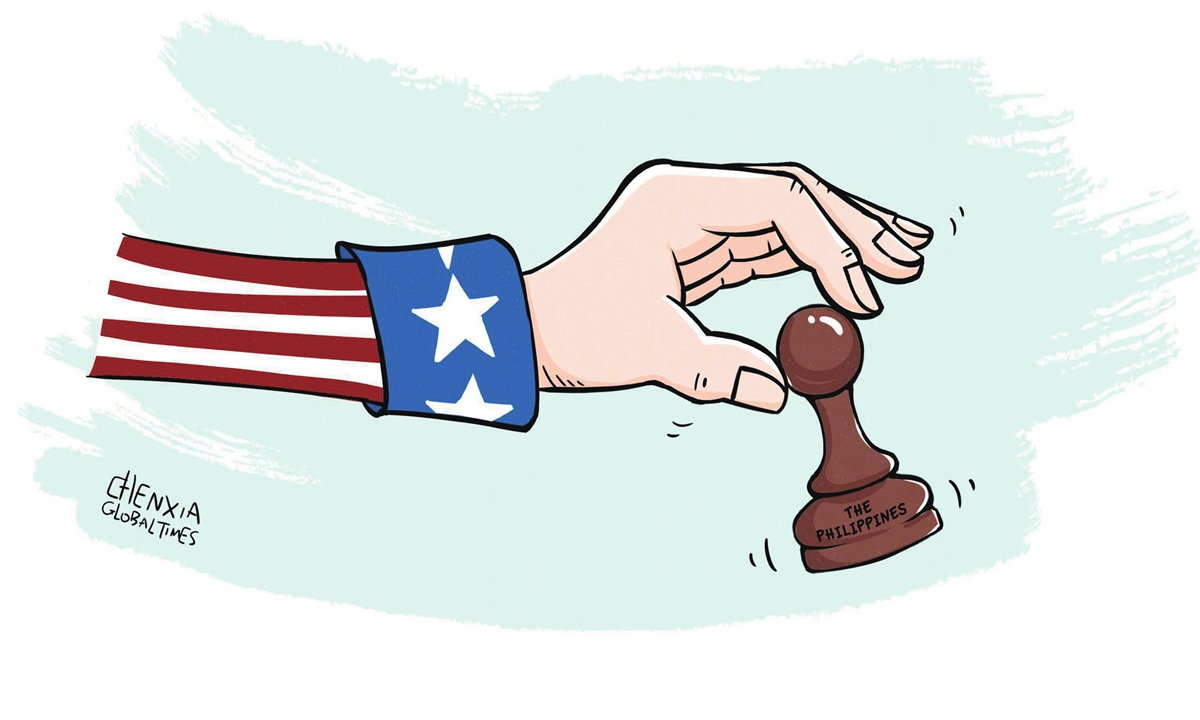

Illustration: Chen Xia/GT

If the Philippines wants to reassure Chinese companies about investing in the country, it may need to take tangible steps to mitigate risks for Chinese investors, rather than just providing optimistic rhetoric.Philippine President Ferdinand Marcos Jr said that business deals that the Philippines secured at a summit with Japan and the US will not affect China's investments in the country, Reuters reported on Friday.

Despite the diplomatic shift, the Marcos government may still hold some pragmatic thoughts on maintaining economic and investment ties with China due to the Philippines' economic needs, but pressure from Washington and Tokyo could pose a dilemma.

It is not hard to see that in collusion with the US and Japan to serve their strategy of containing China, the Philippines has plunged itself into a geopolitical tug-of-war, which other ASEAN countries have been trying to avoid in their regional diplomacy.

Given the Philippines' recent tough attitude toward China and its hype about the "China threat" at a trilateral summit with the US and Japan, it is impossible to expect that such developments won't dampen Chinese investors' confidence in the country.

Yet, no one can easily deny the importance of trade between China and the Philippines, especially at a time when the Southeast Asian country is grappling with multiple challenges such as inflation, energy security and outdated infrastructure.

Like other ASEAN members, the Philippines maintains strong economic and trade ties with China, a vital trading partner and investment source. Chinese investment, particularly in infrastructure, plays a critical role in the economic development of the Philippines.

Take China's State Grid's investment in the National Grid Corp of the Philippines as an example. This is a landmark project that underscores China's important role in infrastructure development in the country. State Grid Corp has successfully operated the national transmission grid in the Philippines using its management experience and relevant technologies, contributing stable support for the country's electricity supply and bringing tangible benefits to the economic and social development of the Philippines.

If anything, this is a prime example of why Marcos still tries to tread a fine line with Chinese investment. Normal economic and trade relations with China are still in line with the interests of ASEAN countries.

Under such circumstances, it is up to the Marcos government to stabilize economic and trade ties with China, especially Chinese investment in the Philippines.

A conducive environment is essential for any investment to thrive. However, excessive political risk can undermine investment confidence. Unfortunately, this is what many Chinese companies may fear in investing in the Philippines.

Even in the case of State Grid, the project has encountered political obstacles, highlighting the complexity of Chinese investment in the Philippines. In May 2023, Marcos reportedly backed a probe to determine whether the government should take over the country's sole power grid operator, in part due to national security concerns, Nikkei Asia reported.

Obviously, the investment environment could become more complex and unpredictable. While the US and Japan promised some economic assistance to the Philippines during the trilateral meeting in Washington last week, they also urged the Philippines to diversify supply chains to reduce reliance on China. It is apparently an attempt to push the Philippines to "decouple" from China.

For instance, the three countries agreed to forge ties to strengthen supply chains for nickel, a critical mineral essential for the batteries used in electric vehicles, a move aimed at creating a supply chain that is not overly dependent on China, The Japan News reported on Sunday.

As an ASEAN member, the Philippines should keep pace with ASEAN members in economic and trade relations with China. If the Philippines wants to rely on military alliances with the US and Japan to resolve the South China Sea issue, it will be hard to reassure Chinese investors about the investment environment in the Philippines.

At the same time, the Philippine government must implement concrete measures to mitigate risks for Chinese enterprises and foster a conducive investment climate, rather than offering oral promises. These actions should include, but not be limited to, bolstering legal safeguards with clear, transparent and business-friendly policies, as well as ensuring a stable political and economic landscape.