Illustration: Chen Xia/GT

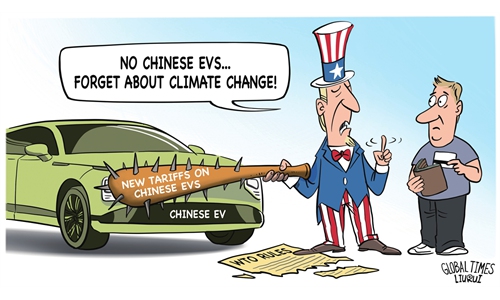

The US on Tuesday announced an increase in tariffs on an array of Chinese imports, ranging from electric vehicles (EVs) to semiconductors. This is a typical example of how the US undermines free trade and fair competition.While US political elites blindly boast that financial and tax incentives have revived US manufacturing, they are so timid that they do not dare to allow fair competition between made-in-China products and US manufactured goods, which is a great irony.

The revival of US manufacturing is at the center of US President Joe Biden's economic agenda. Until now, most of the attention has focused on the Inflation Reduction Act (IRA) and the CHIPS and Science Act, which were signed into law in 2022. The two acts offer financial and tax incentives for investment in clean energy, including the EV and semiconductor sectors, making them two main pillars to revive US manufacturing.

Some US and Western media outlets claim that since the enactment of these acts, the US has witnessed a surge in manufacturing job announcements. This looks like propaganda from Western idealists. Even if tax incentives and subsidies could stimulate business investment and bring back some manufacturing jobs, the effect will be temporary. Short-term incentives and subsidies cannot improve the long-term competitiveness of the US manufacturing industry.

The situation is different for China. In recent years, the US has expanded its export curbs to choke off China's access to critical semiconductor technology, forcing Chinese firms to boost their own ability in terms of independent innovation so that they can make a bigger splash in the increasingly intense international competition.

Chinese companies have built their own competitiveness. Official data showed China's total integrated circuit output surged 40 percent year-on-year to 98.1 billion units in the first quarter of 2024. The anxiety brought by innovation in China's high-end manufacturing industries and increasing competitiveness has been haunting American elites.

It concerns them especially when the US fails to maintain its relative competitiveness in the manufacturing sector. That's why they have to resort to tariffs to provide a protective umbrella for the country's fragile manufacturing sector.

What really worries American elites is the fast-growing market influence of made-in-China products and the concern that US enterprises may be unable to compete in the future.

So, even though Chinese EVs currently hold only a small share in the US market, which means the additional tariffs bear little practical significance, the US is still afraid of competition. The country urgently needs something, such as trade protectionism and additional tariffs, as a psychological placebo to ease its anxiety.

The move to impose additional tariffs on Chinese imports marks another escalation in Washington's campaign to crack down on emerging Chinese industries, but American elites will eventually realize that geopolitical games and trade protectionism cannot help revitalize the US manufacturing sector, including the widely watched EV and semiconductor industries.

Recent decades have seen Asia become a recipient of outsourced manufacturing from developed economies such as the US and the EU. East and Southeast Asia have taken center stage in global manufacturing, creating a regional cluster of supply chains based on the shift in the international division of labor. Compared with Asia, the US economy faces major challenges to rebuild and retain the nation's manufacturing capacity, jobs and innovative edge.

One of the biggest challenges US businesses in the manufacturing sector face is a lack of skilled workers. Attracting investment for manufacturing facilities may be easy, but comprehensive factors - including skilled workers, production costs, industrial chains and technology - are what determines a country's manufacturing competitiveness. In this sense, generous subsidies, tax breaks and additional tariffs are not a panacea for reviving US manufacturing.

The US may appear aggressive in its campaign to crack down on emerging Chinese industries in the short term, but it's unlikely to have positive and practical effects in the long run, as Washington's additional tariffs cannot fundamentally change the comparative advantages of the Chinese manufacturing sector.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn