US mulls extending clampdown on Chinese firms, and China experts call for more resources to support technology self-reliance

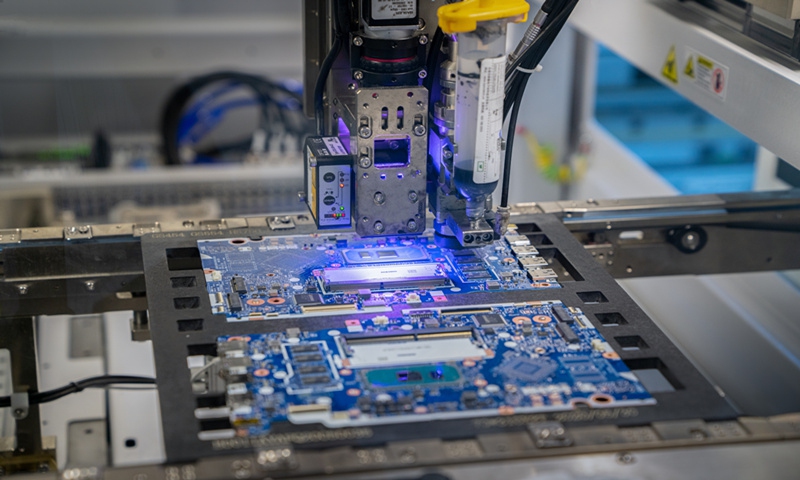

A chip manufacture machine Photo: VCG

The US has been using an array of methods to suppress China's semiconductor industry and other high-tech sectors to contain the country's high-quality development. In the latest move, the US mulled blacklisting another Chinese chipmaker to stifle its growth.

Analysts noted that the US is unlikely to alter its strategy of impeding China's rise, and China should strive for technology self-reliance persistently.

The US is considering adding ChangXin Memory Technologies (CXMT) to its so-called Entity List, to restrict the Chinese company's access to US supplies, Bloomberg reported on Saturday, citing people familiar with the matter.

Hefei-based CXMT is China's top manufacturer of dynamic random access memory chips. The company's memory chips are widely used in computer servers and internet-connected electric vehicles.

Bloomberg cited US-based Micron Technology, South Korea's Samsung Electronics and SK Hynix as CXMT's competitors.

Analysts said that the US again used the Entity List card to recklessly clamp down on China's high-tech sector. The assault on China's semiconductor industry has been expanded to cover many advanced technology fields, such as artificial intelligence (AI).

Shenzhen-based Huawei and Shanghai-based Semiconductor Manufacturing International Co, and Yangtze Memory Technologies Co were placed on the Entity List earlier.

Bloomberg reported that the potential US sanction on CXMT is a response by the Biden administration to a chip breakthrough that Huawei made in 2023, citing an interview with US House Foreign Affairs Committee Chairman Michael McCaul of Texas.

"Until the US gains an upper hand in the contest with China in all technology fields, its tech war against China will show no signs of abating, even if the clampdown bedevils the US' own interests," Zhang Xiaorong, director of the Beijing-based Cutting-Edge Technology Research Institute, told the Global Times on Sunday.

The US knows it can't "decouple" from China, but it is increasingly nervous seeing China's rapid technological rise, Zhang noted.

While the US has repeatedly said that it has no interest in decoupling from China, the US government in October 2023 announced new curbs on the export of high-end AI chips to China. In August 2023, US President Joe Biden signed an executive order that would block US high-tech investments in China.

The US has kept escalating the tech assault on China, indicating that its previous policies have failed to achieve their purposes, Ma Jihua, a veteran telecom observer, told the Global Times on Sunday.

"It should be said that the US has been and is still going mad in clamping down on China's semiconductor industry. Chinese enterprises should get prepared and don't expect the US to ease its assault," said Ma.

Analysts have urged the US government to remove its high-tech clampdown on Chinese companies, in order to avoid disrupting global industry and supply chains. And, they also urged China to strive for self-reliance in technology innovation through enhanced international cooperation, given the endless US sanctioning measures.

China has placed scientific research and tech innovation as a priority of its economic development this year.

The 2024 Government Work Report said that China will strive to achieve faster development of new quality productive forces through upgrading industry and supply chains, fostering emerging industries and future-oriented industries, and promoting growth of digital economy.

China is now actively developing cutting-edge AI, quantum computing and biopharmaceuticals, Wang Peng, an associate research fellow at the Beijing Academy of Social Sciences, told the Global Times on Sunday.

"These cutting-edge technologies are expected to help China break the sci-tech blockade by the US and achieve self-reliance," said Wang.

Analysts pointed out that the development of new quality productive forces is picking up pace in China and has made marked achievements.

Between 2018 and 2023, national fiscal expenditure in the sci-tech area grew from 832.7 billion yuan ($115.94 billion) to 1.06 trillion yuan, with an annual growth rate of 6.4 percent on average, according to the Ministry of Finance.