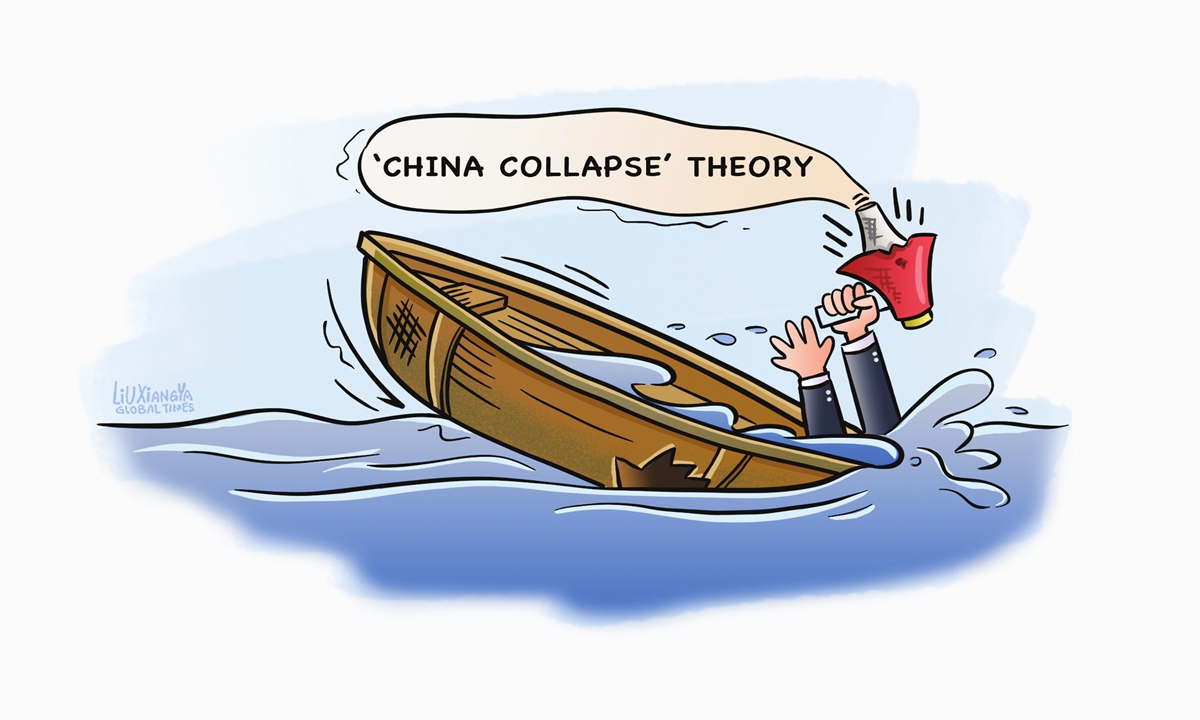

Illustration: Liu Xiangya/Global Times

Will the Chinese economy collapse because of the property problem? Western media outlets have appeared very concerned about this issue, which is affecting the world's objective and accurate view of the Chinese economy. Looking at the latest data and recent policies, we can confidently tell all those concerned about China's economy that the real estate sector may pose a problem, but it won't cause a collapse.This is a problem that must be solved in the process of economic transformation, and the other side of the transformation points to accumulating growth momentum for China's economy.

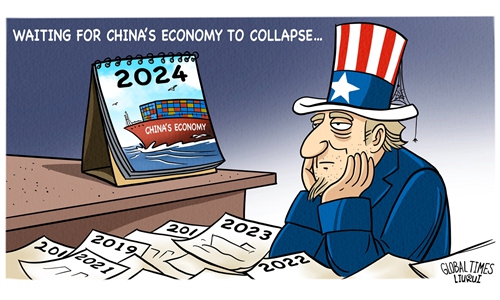

China's National Bureau of Statistics (NBS) on Monday released several macroeconomic indicators. At times like this, it is common to see the world closely watch China's economic data and offer analyses and predictions. However, some Western media outlets tend to magnify the problems in the Chinese economy by playing up concerns over issues like the property sector, which is likely to lead to a misjudgment of the Chinese economy.

The figures released by the NBS on Monday showed that investment in property development in China fell 9 percent year-on-year to 1.18 trillion yuan ($163.93 billion) in the first two months of 2024, while property sales by floor area slid 20.5 percent.

While the recent downturn in the property market does raise some concerns about the Chinese economy, there is still good reason to believe that China's real estate sector will not collapse. The government has taken steps to address risks and stabilize the property market through the optimization of real estate policies.

Since the beginning of this year, China's support for the real estate market has been increasing, including a whitelist coordinating mechanism aimed at supporting the financing needs of property companies. Meanwhile, monetary policies like cutting reserve requirement ratios and interest rates have further lowered the costs of home purchases.

The real estate market is still in the process of adjustment and restructuring, with the task of stabilizing the market remaining challenging. Since the high-speed growth of past decades has brought a lot of problems, the pursuit of high-quality development has become the consensus of the industry. Therefore, the development of the real estate market should be viewed from a medium- and long-term perspective, rather a short-term one.

More importantly, the restructuring of the property sector is not a matter that's just within the industry, but one that needs to be coordinated with the needs of the entire economic transformation, especially the new urbanization strategy. Only in this way could the real estate market still have great potential for growth.

At a press conference held on the sidelines of the two sessions on March 6, Zheng Shanjie, head of the National Development and Reform Commission, said that China will deepen the implementation of the new urbanization strategy to continuously unleash the huge potential of domestic demand and provide momentum and support for the country's modernization.

New urbanization is not just about urban expansion. It also needs to promote economic efficiency based on coordinated industrialization plans, thus boosting employment and public services.

Such a transformation, which combines coordinated planning and technological progress, has become the key to promote China's economic development in the long run, which is also reflected in all aspects of the economy.

For instance, in the first two months of this year, investment in high-tech industries increased by 9.4 percent year-on-year, 5.2 percentage points faster than total fixed-asset investment. The data points to the continuous industrial upgrading in China that will lead to high-quality and more sustainable development.

Moreover, the steady growth in consumption indicates that the fundamentals of the Chinese economy remain stable and resilient. In the long run, the conditions that support the continuous growth of the Chinese economy will persist and prevail.

Given the complex domestic and external environment, it is more crucial than ever to objectively and comprehensively assess the Chinese economic situation to avoid misunderstandings and misjudgments, especially as global uncertainties increase. While acknowledging the challenges, we also recognize the resilience and potential of the Chinese economy. With proper measures to actively promote economic transformation and upgrading, our confidence in the stability of growth momentum will not change.