China achieves progress in building financial powerhouse: report

Country has 'plenty of room' for monetary policy maneuver to cope with global uncertainties

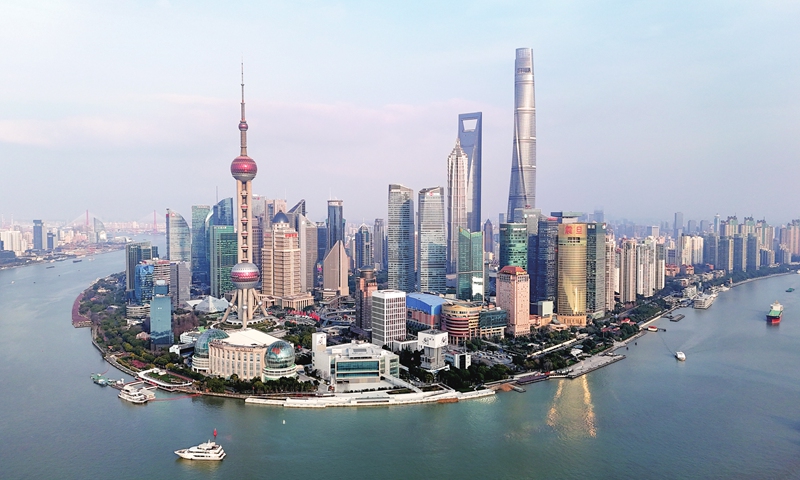

A view of Shanghai’s Lujiazui area, a major financial zone in China Photo: VCG

The nation's goal of building itself into a financial powerhouse has achieved progress in six key elements that have Chinese characteristics: the internationalization of the yuan, the construction of a modern central bank system, the expansion of financial institutions, the improvement of the modern financial supervision system, the strengthening of a global financial center and the improvement of financial professionals, according to the China Financial Policy Report 2024 released on Monday.

The report, which is China's first systemic report on financial policy, was launched at a sub-forum of the 2024 Tsinghua PBCSF Global Finance Forum, which kicked off on Monday in Hangzhou, East China's Zhejiang Province.

The report summarized China's multiple efforts to construct a modern financial system with Chinese characteristics and push forward the high-quality development of the Chinese financial industry.

According to the report, the scale of global yuan-denominated reserves stood at $261.73 billion as of the end of 2023, accounting for 2.29 percent of total foreign exchange reserves with specified currency compositions, which underscored the continuous improvement of the yuan's globalization.

It also highlighted the resilience of the yuan since mid-April, with the currency maintaining overall stability despite the depreciation of major Asian currencies against the stronger US dollar.

The country is also making a steady push to deepen financial opening-up, the report said, listing a number of milestones including the orderly promotion of cross-border financial infrastructure connectivity as well as making it more convenient for overseas investors to participate in the Chinese bond market.

In the domestic market, Chinese authorities have used multi-faceted policies to maintain financial stability and guard the bottom line of "China's financial security," the report said, giving as an example the recent financial support for property developers and the reduction of housing loan interest rates.

He Haifeng, chief economist of Guotai Junan Securities Co, told the Global Times on the sidelines of the forum on Monday that measures to stabilize the property sector are consequential, not only from the financial perspective but also in aligning with China's social development upgrading and transition goals. He was one of the executive chief editors of the China Financial Policy Report 2024.

China's financial institutions have also been improving their ability to serve the real economy, the report said. As of end-2023, the balance of medium- and long-term loans to the manufacturing sector had risen by 31.9 percent year-on-year, with the growth rate of medium-term loans for high-tech manufacturing reaching 34 percent, according to the report.

While acknowledging areas of progress, veteran Chinese industry insiders and observers participating in the forum noted that it is very important to build on these achievements and fast-track the financial development goal.

China's central financial work conference held last October called for accelerating the building of a nation with a strong financial sector, which elevated the importance of financial work to a higher strategic level.

"China's financial market must continue to move from quantity-driven to quality-driven, with the competitiveness of financial products being raised to be on par with global peers. Meanwhile, the financial sector needs to be more pragmatic to provide a real boost to the real economy," Tu Guangshao, a member of the CF40 Executive Council and Chairman of the Executive Council of the Shanghai Finance Institute, said at the sub-forum.

China has the world's largest banking system and the second-largest insurance, stock and bond markets, observers noted, calling for a further improvement in the country's financial market in serving the real economy.

"It is important that China's capital market continues to support listed companies that bear fruit from technological innovation, some of which are in the early stages of commercialization. We can see that process encouraging trends in the A-share market, where some technology-related shares have risen to new highs," He Haifeng said.

As to how a delay in the US Fed's decision on interest rate cuts would affect China's financial stability, He stressed that China has plenty of room for monetary policy maneuvers to cope with global uncertainties, including a potentially volatile external interest rate environment.

"Chinese policymakers will take various factors into consideration, including stabilizing the economy and employment, as well as the balance of international payments," He explained.

As part of an effort to strengthen counter-cyclical adjustments, China's central bank reduced the reserve requirement ratio for financial institutions twice last year and cut interest rates twice, respectively, according to the report.