Illustration: Tang Tengfei/Global Times

The rebound of South Korea's semiconductor manufacturing sector is a hint that the global chip industry may enter a new cycle of prosperity, but this time may be different from earlier cycles.South Korea's output and exports of chips rose in recent months. The strong sales of chips drove up overall exports by 3.1 percent year-on-year in March, while increasing semiconductor production drove up overall industrial output in February, the Yonhap News Agency reported on Sunday.

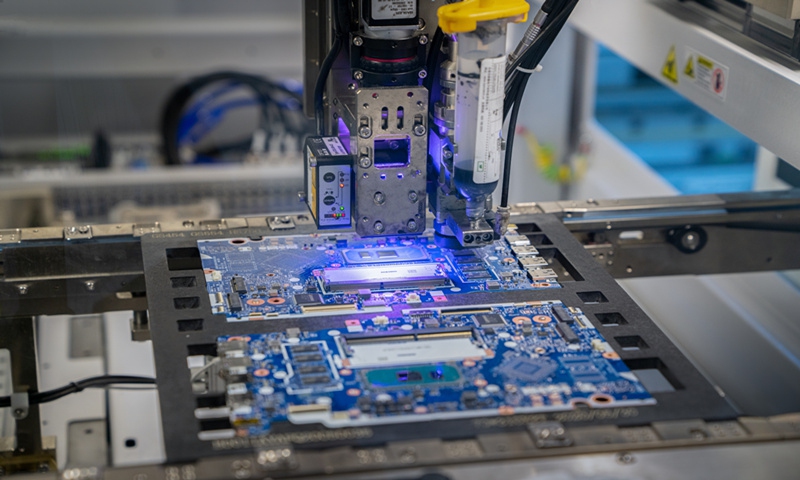

The growth in semiconductor production is highly likely to continue in the coming months. Citing market research firm Omnia, South Korea's Chosun Daily reported last week that Samsung Electronics has revised its average monthly DRAM wafer input from 590,000 to 600,000 wafers in the second quarter of this year, which would be a 13 percent increase from the previous quarter. SK Hynix has also been gradually increasing wafer input.

Samsung Electronics and SK Hynix together reportedly account for almost 70 percent of global DRAM production. The growth of their production is expected to have a huge impact on the global market.

The semiconductor industry has experienced numerous boom-and-bust cycles throughout its history. Now, the semiconductor surplus that emerged in 2022 has begun to ease, which perhaps means a new round of development for the industry.

However, as Washington's chip war escalates, the industry is witnessing intense competition, with players worldwide vying to boost semiconductor production, making the current situation very different from previous times.

As reported by the Japan Times, Japan went all-in on semiconductors in 2023, backing new plants and rolling out extensive support. With countries around the world investing hundreds of billions of dollars to bolster domestic chip manufacturing to insulate supply chains from US-initiated geopolitical tensions, excess capacity is becoming an increasing problem. This is an inevitable side effect of the US chip policies.

One possible outcome is that the new cycle of prosperity will be shorter than expected. Moreover, the competitive expansion of production capacity will result in fierce market competition for enterprises.

At a time when the global chip market sees a turnaround, it is understandable for South Korean companies to expand their capacity, but they may need to consider how they will sell those semiconductors, while avoiding oversupply and price declines.

Challenges in the semiconductor market may be more severe than ever. First, the situation requires South Korean chipmakers to increase investment in technology and accelerate technological innovation. The technology gap between South Korea and China in DRAM technology is estimated at only five years. As China and other developing countries rapidly upgrade their high-tech sectors, South Korean companies will face more market competition.

South Korea's semiconductor ambitions got a boost when the country in January unveiled plans by leading firms such as Samsung Electronics and SK Hynix to spend more than $470 billion establishing the world's largest chipmaking cluster, but the realization of this ambition must be based on technological upgrades.

Second, South Korea needs to further strengthen its connection and cooperation with chip consumer markets, including China, which is currently the world's top semiconductor consumer. Amid fierce competition, it is not easy for South Korea to find an alternative market to replace China.

As South Korea increases investment in the semiconductor industry, it is crucial to accelerate technological innovation in South Korean companies' Chinese factories.

Third, Washington's coercive move to involve South Korea in its chip stranglehold against China is causing significant losses for South Korean chipmakers. This situation means that South Korea needs to strengthen independent technological innovation to counter cutthroat pressures, and reduce its dependence on US technologies.

As the restructuring of the global chip industry chain seems to have accelerated, technological upgrading should be a key part of South Korea's efforts to maintain market share in China and in the global markets.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn