Smart manufacturing advances production line in Hefei, US ‘overcapacity’ hype originates from competition anxiety

Editor's Note:

As the Chinese economy, along with the entire global economy, has been facing considerable challenges in recent years, some Western officials and media outlets have stepped up their long-standing smear campaign against the world's second-largest economy. They cherry-pick information and even distort facts to hype various specious narratives such as "Peak China," while turn a blind eye to China's considerable strengths and vast potential.

In order to set the record straight, the Global Times is launching a multimedia project, which will include in-depth articles, objective analysis, and visual arts, to present a large, comprehensive and true picture of the Chinese economy. Our reporters will travel across the country from the old industrial base in Northeast China to the burgeoning Greater Bay Area in South China. They will document new development trends, new business models and new growth drivers, in order to demonstrate China's economic strengths and its vast potential. This is the first installation of the project, focusing on the Hefei NEV industry.

Hefei, the capital city of East China's Anhui Province, is a "dark horse" in China's new-energy vehicle (NEV) industry where one NEV is rolling off the assembly line every minute on average for some producer. The city is home to six vehicle manufacturers including JAC, BYD and NIO, as well as more than 500 upstream and downstream industry chain companies.

Against the backdrop of the current rapid development of China's NEV industry, the US has sought to over hype a narrative of Chinese "overcapacity."

Global Times reporters recently visited several of Hefei's NEV suppliers, including those from upstream and downstream industries, where local business leaders and experts noted that local NEV is developing in a competitive market where technological innovations and stable supply chains are key. The claims of "overcapacity" are a thinly veiled guise for protectionism, where are quickly dismissed upon examining the reality of the ground.

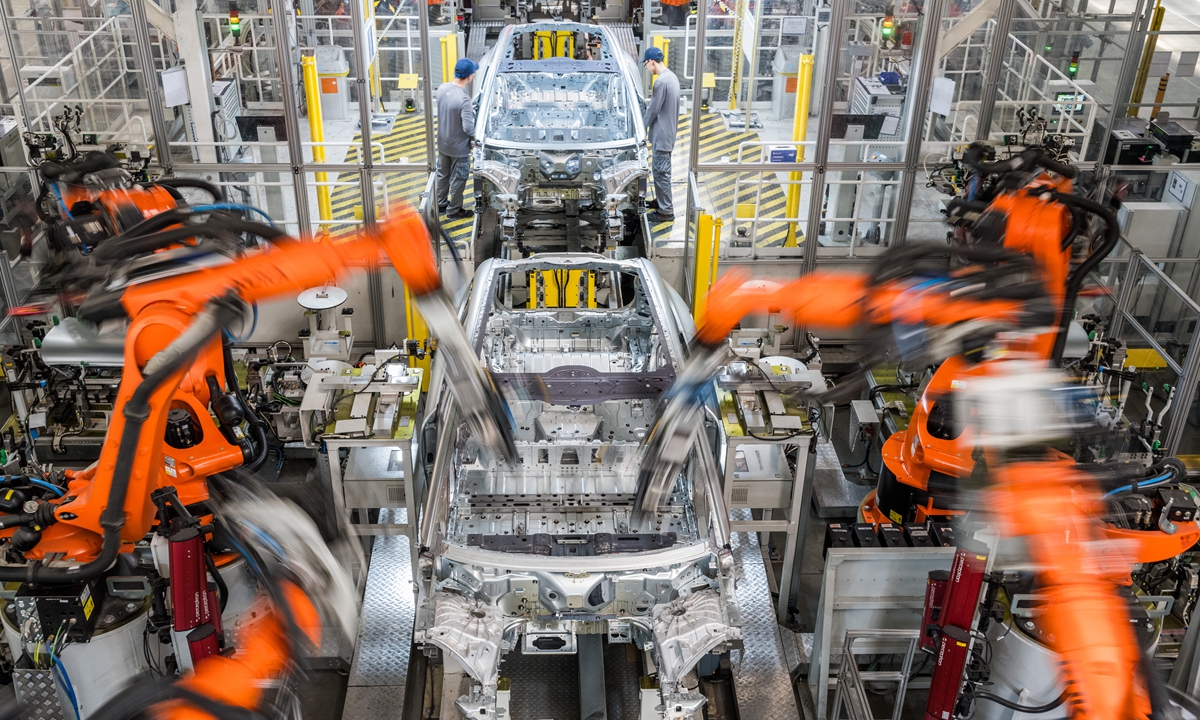

Robotic arms install doors in NIO Second Advanced Manufacturing Base in Hefei, East China's Anhui Province on April 15, 2024. Photo: Chen Tao/GT

'A car produced every minute'

Wang Yang, who leads SinoEV (Hefei) Powertrain Technologies Co, has witnessed the development of NEV industry from scratch in Hefei.

Established in 2010, the company has produced more than 1.4 million power battery systems as of the end of 2023, cementing its position as the fourth largest power battery system supplier for pure electric passenger vehicles in China.

"The NEV industry chain in Hefei is complete with concentrated upstream and downstream industries, bringing a relatively large competitive advantage for us," Wang said.

In Wang's factory, Global Times reporters witnessed production line workers, dressed in neat work clothes, carrying out inspection, dispensing and welding in an orderly manner to ensure the precise assembly of battery cells and the accurate connection of circuit boards.

SinoEV's other factory came online in October last year. It currently provides supporting services to many well-known NEV companies such as JAC Group, and Changan Automobile.

The city of Hefei has formed a complete industrial NEV chain of around 500 companies, ranging from vehicle manufacturing companies to key components such as batteries and electronic controls, with a local matching rate of new energy vehicles of around 35 percent.

In 2023, local NEV output stood at 740,000 units, accounting for around 8 percent of the national output, or ranking the top three among the cities. Hefei produced 163,200 NEVs in the first quarter of this year, representing a year-on-year increase of 28.8 percent.

The NIO Second Advanced Manufacturing Base is a must-to-visit site for NEV observers visiting Hefei. A garage that can accommodate 246 vehicle frames and resembles a "Rubik's Cube" is visually impactful when entering this smart factory. At first glance, the colorful frames are waiting for "flexible" production to meet the needs of individual customization.

The base is known as a smart factory. Inside the factory, reporters saw very few workers, only giant mechanical arms and robots operating along production lines. In the body shop, four orange-red robotic arms were installing the doors in an efficient and precise manner. The four doors are connected to the frame in just a few seconds.

According to Jiang Zhaojun, who oversees the base, the "brain" of the factory is the intelligent manufacturing management system. Everything from the production scheduling of the factory workshop to the tightening strength of each screw is controlled by this system, with a machined installation plus and minus error of only 0.5 millimeters.

The fully automated production line has greatly increased the speed of producing a vehicle, meaning a car rolls off the production line every minute. It only takes 14 days for a personalized customized vehicle to leave the factory, Jiang explained.

We actively embrace artificial intelligence technology and humanoid robot facilities to improve production efficiency. The smart manufacturing has become the most interesting place for many foreign companies to visit, Jiang added.

Currently, there are six new R&D institutions and 70 innovation platforms for vehicles located in the city. Semi-solid-state batteries, lithium metal batteries and smart cockpit chips are world-leading, according to the information that local departments shared with the Global Times.

The production line workers in SinoEV (Hefei) Powertrain Technologies Co in Hefei, East China's Anhui Province on April 15, 2024 Photo: Chen Tao/GT

'Support of overall environment'

China is the world's most competitive NEV market. The booming market has also driven the development of related industrial chains, including battery manufacturing, charging facility construction and intelligent control systems.

However, companies have found that China's complete NEV industry chain difficult to replicate elsewhere.

Wang from SinoEV told the Global Times that his company had also launched businesses in India and the US, while, "the biggest difference between China and other countries is the completeness of the industrial chain," he said.

Take India as an example, although the development of NEV and power batteries in India is in its early stages and has great potential, the Indian market currently lacks raw materials, such as lithium ore resources and battery cell production capacity for power battery industry.

"In comparison, domestic NEV industry chain is very complete, for there are many suppliers for the same parts to choose from, and different suppliers have their own advantages," Wang said.

"The development of our business cannot be separated from the support of overall environment." Wang added.

China's complete NEV industry chain has continued to attract foreign investment.

In April this year, Volkswagen China announced that it plans to invest 2.5 billion euros ($2.7 billion) to expand its production and innovation center in Hefei, and accelerate the development of two smart electric models jointly developed with NEV maker Xpeng.

In just three years, Volkswagen has established a new intelligent connected EV center in Anhui and built complete NEV value chain covering R&D, production, sales and after-sales services.

The carmaker systematically building Hefei into the Volkswagen Group's innovation center in China, and is accelerating to implement the strategy of "in China for China" - providing rapid and customized solutions for the dynamic Chinese market, according to Volkswagen Anhui.

During the recent 2024 Beijing International Automotive Exhibition, known as the Beijing Auto Show, the spotlight was undoubtedly on NEVs, which accounted for more than 80 percent of the 117 new vehicle models debuted at the event.

A total of 278 NEV models both with and without internal combustion engines were put on display, marking a 74 percent increase from the previous auto show. Large well-known foreign companies also displayed their newest NEV products and expressed confidence in China's development.

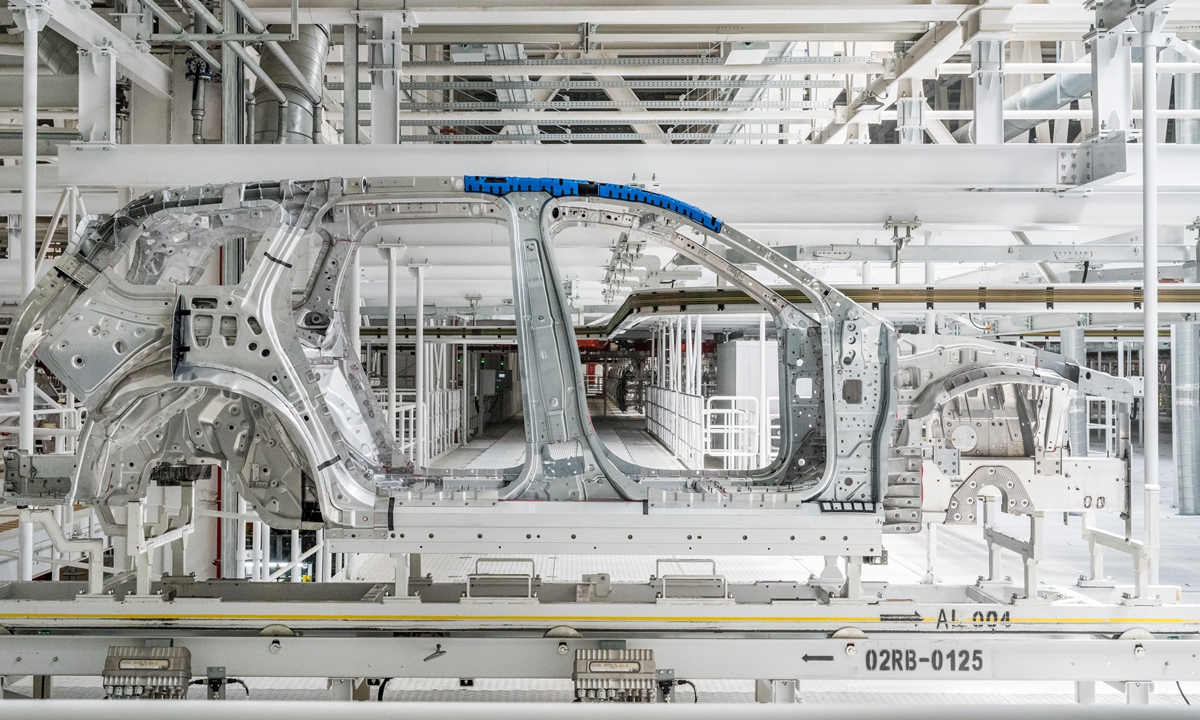

A production corner in NIO Second Advanced Manufacturing Base in Hefei, East China's Anhui Province on April 15, 2024 Photo: Chen Tao/GT

'Concern over China's competitiveness'

In response to the foreign media reporting on an "EV price war" and "Major EV company going bankrupt" as the evidence of "overcapacity," industry insiders said that China's NEV companies are developing in a competitive market environment thanks to the technological innovations and well-established and stable local supply chains, as well as Chinese consumers who are willing to accept new things. They believe the consumer market is not saturated and there will not be excess high-quality production capacity.

The hype of "overcapacity" is more out of concern over China's increasing competitiveness and the fear of losing its own industrial advantages, based on protectionists concerns, they said.

Wang from SinoEV said that when discussing the issue of "overcapacity," we should first focus on the demand side. "In fact, global sales of new energy vehicles continue to rise," he said.

Data from Clean Technica showed that for the whole of 2023, global cumulative sales of new energy passenger vehicles were 13.68 million units, a year-on-year increase of 31 percent. Wang believes that the consumer market is not saturated, judging from the current growth rate.

According to Bloomberg, in the EV sector, the capacity usage rates of the majority of China's leading auto exporters are considered normal; the ratio of exports to production is far lower than other car producing nations such as Germany, Japan and the South Korea; and Chinese companies aren't dumping EVs onto global markets, for the export prices of those cars reflect the laws of the market.

Huo Jianguo, a vice chairman of the China Society for World Trade Organization Studies in Beijing, told the Global Times that the US fallacy of "overcapacity" is actually curbing China's technological development and industrial upgrading, aiming to protect the US own backwardness, and "it is real trade protectionism."

This approach distorts fair competition and disrupts the global NEV industry chain and supply chain, Huo said.

China's NEV exports have impacted the traditional automobile industry, and that the US "Inflation Reduction Act" in the name of "responding to climate change" and "low-carbon environmental protection" is actually designed to prop up and protect its traditional automobile industry, he said.

The US is using the excuse that China's subsidies for NEVs have exacerbated domestic inflation is actually false, Huo added.

A number of NEV companies also said that they are focused on flexible output instead of blind expansion.

"We hope that our business and customers will be more widely distributed, but currently, production and site selection are based on actual needs, rather than blindly building factories and expanding production capacity," Wang said.

The production line workers in SinoEV (Hefei) Powertrain Technologies Co in Hefei, East China's Anhui Province on April 15, 2024 Photo: Chen Tao/GT

Jiang from NIO also said that Chinese NEV companies are not wildly expanding production, but are following market rules and centered on controllable dynamic balance in meeting market demand and company development.

Production capacity that meets needs of the market remains insufficient, and there is no excess of high-quality production capacity, Wu Shuocheng, a veteran automobile industry analyst, told the Global Times.

For the future development, NEV companies still express strong confidence in the market.

"Domestic NEV industry chain companies have contributed to the global response to climate change and green transformation. In the future, relying on technological innovation and excellent quality, China's NEVs will become more popular," Wang said.