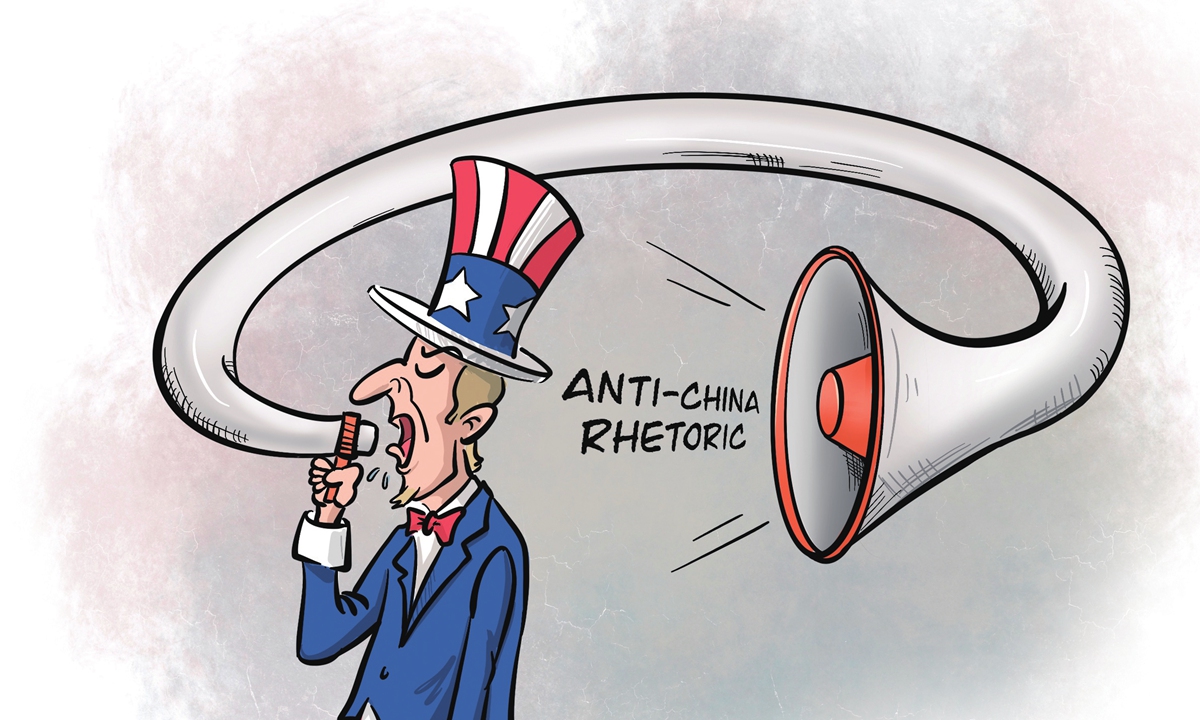

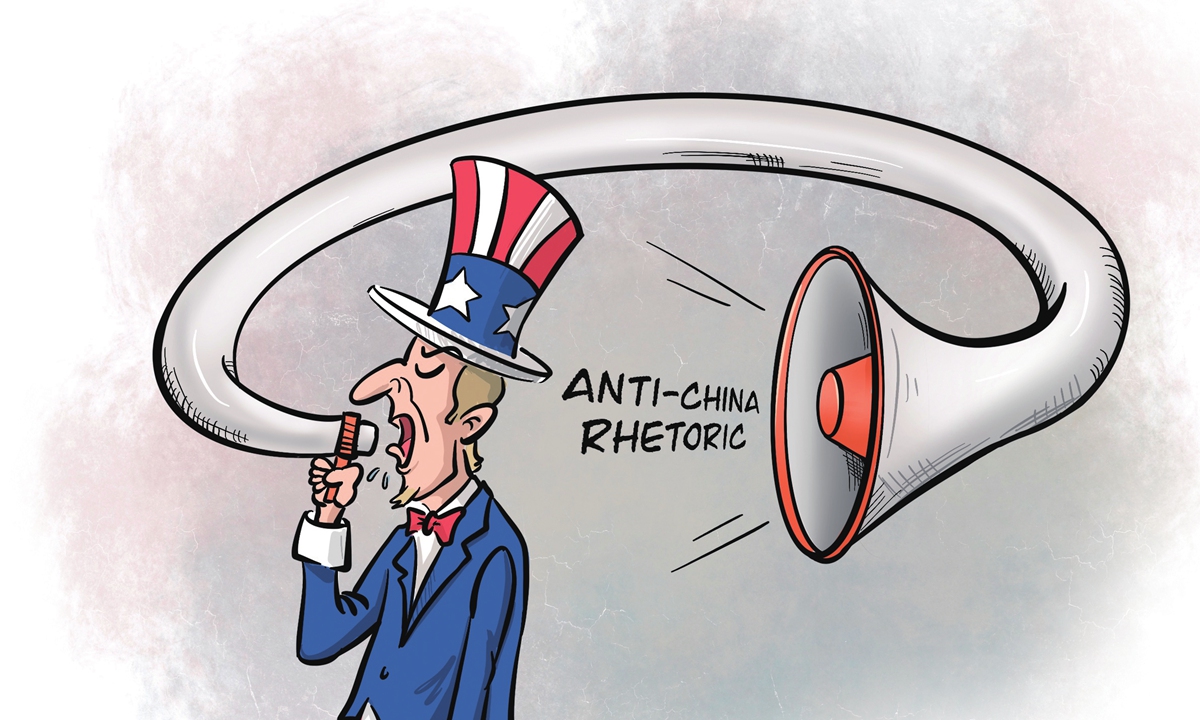

Illustration: Liu Xidan/Global Times

"Does China Matter?" asked Gerald Segal, the renowned geopolitical analyst and prolific writer in 1999. He arrived at profoundly wrong conclusions and dismissed China as a small market that matters little to the world and as a second-rank middle power at best. Segal could be forgiven for his flawed forecast, since China was still poor and accounted for only 3 percent of global trade at the time. However, 25 years later, there is no excuse for Western analysts to continue dismissing China using logical fallacies, cherry-picked data and Orwellian doublespeak.

Such blatant propaganda is exemplified by the recent article, "China Is Gaslighting the Developing World," written by Robert Manning for the esteemed Foreign Policy magazine.

Debunking this one article is to debunk most of the anti-China propaganda emanating out of the American echo chamber.

For starters, the entire article is self-contradictory. The subtitle of the article is, "Beijing's promises of equality are a guise for hegemony" but most of the article portrays a China that is "faltering" in every aspect - at home and abroad. But, wait a minute, if China is performing so badly, there is no way it can achieve "global hegemony." The only one gaslighting everyone is the US establishment.

The rest of the article can be summarized as follows: A multipolar world is a faux utopia, de-dollarization is going nowhere, BRICS has no future, and everyone prefers the US-led world order. The standard lies about China are also recycled: Its economy is stumbling, it bullies its neighbors, it uses the "debt trap," and it has no soft power.

Let's refute those lies one by one.

First, the rise of a multipolar world is not only inevitable but is happening in real time. The economic, technological and geopolitical centers are shifting rapidly to Asia. In terms of GDP by purchasing power, BRICS is larger than G7, and Asia is larger than the collective West. According to some projections, by 2030, six out of the ten largest economies in the world will be in Asia. The world's largest and fastest-growing middle class is in the Global South. And China has been leading the world in patents and scientific publications for many years.

No serious analyst can ignore the rapid expansion of BRICS and the resentment toward US-led perpetual wars and chaos. The fact that Saudi Arabia, Iran and the UAE - three energy powerhouses and geopolitically strategic countries - opted to join BRICS last year should be a wake-up call for the exceptionalists. Thirty more countries have queued up to join BRICS, which offers a vision of multilateralism, cooperation, shared destiny and common prosperity.

As for de-dollarization, the global trends are obvious: More than half of China's cross-border transactions are now happening in yuan, and Russia-China trade is almost completely devoid of the US dollar. From Latin America to Africa and ASEAN to India, everyone is exploring ways to decouple from the US dollar, which has been weaponized. When OPEC starts selling oil for yuan, it will ring the death knell for petrodollar. Creating alternatives to the current rigged financial system is difficult but not impossible. No global reserve currency or empire lasts forever.

While China's economy has slowed down, 32 percent of global economic growth came from China last year. Also, in 2023, China became the world's largest exporter of cars - another milestone in China's manufacturing prowess. In 2024, the World Bank projects the US to grow at 1.6 percent and the Eurozone at 0.7 percent. This means if China achieves its target GDP rate of 5 percent, it will grow 3 times faster than America and 7 times faster than Europe.

China's economy is "stumbling" forward so fast that Americans created a new word - "overcapacity" - to hobble China's success in the next-generation technologies.

Most of China's problems with many of its neighbors have one source: the US. However, China patiently works to find win-win solutions. For example, Australian Prime Minister Albanese visited Beijing last year, and now China's tariffs on Australia's coal, wine, among others, have disappeared. A recent poll also reveals that ASEAN citizens would choose China over the US.

Regarding China's so-called debt trap, let's not forget that 86 percent of developing nations' external debt is owed to private and multilateral creditors. China's share is minimal. More importantly, Chinese "debt" are crucial investments that lead to tangible projects such as highways, railways, seaports, airports, dams, schools and hospitals. These are indispensable for the growth of developing nations.

In summary, the US is now wasting an enormous amount of money on ineffective geopolitical campaigns.

The author is a geopolitical analyst, columnist, blogger, podcaster, and writer based out of Bangalore, India. His work can be found on Substack, X and more. opinion@globaltimes.com.cn