A wind farm at mountainous region of Ji'an, East China's Jiangxi Province Photo: CFP

US President Joe Biden has slapped major tariffs on Chinese electric vehicles, advanced batteries, solar cells, steel, aluminum and medical equipment. One of the reasons the US gave in the context of "overcapacity" to justify the tariffs are all superficial, and there's no need to spend too much effort on them. They talk about overcapacity, but why don't they mention the overcapacity in their own chip industry?

The implication of overcapacity is that they couldn't compete with China in new-energy products and they lost in the competition, and thus they implemented a series of targeted measures, including imposing tariffs on Chinese products, to protect their own industries and also tried to compete with China in other global markets.

What are the consequences of the tariff hikes on Chinese new-energy products on the US and the global markets? I think there are several possible outcomes.

The first is the emergence of parallel new energy systems, meaning that China and other regions could develop their new-energy product markets, while the US will protect its own market.

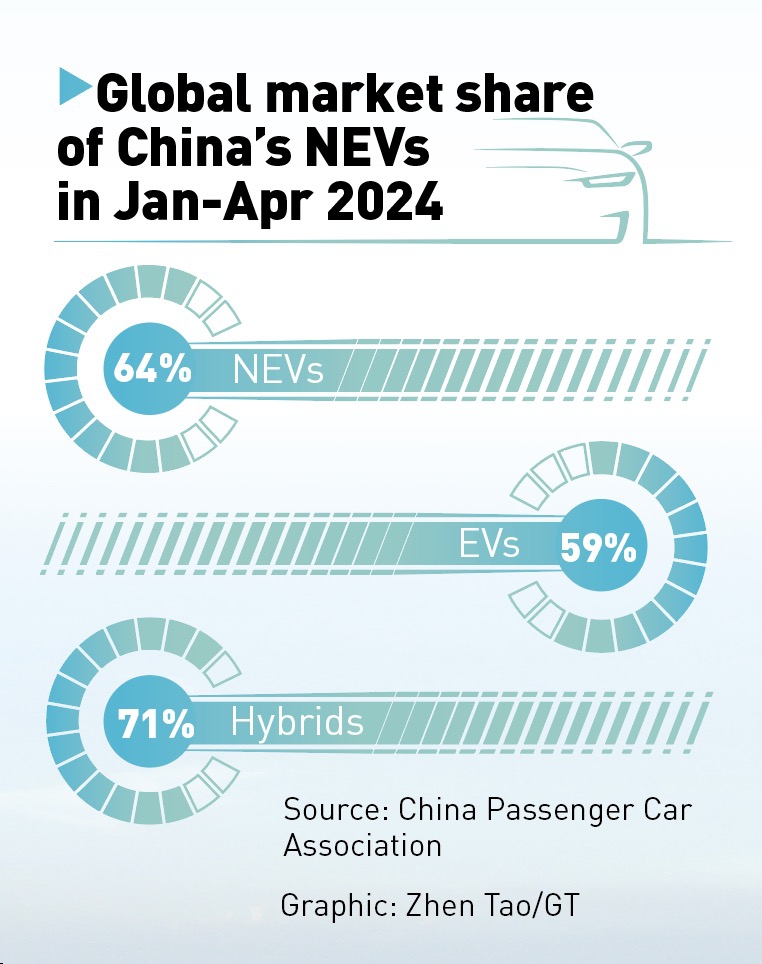

China's production and sales of new-energy vehicles (NEVs) account for more than 60 percent of the world's total last year. The US is now making efforts in this area. The question is how big can this parallel market be, created by the US? Or at the very least, if the US protected its new energy market from being overly exposed to competition by Chinese products, and thereby allowed its domestic new-energy products, such as electric vehicles and photovoltaic systems, to develop, would it develop sufficient production capacity?

In areas such as photovoltaic and wind power generation, the US lags even further behind. In such circumstances, we could imagine that if the US protects its market for 10 years and still fails to catch up, it might end up isolating itself from the global market. So the first scenario is that the US' strategy could backfire if it cannot significantly develop its own new energy sector.

There's a possibility that the US ends up isolating itself from the global market. China should work together with groups and people who are genuinely concerned about the future of climate change in the US, Europe, and other countries, to mitigate the negative impact of US policies on climate change goals. There are significant segments of American and European societies that are truly, not just superficially, concerned about climate change.

The US has also attempted to rope into more allies in its curb against China's new-energy products. US Treasury Secretary Janet Yellen has been talking about this everywhere, including in Europe, stating that China's products are already very strong and that if they don't compete, they will fall behind. And China should prepare for that.

Ju Jiandong Photo: IC

Avoiding a lose-lose situation

Now, looking back at the past four to five years of the trade war between the world's two largest economies, it is easy to conclude that the US policies should be more rational.

After all these years, despite the Washington's crackdown against Chinese tech firm Huawei and the reckless trade blockades against China, our new-energy products have continued to make progress. The US has imposed a 25 percent tariff on $200 billion worth of Chinese goods over the past few years. Most American economists believe that these tariffs have increased costs for American consumers and have been a significant factor in driving up inflation in the US.

The competition between China and the US is no longer just an escalating trade war; it has become a comprehensive great power competition. In addition to the trade war, there is also a technology war, a financial war - all initiated by the US, and the two countries also have conflicts on regional security issues.

Just like trade wars that have different dimensions, great power competition also would lead to different scenarios in the future. Based on the review, I believe that even at this stage of great power competition, both sides should adhere to one principle: Agreeing that a lose-lose situation should be avoided.

China's economic prospect

The Chinese economy has gotten off to a good start, achieving better-than-expected growth in the first quarter and the country is on track to achieving its goal of expanding at a rate around 5 percent this year. If China could maintain a GDP growth rate at around 5 percent in the following years, it is likely that the country could overtake the US to be the world's largest economy by 2035.

China faces the challenge of an aging population, and this has a significant impact on the economy. However, this substantial impact will not necessarily prevent China's economy from catching up with that of the US.

The impact of an aging population on the economy would only manifest at a period around 2050-2060, when China's GDP accounts for 28 percent to 30 percent of the global economy. That time could likely to be a peak of the Chinese economy, and any talks about Chinese economy peaking already seem like frontloading the process.

China's current per capita GDP is about one-sixth of that of the US, and our population is over four times larger than the US, as China has about 1.4 billion population whereas the US has about 330 million.

So, for China's GDP to catch up with the US, our per capita GDP only needs to reach one-fourth of the US'. As Japan's per capita GDP was 1.5 times that of the US in 1995, the goal that China could reach one-fourth of the US' per capita GDP seems very reasonable, and there's no evidence supporting claims that the Chinese economy has peaked.

The opinion is based on an interview with Ju Jiandong, chair professor of Finance at Tsinghua PBCSF and director of Center for International Finance and Economic Research of Tsinghua NIFR