The 2024 Tsinghua PBCSF Global Finance Forum held in Hangzhou, East China’s Zhejiang Province from May 27 to 28, 2024. Photo: Tsinghua PBCSF Global Finance Forum

Editor's Note:

This year marks the 80th anniversary of the establishment of the Bretton Woods System, which anchored the value of the US dollar to gold and secured the dollar's status as the global reserve currency. However, in the face of a fragmented global economy, rising debt and a volatile global financial environment, there are growing calls for reforms of the current Bretton Woods system.

This week, the 2024 Tsinghua PBCSF Global Finance Forum took place in Hangzhou, capital of East China's Zhejiang Province. It invited globally renowned scholars to discuss how to reform and reconstruct an international monetary and financial system for all.

Global Times reporter Li Xuanmin (GT) interviewed Zhu Min (Zhu), founder of the Global Economic Governance 50 Forum, former deputy governor of China's central bank and former deputy managing director of the IMF, and Marc Uzan (Uzan), executive director of the Reinventing Bretton Woods Committee, on the sidelines of the forum. The two economists shared their insights on the global de-dollarization trend and China's role in the construction of a new global financial system.

Zhu Min Photo: Tsinghua PBCSF Global Finance Forum

GT: How do you evaluate the global de-dollarization trend?

Zhu: The trend of global de-dollarization is evolving. There are several reasons behind this. First, the proportion of the US economy in the global economy has been declining over the past 50 years. When the Bretton Woods System was established after World War II, the industrial output of the US accounted for 52 percent of global output, but this proportion is now gradually decreasing.

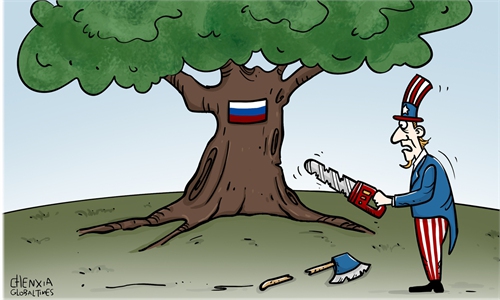

The second important reason is the changing geopolitical environment, as confidence in the US dollar has plunged amid its reckless weaponization of its currency, which leads to the diversification of global reserve currencies.

Also, global economies are showing increasing concern over the high fiscal deficit of the US. In 2020, the US fiscal deficit jumped rapidly, reaching as high as 10 percent of GDP, and the accumulated US government debt is 130 percent of GDP, which is almost twice the traditional economic standard of 60 percent.

It is projected that over the next five years, the US would continue running fiscal deficits at a rate of over 5 percent of GDP. This is a very serious fiscal deficit problem, which - taking account of the current high interest rate of US government bonds - has further triggered concerns over US fiscal sustainability.

The US government borrowed extensively two years ago, when the interest rate was at nearly zero. However, interest rates have suddenly risen to 5.5 percent, and the cost of paying the interest has increased rapidly. We estimate that by 2028, the interest payments on US government debt will account for about 13 percent of its fiscal spending, even far exceeding its military expenditure. This is a significant burden on the US government, and it means that the US will need to continue issuing more government bonds [to pay the interest], and such a cycle will erode confidence in US Treasury bonds, as well as the US dollar.

GT: In your perspective, is there a sense of urgency in reforming the Bretton Woods System, which has been in place for 80 years?

Zhu: There have been constant and strong calls for reforming the Bretton Woods system, especially from emerging market economies and developing countries. The Bretton Woods system used to play a very important role in post-war reconstruction, financing and supporting globalization. However, it has been subject to increasing volatility.

For example, the decoupling of the dollar from the gold system has led to significant financial crises, one after another. So the system has its inherent flaws.

What matters more is the allocation of voting rights within the system, which has not kept pace with structural changes in the global economy. Initially, the system was dominated by the US and it gave the US as well as Europe substantial power. However, emerging and developing economies now account for more than 50 percent of global GDP based on purchasing power parity, yet their shares of voting rights remain far below this proportion.

According to the rules and principles of fairness, voting rights should be adjusted to reflect each country's share of the global economy. However, the adjustment of these rights and the representation of emerging economies have lagged far behind. This discrepancy is also a significant issue. These countries seek to assert their rights, but more importantly, they desire a stable global financial environment and robust economic growth, which they hope will be achieved through systematically reforming the current financial system.

There's also an increasing demand for new global public goods. For instance, climate change is a major global issue. This challenge and other potential global issues require global financial institutions to provide new public goods that meet these needs. From this perspective, the Bretton Woods system is inadequate in addressing these new public demands.

As geopolitical risks and volatility are rising, populism is on the rise as well and globalization is retreating. We should start with smaller, actionable steps to address current issues from a practical point of view.

For example, recent fluctuations in the US dollar and US Treasury markets have been substantial, with significant spillover effects on other countries, which greatly affects global financial stability.

It is important to urge the US to consider the international impact of its monetary policy and to establish an international framework, within the current financial system, for oversight and coordination to mitigate these effects.

Both developing and developed countries face high debt risks, so establishing a basic framework for resolving national and international debt issues is also an urgent mission. Also, we need to mobilize significant financing from international financial institutions and the Bretton Woods system to support the global transition to carbon neutrality. This is essential for steering the global economy onto a green and sustainable path.

GT: What is the role of China in pushing forward the reform of the Bretton Woods System?

Zhu: China will play a significant role in the process. As the world's second-largest economy, China is undoubtedly a crucial force in promoting international financial system reforms. China seeks recognition in the equity share structure of the entire international financial system and aims to represent emerging economies and developing countries, ensuring their recognition as well.

China is also making significant efforts to address the spillover effects of global reserve currency liquidity, working closely with the IMF. These efforts are of great importance, aligning with both China's interests and broader global interests. While undertaking these efforts, we also support the further internationalization of the Chinese yuan, which is a particularly important aspect of China's financial development.

We must recognize that the most important task for China is to continue with reform and opening-up. This is particularly crucial. For instance, further marketizing China's exchange rate policy is a significant aspect of the yuan's internationalization. Another important basis for the yuan's internationalization is the construction of a bond market. For the yuan to go global, there needs to be a large bond market. When foreigners hold yuan, they need to be able to invest their holdings in the yuan-denominated bond market.

Therefore, the development of China's financial market, along with broader macroeconomic and monetary policy reforms, is particularly important for the internationalization of the yuan.

Since the yuan has been included in the IMF's special drawing rights (SDR) basket, we should continue to promote the internationalization of the SDR and its wider use. This means transitioning the SDR from merely a notional unit of account to an actual unit of account and payment. It is also viable to develop a digital SDR to enhance global connectivity, payments and reserve currency functions, among other uses.