cars for export in the workshop of a new-energy vehicle manufacturing company in the Economic Development Zone of Ganzhou, East China's Jiangxi Province, on February 18, 2024. Photo: VCG

Editor's Note: While China's economy is undergoing a crucial transformation and upgrade amid the current complex international environment, Western propaganda machines persist in attempting to undermine China's economic progress by creating biased and inaccurate narratives. To counter these false claims, the Global Times is publishing a series of articles that unveil the reality of China's consistent economic development.During the upcoming two sessions, China is expected to announce this year's targets for GDP growth, as well as consumer prices, employment and other economic metrics. Taking into account the goals announced at recent provincial-level two sessions, it is anticipated that China's 2024 economic growth target may be set at about 5 percent.

The potential growth rate of the Chinese economy is estimated to be 5.5 percent. In my opinion, setting the target at 5-5.5 percent and striving to reach the potential growth rate will be more conducive to fully utilizing economic resources.

In the long run, a higher economic growth target for 2024 will also prepare China to achieve its long-term objectives through 2035. To achieve these long-range visions, an average annual growth rate of 4.7 percent is needed. In the past few years, due to factors such as the COVID-19 pandemic, the country's average growth rate did not reach this level. Until 2030, the annual growth rate should exceed 5 percent.

A higher economic growth target will also boost market sentiment. Setting this year's GDP growth rate at higher than the 5.2 percent actual rise for 2023, will send a clear signal that the priority this year is stabilizing economic growth.

During the two sessions, China is expected to announce its fiscal deficit ratio too. Regarding macroeconomic policies, China has repeatedly stated that it will not adopt a deluge of strong stimulus measures like some Western countries. China has learned from the negative impacts of excessively loose monetary policies in Europe and the US. In order to avoid debt expansion and high inflation, China is unlikely to implement the kind of large-scale stimulus measures seen in Europe and the US.

China will introduce more stimulus plans to boost economy, but these are expected to be more targeted and precise. China's monetary policy has always pivoted on precision in implementation, so the pace of reserve requirement ratio cuts has been relatively measured.

As for fiscal policy, it is expected that the scale of local special-purpose bonds will remain the same as last year, while the central government may slightly raise the deficit ratio. It is generously believed that a deficit ratio of 3.5 percent is more plausible.

The fundamentals of the economy are sound. Some foreign China watchers who make pessimistic comments about China's long-term economic growth do so without any basis. The growth potential of the Chinese economy is still very significant.

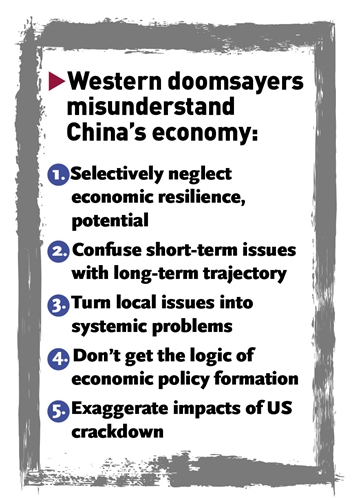

When Western media outlets hype the "confidence collapse theory" or "peak theory" about China's economic development, their major arguments interpret short-term phenomena as long-term ones. Because China's economy has encountered some setbacks in recent years, they tend to see these phenomena as long-term trends, which is actually a common mistake made by many observers.

Western media outlets' hype about the "collapse of confidence" exaggerates the impact of the technological and economic crackdown by the US on China. In reality, it is still a form of US-centric thinking.

Such claims hype the idea that if American capital and technology are not allowed to come to the Chinese market, China's economic prospects are dim. Given the immense size of the Chinese economy and its strong technological capabilities, it can still do very well despite US containment.

Many economic observers, including domestic observers, do not understand the logic of the Chinese government's policy-making. Unlike Western countries' macroeconomic policies, China's policy goals are diverse, including economic, social and political objectives.

When observing China's economic policies, it is essential to consider the changes in the weights given to these multiple objectives. When non-economic goals have a higher weight, the economic growth rate will obviously be affected, as can be observed from economic fluctuations in recent years.

Last year, the Central Economic Work Conference clearly called for including non-economic policies in the assessment of macroeconomic policy consistency to ensure that the policies form a synergy. It is obvious this year that the weight of China's policy-making has shifted more toward expansion, so the outlook for economic growth this year is promising. If foreign experts and media outlets understand the logic behind China's government policy-making, they will not have a pessimistic view of the Chinese economy.

Infografic: Global Times

China's economy saw many new growth points in 2023, and there are still many new highlights to look forward to this year. In the field of medium-level technologies, China is constantly replacing products from developed countries. In the high-tech field, China is rapidly catching up with developed countries.In some areas, such as new-energy vehicles and artificial intelligence applications, China is even playing a leading role. A potential new bright spot in China's economy this year is the process of making electric vehicles (EVs) smarter. The development of the EV industry has already entered the second-half stage.

The first half-stage competition was about the battery, now it's about smart cars. In the field, China is leading the world. In some areas, Chinese brands have even surpassed Tesla. This is something worth paying attention to this year.

Another issue worth paying attention to is whether the real estate market stabilizes this year. If it does, it will play a very important role in stabilizing the entire economy.

This year, it is likely that foreign trade will resume growing on a full-year basis, as exports rose in the final months of last year. Yuan-denominated exports did not decrease last year. This year, if the Chinese economy recovers well and the US Fed lowers interest rates, the yuan may even appreciate against the dollar. Additionally, global demand is recovering, so with these two factors combined, it is believed that China's foreign trade will most likely record a growth this year.

The author is an economist and Boya chair professor at Peking University. bizopinion@globaltimes.com.cn