'Overcapacity' claims show typical Western double standards, but will not stop China's rise: Brazilian scholar

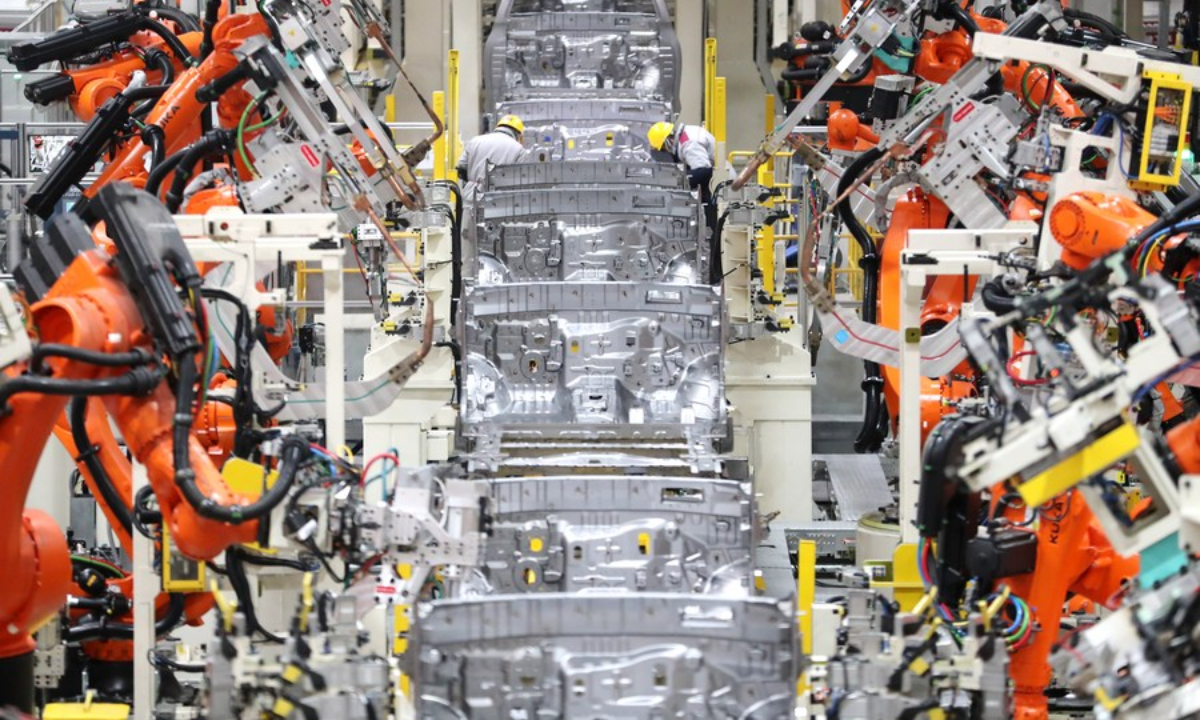

Robots conduct welding work at the workshop of an automobile manufacturing factory in Qingdao, East China's Shandong Province, on January 14, 2023. Photo:Xinhua

Editor's Note:China witnessed better-than-expected GDP data for the first quarter, providing a strong basis for the year's growth. With multiple stimulus policy measures having been put in place recently, global confidence in and expectations for a sustained rebound in the world's second-largest economy are also increasing.

On May 29, the IMF announced an upward revision of its forecast for China's GDP growth in 2024, adjusting the projection of 4.6 percent it made in April to 5 percent. This follows similar revisions by other international financial institutions such as Goldman Sachs, Morgan Stanley, and UBS, which have also raised their growth forecasts for China's economy this year.

The trend added to positive signs of China's economic rebound, in stark contrast to attempts by certain Western officials and media outlets to portray China's economy as "collapsing" or "peaking." In an interview with Global Times reporter Ma Tong (GT), Marco Fernandes, a Brazilian political commentator and scholar, discussed the promising aspects of China's economic landscape, as well as the unjustified crackdowns by the US and the so-called "overcapacity" fallacy.

GT: How do you evaluate the recent upward revisions in China's growth forecasts by some international financial institutions such as the IMF?

Fernandes: Certainly, economic forecasts should be taken with caution as they often provide only a snapshot of the current situation and may not reflect a comprehensive analysis of a country's economy. It is common for organizations like the IMF to update their forecasts throughout the year based on evolving economic conditions. It has been proven that Chinese economists have a track record of accuracy in guiding the country's economic direction and addressing its challenges.

GT: What do you think are the highlights and the prospects for China's economic recovery?

Fernandes: In the first quarter, China's GDP expanded by 5.3 percent, aligning with the government's target of "around 5 percent" and setting a positive tone for the rest of the year. China's industrial sector saw a 6.1 percent year-on-year increase in value-added for large enterprises, and a rise of 7.5 percent for the high-tech manufacturing sector.

I would like to highlight the rapid growth in value-added in key sectors in April, with notable increases in automobile manufacturing at 16.3 percent year-on-year, computer/communication/electronic equipment manufacturing at 15.6 percent, and high-tech manufacturing at 11.3 percent. This highlighted an important aspect of China's new trend of accelerating the high-technology sectors of the economy.

We have also seen the rebound of foreign trade in the first quarter after a hard time of negative growth last year. Looking ahead, the country has been pushing for a comprehensive economic upgrade from an economy that was relying too much on the real estate sector to one primarily driven by the new quality productive forces.

China's fundamentals remain solid: huge financial resources in the hands of the state, a vast domestic market, a progressively skilled labor force, unrivaled industrial capacity globally, and accelerated advancements in cutting-edge technologies. When considering these factors, China stands poised for continued success.

GT: How will China's economic recovery impact global economic development and cooperation between China and other developing countries?

Fernandes: Despite rising global challenges, China, which contributed approximately 30 percent of global growth in recent decades, will maintain its role as the primary global growth driver in the coming years. Strengthening collaboration between China and other Global South countries is of strategic significance for both sides.

Elevated bilateral economic ties are becoming imperative and will be reciprocal amid increasing global uncertainty. Thus far, partnerships with China have yielded significant benefits for these countries, exemplified by the large-scale investments of nearly $1 trillion, financing, and loans as part of the Belt and Road Initiative (BRI).

There is an urgent need to tackle industrialization challenges in the Global South. Leadership in these countries must take proactive steps to boost cooperation with China. This may involve attracting Chinese investment to establish localized factories instead of solely exporting raw minerals, as well as forming joint ventures to facilitate technology transfer from China.

The governments of Zimbabwe and Indonesia have recently enacted measures to ban the export of raw lithium and nickel, respectively. Instead, they are encouraging Chinese companies to invest in local processing facilities for these metals. This initiative has yielded positive results, fostering the development of their respective industries, enhancing the value-added of these commodities, and facilitating the local training of engineers and technicians.

Through win-win cooperation, these countries will gain opportunities to achieve significant economic advancement in the coming decades. Meanwhile, Chinese companies will get increased access to markets in the Global South, leading to heightened economic exchanges within the developing countries.

GT: How do you see the US and EU's crackdowns targeting Chinese products and their claims of "overcapacity" in recent times?

Fernandes: It's not easy to address the escalating tensions as the US and the EU will not stop this trend. Both regions have realized they are falling behind China in terms of high-tech development, evident in failed attempts such as starting a trade war and efforts to contain Chinese high-tech companies, which ultimately backfired, as in the case of Huawei.

Despite current attempts to curb China's access to high-end chips, the country's substantial investments and large talent resources indicate it will likely catch up shortly. The West's anxiety stems from its inability to impede China's long-term development.

The "overcapacity" rhetoric is biased and shows double standards. The dominance of Boeing and Airbus in global aviation, or Volkswagen's significant car exports, these raise no concerns about overcapacity in Western countries. However, when a Chinese company such as BYD gains global leadership, accusations of "overcapacity" suddenly emerge.

In recent times, the US has allocated hundreds of billions of dollars in financial subsidies to their companies through initiatives such as the US Inflation Reduction Act and CHIPS and the Science Act. However, when China engages in similar practices, it is often criticized as being harmful to the market economy, showing a typical Western double-standard view.

There are concerns that as the US grapples with China's unstoppable growth, it may resort to risky actions in regions close to the Chinese mainland. Addressing these challenges may require increased unity among Global South countries.

Global Times