Illustration: Xia Qing/GT

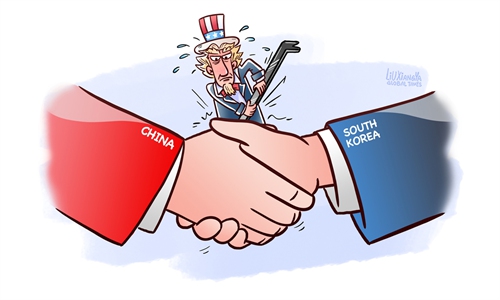

Although South Korea's semiconductor exports have surged in recent months, the industry, an engine of economic growth in South Korea, is facing stiff headwinds, which suggests that Seoul should do more to prevent US chip restrictions from further squeezing the development space of South Korea's semiconductor industry.Recent media reports said some South Korean chip companies would sell their stakes in subsidiaries based in China. Against the backdrop of US restrictions on chip supplies, these reports led to speculation among investors as to whether South Korean chipmakers will scale back their operations in China.

We hope the answer is negative. China is an important production base and sales market for South Korean chip enterprises. If Seoul is unable to protect these companies' interests and further exposes them to US economic coercion and bullying, which may prompt these enterprises to reduce their presence in China, South Korea's semiconductor industry will suffer heavy losses.

Citing people familiar with the matter, Reuters reported that the US has revoked licenses that allowed companies including Intel and Qualcomm to ship chips used for laptops and handsets to Huawei.

Such efforts fueled a new round of commentary that Washington will further tighten export restrictions on semiconductors and chip manufacturing equipment. South Korea is unlikely to remain unaffected. Seoul should do its utmost to minimize the losses for the South Korean economy.

As for China, it should be noted that Washington-initiated trade war has forced the country to pursue a path of independent innovation and overcome challenges in commercializing chip technologies. With persistent investment, China aims to climb the semiconductor value chain and expand chip production capacity.

If some South Korean companies decide to sell their stakes in subsidiaries to local Chinese enterprises, it is hoped that such sales can facilitate deeper cooperation and interaction between Chinese and South Korean companies, especially in the fields including technology. Amid uncertainty generated by US restrictions on chip supplies, South Korean companies should strengthen their presence in China, one of their most important markets, through various means. Seoul should help companies to resist pressure from the US, offering more space for China-South Korea semiconductor cooperation to grow.

Semiconductors are a key foundation of South Korea's export-driven economy. The South Korean economy is facing headwinds on multiple fronts, including inflation, currency depreciation and a shrinking population. The Financial Times published an article with the headline "Is South Korea's economic miracle over?" Exiting the COVID-19 pandemic, South Korea's economic growth has been relatively slow, standing at 4.3 percent in 2021, 2.6 percent in 2022 and 1.4 percent in 2023, according to the Korea Times.

The semiconductor industry is a key component of the South Korean economy. The South Korean government should prioritize efforts to drive the economy and, in this process, the semiconductor sector is of the utmost importance to the economic recovery.

It's no secret that Washington wants South Korea to further restrict the export of advanced semiconductor technology and tools used for making high-end chips to China, but this is not in line with the interests of South Korean companies. As pressure from the US increases, if Seoul continues to make compromises and is even forced to take sides in Washington's chip war against China, South Korean chip companies will suffer serious losses. The country's economic recovery will also be negatively affected.

In recent times, there have been signals indicating that Seoul wants to further strengthen the US-South Korea alliance and lean more toward the US in political and economic affairs. South Korean policymakers should remain sober to avoid sacrificing the interests of South Korean companies to consolidate the US-South Korea alliance. Otherwise, South Korea's economy is likely to expand at a slower pace as the US forces South Korea to take sides in its tech cold war.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn