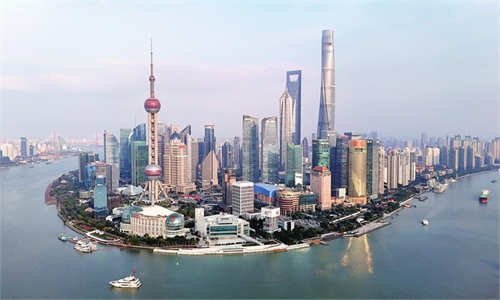

A view of the skyline of Lujiazui in Shanghai on January 24, 2024 Photo: VCG

Global leading financial institutions,including Neuberger Berman and Fidelity International, have announced moves to increase their registered capital or set up branches in China recently, highlighting their confidence in the future of the Chinese economy as well as vast opportunities the market creates for foreign financial players.

Neuberger Berman Fund Management (China) Co, the Chinese unit of US asset manager Neuberger Berman, has raised its registered capital by 40 percent to 420 million yuan ($58.11 million). It's the third capital increase for the company in China, the Economic Information Daily reported on Wednesday, citing data provider Tianyancha.

"We believe that there is still considerable potential for China's growth in the global capital market, largely hinging on the openness of the Chinese capital market," Patrick Liu, head of Asia Pacific of Neuberger Berman, told the Global Times in a previous interview.

As China persistently advances opening-up and innovatively restructures its capital market, we anticipate a steady inflow of overseas capital, he said.

According to Wind data,the inflow of northbound capital- money invested from the Hong Kong Special Administrative Region into the Chinese mainland through stock connect programs - stood at 60.7 billion yuanin February, the highest in about a year. Between February 1 and March 25, northbound capital inflowsreached approximately 83 billion yuan.

Recently, Fidelity International announced the opening of a new Beijing office and added $30 million to the registered capital of its China funds unit, taking its overall capital base to $160 million.

"Our long-term commitment to the China market is unchanged," the company told the Global Times on March 19.

Industry analysts said that these moves reflect a positive long-term view of the economy.

"Compared with developed economies whose financial sectorsare mature, China's financial industry has vast development potential. Moreover, the A-share market remains at a relatively low level, which means long-term investment value," Xi Junyang, a professor at the Shanghai University of Finance and Economics, told the Global Times on Wednesday.

In addition, China's firm commitment to high-level opening-up, underlined by policies to boost institutional opening-up and improve the business environment, is one of the most important factors in attracting foreign capital, Xi said.

On March 15, the China Securities Regulatory Commission (CSRC) issued four guidelines, vowing to promote high-level opening-up.

With equal emphasis on "bringing in" and "going global," we should steadily expand institutional opening-up in the financial sector and support qualified foreign financial institutions to set up branches in China, it said.

The long-term fundamentals of the Chinese economy remain unchanged, and thus increased investment will help global financial institutions diversify risks, especially risks from US-led protectionism and financial instability, Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China, told the Global Times on Wednesday.

Dong stressed that improving the quality of listed companies is key to the healthy development of the A-share market and called for strengthened regulations in this regard.

Securities regulators should promote a survival of the fittest approach in delisting and severely punish illegal activities including financial fraud, IPO fraud and insider trading, according to Dong.

Wu Qing, head of the CSRC, on March 6 said in his first public appearance before the media since taking his new post that enhancing institutional build-up and attracting long-term investment will be pursued to accomplish the tasks outlined in this year's government work report.

Wu reiterated the importance of prioritizing investors, combating financial frauds, and encouraging listed companies to engage in cash dividends and buybacks.