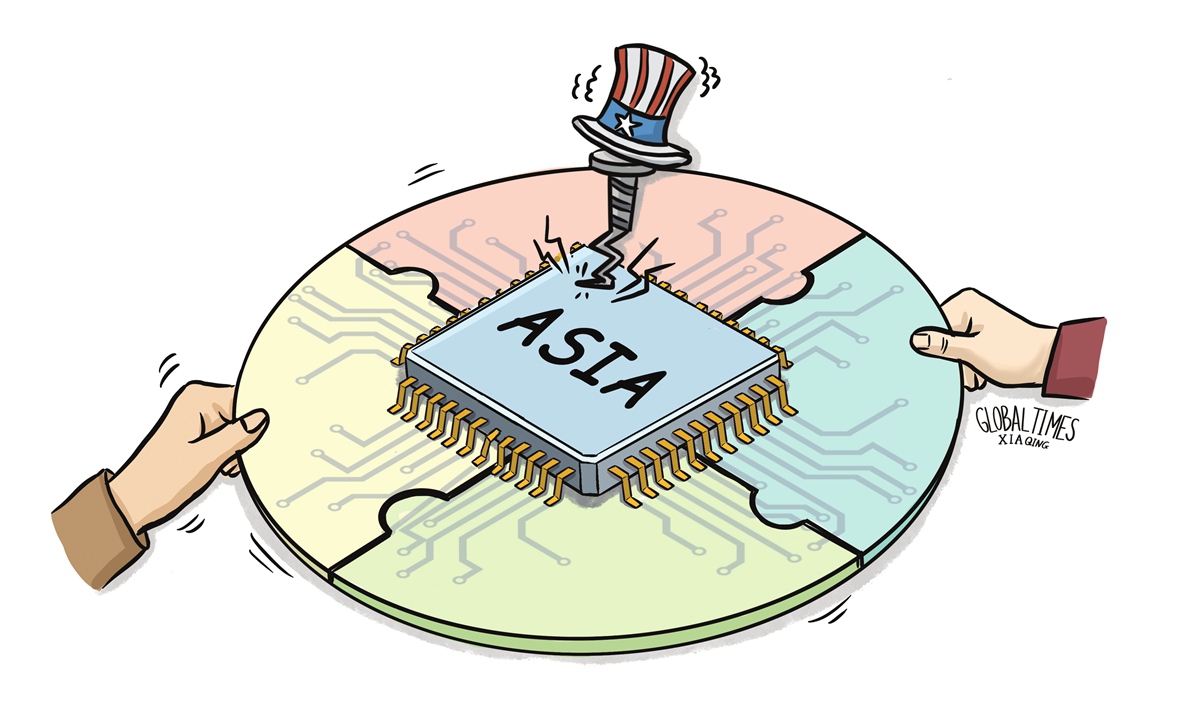

Illustration: Xia Qing/Global Times

Under the current complicated backdrop of mounting US pressure on South Korea and other countries to isolate China from the global semiconductor supply chain, South Korean chipmaker SK Hynix's latest remarks deserve attention as a window to observe the growing importance of the Chinese market for global semiconductor companies.Chinese Commerce Minister Wang Wentao met in succession with several global business executives, including SK Hynix CEO Kwak Noh-Jung, in recent days.

Kwak Noh-Jung said on March 23 that China has become a most important production base and sales market for SK Hynix, so the South Korean chipmaker "will continue to tap into the Chinese market and strive for greater success in its business operation in China."

Earlier this year, SK Hynix dismissed rumors that it was considering selling its factory in Dalian, Northeast China's Liaoning Province, which mainly produces 3D NAND flash memory. Kwak Noh-Jung's visit highlights the importance of the Chinese market to SK Hynix, and shows the chipmaker's determination to achieve "greater success" in China.

Kwak Noh-Jung's trip came at a sensitive moment when the South Korean government is reportedly considering whether to cooperate with US-led restrictions on the export of chipmaking equipment to China. It is our hope that the news isn't true, but if Seoul is indeed considering this question, it is hoped Seoul can make a rational choice to protect, rather than harm, the interests of South Korean enterprises.

The South Korean government should listen to the voices of SK Hynix and, at the very least, respect the company's willingness to invest in the Chinese market and provide a fair and free environment for trade and investment.

SK Hynix is in a critical period of stabilizing its business. The chipmaker reported an operating profit of 346 billion won ($259.8 million) for the October-December quarter, marking its first operating profit since the third quarter of 2022, Reuters reported. For all of 2023, SK Hynix marked an operating loss of 7.7 trillion won, with a total revenue decline of 27 percent.

China is an important consumer of semiconductors, and global chipmakers face life-and-death stakes if they lose the massive Chinese market. In a rapidly changing market, SK Hynix can only keep up with trends by continuing to invest in China and developing more high-end semiconductors, rather than producing cheap, low-quality goods. This is the only way to achieve "greater success" in the Chinese market.

SK Hynix must have already realized this. According to the Korea Herald, SK Hynix said in January that it will upgrade its legacy chip fab in China to produce high-value-added products in order to enhance profitability and meet the demand for recovery.

SK Hynix has made a massive investment in China. As reported by the New York Times, SK Hynix produces 30 percent of its NAND chips and almost half of its DRAM chips in China. If semiconductors produced in SK Hynix's chip fab in China lose competitiveness, a significant portion of SK Hynix's semiconductors will also lose competitiveness. Therefore, SK Hynix must increase its investment to upgrade its technology, despite facing challenges due to the US chip war against China.

The US chip war is intensifying. It is hoped that Seoul can provide greater space for South Korean companies including SK Hynix, allowing them to freely invest in China, continue to tap into the Chinese market, and have technology upgrades to win the market.

Additionally, if the US continues to tighten restrictions on exports of chip equipment to China, South Korean companies can enhance their cooperation with China's local supply chain. The technological gap between China and South Korea in NAND flash chips and DRAM chips is narrowing, with Chinese domestic chip technologies advancing rapidly. This means that South Korean companies doing business in China can receive more support from China's domestic supply chain.

During Chinese Commerce Minister Wang Wentao's meeting with Kwak Noh-Jung on Saturday, Wang expressed hope for SK Hynix to continue to increase investment in China, further unlock the Chinese market, and share the growth opportunities in China's high-quality development.

Hopefully, Chinese officials' voices can be heard by more people, especially those in Seoul.