Illustration: Liu Xiangya/Global Times

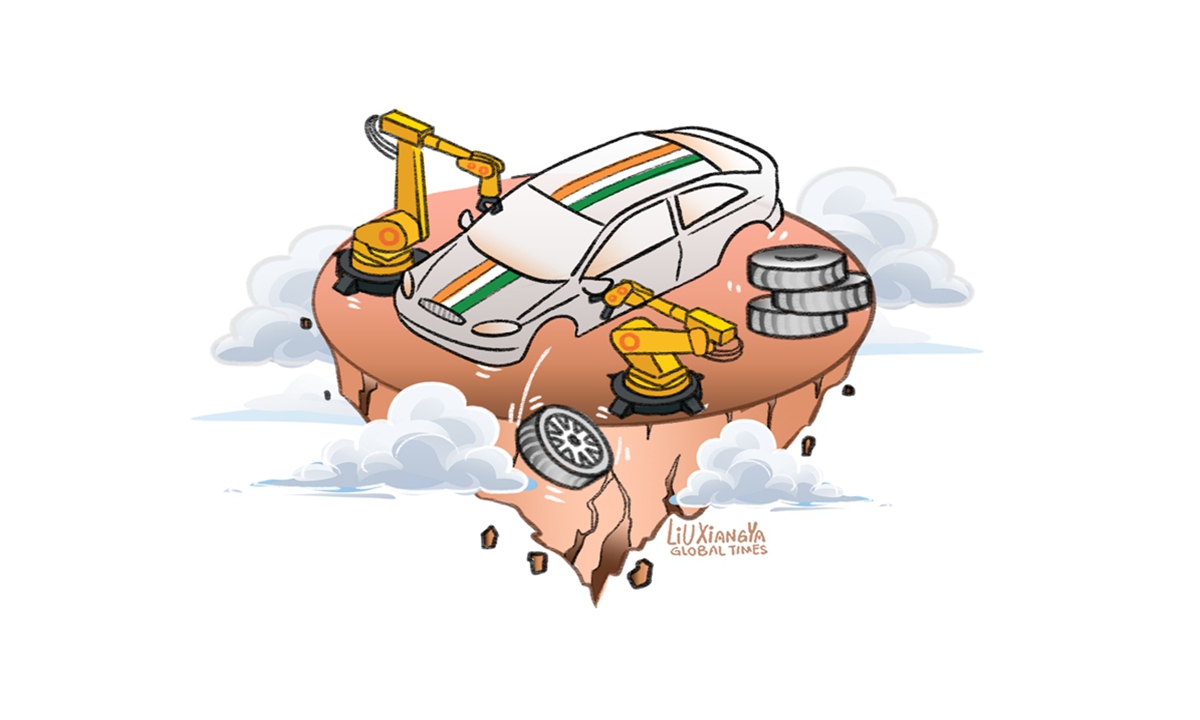

Recent policy developments from the Indian government suggest a bold ambition to position India as a manufacturing hub for electric vehicles (EVs). However, it is ironic that some Indian elites seem oblivious to the significant gap between the current state of the Indian EV industry and their lofty EV target.Instead of addressing this disparity, they appear more obsessed with the idea of excluding China from India's EV supply chain.

A report by think tank Global Trade Research Initiative (GTRI) released on Sunday said that the Indian government's push to boost domestic EV manufacturing may lead to the large-scale entry of Chinese auto firms in the local market, PTI reported.

Also, it will lead to a sharp increase in dependence on components imported from China, the GTRI report said, suggesting that the government and industry stakeholders will need to carefully manage the risks of over-reliance on foreign manufacturers and potential trade imbalances.

There is no denying that India has a strong vision for developing its EV manufacturing industry. However, it is crucial for this ambition to be rooted in reality rather than being a mere castle in the air. Given the status quo of India's EV industry, it's laughable for some Indians to worry about whether their EV efforts will benefit Chinese companies.

Given the development of India's auto sector, it is obviously unrealistic for India to expand the EV market while promoting the localized supplies of EV parts. That may be why India is trying to persuade foreign carmakers like Tesla to invest in India.

The Indian government recently announced a policy to cut the import duty on EVs, which now runs at 70-100 percent, to 15 percent, if a foreign company invests at least $500 million to make EVs in India, in a bid to attract major global players, according to the PTI report.

Yet, India's EV market is still small. EV sales jumped 49.25 percent year-on-year to 1.53 million units in 2023, according to data released by the Federation of Automobile Dealers' Association. But most of the sales were for two-wheelers and e-three-wheelers, with e-commercial vehicles at merely 5,673 units, PTI reported.

Meanwhile, India's lack of a charging network for EVs could also pose an obstacle to its desire to lure foreign players.

Indeed, by any measure, India's EV industry is essentially just a plan on paper, lacking substantial progress or tangible results. The country's vehicle industry is not well established and it lacks the technology and manufacturing capacity to support mass production of EVs.

By comparison, China has developed its EV sector on the basis of a huge, mature auto industry as well as a comprehensive supply chain.

China's remarkable achievements in the global EV industry are underpinned by the strength of its domestic industries, a stark contrast to the weaknesses seen in India's own industrial sector.

Lacking a solid industrial foundation, India, despite its promising consumption market, is bound to face great challenges in pursuing its EV ambition.

One can't help but wonder, is India naive or just plain delusional? Does it truly believe that it can build a domestic EV industry with its current sales level, shaky industrial foundation and poor infrastructure?

Whether it's fixing its infrastructure problems, like charging stations and smart driving networks, or ensuring the supplies of key EV parts like batteries and the transmission system, India clearly still has a long way to go.

Under such circumstances, it is completely misguided for someone to consider whether or not to exclude Chinese supplies from India's EV industry, which is still in its infancy.

If anything, such a mindset casts a shadow on India's EV dream, as a failure to recognize its own shortcomings and China's position in the global EV industrial chain will only slam the brakes on India's ambitions.