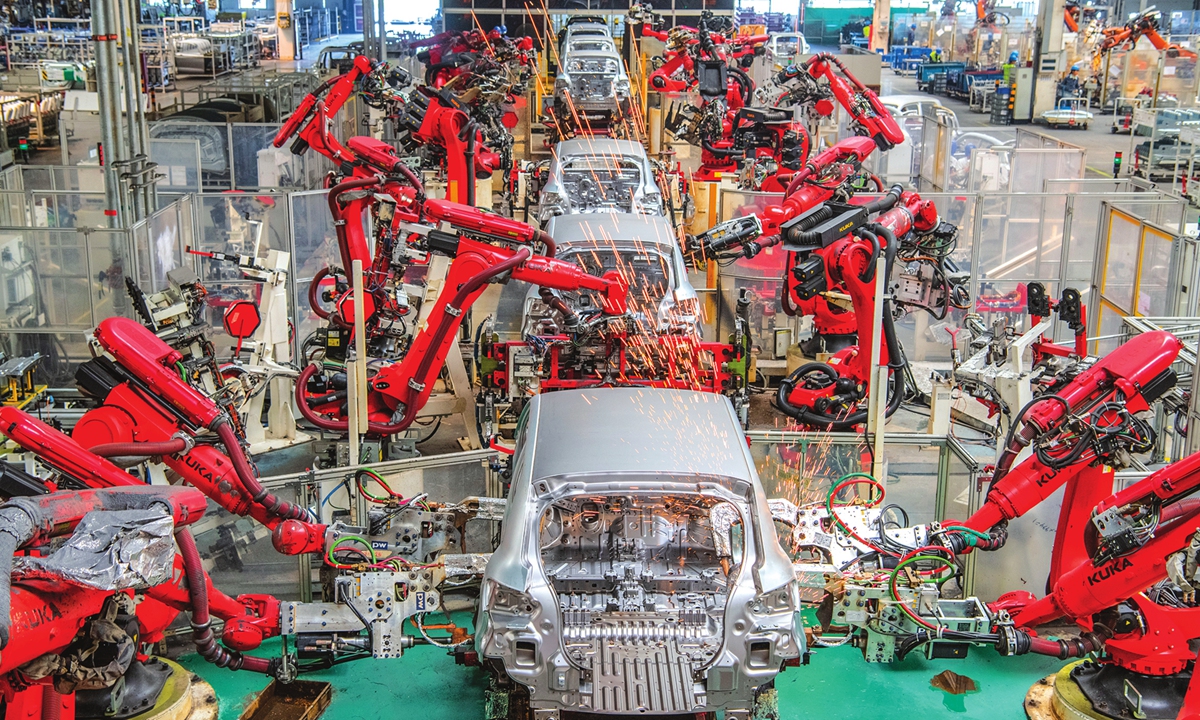

An automated production line runs in a new energy vehicle intelligent factory in Jinhua, East China's Zhejiang province, on April 1, 2024.Photo: VCG

The third plenary session of the 20th Communist Party of China (CPC) Central Committee will be held in Beijing in July, according to a decision made at a CPC Central Committee Political Bureau meeting on April 30. The announcement of the "third plenum" immediately ignited investor enthusiasm as the Hong Kong stock market surged in the following days. The mainland's stocks closed higher on Monday, with the benchmark Shanghai Composite Index up 1.16 percent to 3,140.72 points, and Shenzhen Component Index up 2 percent at 9,779.21 points after a five-day holiday break. Investors are waiting for this big news to lead to a bull run.More pro-growth stimulus measures are expected to come out soon. The CPC Central Committee political bureau meeting said that ultra-long special treasury bonds should be issued at an early stage and put in good use, and it is necessary to flexibly employ policy tools such as interest rate and reserve requirement ratio to increase support for the real economy, while provinces and cities facing high debt risks are urged to unwind their debt burdens.

Specifically, the meeting asked for assessing and implementing a set of comprehensive reform measures to cut housing inventories and improve the quality of newly-added housing.

The real estate sector has been in a lull since the outbreak of the pandemic as market demand withered. Now, the property bubble has been deflated, and it is time to rejuvenate the important industry. By all metrics, the new mandate to reduce housing inventories is definitely warranted, and it's broadly deemed supportive of the industry's healthy development.

China overcame many domestic and external difficulties to achieve an impressive 5.2 percent GDP growth rate in 2023. The State Council, the cabinet, announced in March in its annual Government Work Report to the National People's Congress that China will aim for around 5 percent growth in 2024. That target would be more difficult to attain than in 2023, due to the much higher base effect this year than in 2023. The reckless harassment by the US to stymie China's high-tech industry will make the job even harder.

However, Chinese policymakers won't sit idle and passively see the 5 percent growth target elude them. As proved by the past four decades, economic difficulties can only be addressed through persistent and brave reforms. It was the "third plenum" in 1978 that kicked off the historic and transformative epoch of China's reform and opening-up drive, which has led to miraculous economic achievements by the country.

The impending "third plenum" in July will make another important mark in history, by navigating the Chinese economy's path through rough seas.

The landscape of international economic and technology competition is undergoing critical changes. China should have no illusions that the hegemonic US government will stop its obstructive, callous gimmicks to harm Chinese enterprises and slow China's development. Washington's notorious "small courtyard, high walls" policy to "starve" Chinese companies of American technology will continue, if not accelerate and harden in the coming months.

So, pivoting the Chinese economy to a more self-reliant and sustainable path has taken on greater urgency and significance. Developing and advancing new quality productive forces in the country will be the best and most effective way to offset the ruthless US containment. Domestic tech innovation will act as the biggest variable in the contest of national strengths.

Provided that China can achieve more indigenous tech innovation, be it high-speed digital transmission methods, high-end electric vehicle batteries and renewable energy exploration, or high-quality artificial intelligence solutions and transformative robotics, this country will surely prevail in the competition. As these cutting-edge technologies can never be bought, China must continue to invest heavily in scientific research and development.

The new reform measures to be presented and discussed at the "third plenum" in July will have a major impact on China's economic growth for the coming five to 10 years. The political bureau meeting admitted that the Chinese economy faces many challenges, like insufficient domestic demand, and the complexity, severity and uncertainty of the external geopolitical environment.

At the current stage, it is of great importance for the country to put more energy into resolving domestic issues, which explains the meeting's call to expedite the issuance of the ultra-long special-purpose treasury bonds in order to provide extra support for the economy.

Last week, the capital city of Beijing ended a curb on multiple home purchases outside of the Fifth Ring Road, following the removal of restrictive housing policies in Chengdu and Suzhou intended to digest inventories.

The prospects for restructuring and upgrading China's economy, including bolstering technology innovation, shoring up the role of free market competition, expanding opportunities for all types of businesses, allocating capital more efficiently, and improving the balance between domestic consumption and investment, are better than at any point in the past.

The political bureau meeting called for enhanced efforts to develop new quality productive forces and ramp up China's high-quality manufacturing capability as well as strategic future industries. China should actively develop venture capital and shore up patient capital in the course of fostering important technology-based emerging industries, the meeting announced, which again illustrated the creativity and audacity of China's policymaking.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn