Illustration: Tang Tengfei/GT

It is regrettable that there are media reports claiming that Australian Treasurer Jim Chalmers has ordered five international companies linked to China to divest their shares in a strategically crucial heavy rare earths project in the Oceanian country.

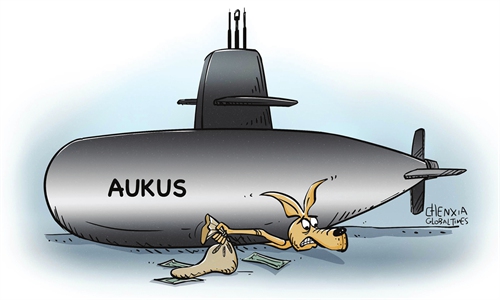

Australia is blessed with abundant reserves of critical minerals such as rare earths, and thus is regarded by Washington as an ideal partner to counter China's influence over rare-earth supply chains. The US trumpets "decoupling" from China, but the narrative goes against the interests of its allies, including Australia.

Australia, one of the world's biggest suppliers of raw minerals, has taken a number of measures in recent years to boost the processing of critical resources used in clean energy technologies. This nationwide move is aimed at moving Australia up the global value chain in critical minerals, energy and manufacturing, which is obviously a good thing for the Australian economy.

What complicates the story furthermore is that Australia's move comes amid a push by Washington to upgrade relations with allies and reduce China's role in their sourcing of critical minerals. Australia is perhaps one of the targets of pressure from the US, and that pressure is likely to continue.

However, even in face of such a complex situation, the wisest approach for Australia is not to obey US orders, decouple from the global supply chain and reject international investment. Instead, it should adopt a more pragmatic approach, cooperate with as many partners as possible, and attract as much investment as it can. This is the only way Australia can maximize its own economic interests.

The rare-earth sector is a typical example. Rare-earth minerals actually aren't that rare. Numerous studies have shown that there are enough rare-earth minerals on Earth for the switch to renewable energy. For instance, there is 12 times more dysprosium, a valuable rare-earth mineral, available than is currently needed.

What is "rare" is a low-cost and low-pollution processing capacity. The reason why China plays an important role in the global rare-earth supply chain is partly because the country has advanced processing capacity after years of efforts in forming a low-cost industrial chain and accumulating experience in managing pollution.

China imported 18,049 tons of rare-earth ores and compounds in the first four months of this year. China is a country rich in mineral reserves, but it still imports rare-earth metals.

That's because processing costs in Western countries are much higher than that in China, so global rare-earth producers choose to export their products to China for processing, and thus form a cost-effective and competitive global supply chain.

Both China and Australia are participants and beneficiaries of global industrial and supply chain cooperation. This means the two sides share potential for cooperation in this field.

Especially when Australia ramps up efforts to develop mining and processing industries, what is needed today is cooperation, rather than decoupling from the global supply chain.

Although there were some differences, people from both sides now have an overall positive outlook for future China-Australia economic and trade relations. This is an opportunity to further tap the potential of cooperation in all fields.

The mutually beneficial cooperation between China and Australia should have more solid foundation than the current headwinds brought about by the US decoupling and trade protectionism. The US is keen on forming small circles, setting up a critical mineral alliance that will further disrupt the global industrial and supply chain.

China has repeatedly reaffirmed that it has no interest in fighting a rare-earth mineral war with the US and any other countries. China's management of rare-earth resources is in line with common international practice. The US is the one that is disrupting the global industrial chain.

The current rare-earth situation is a shared challenge for all countries to be rational when dealing with a precious resource. Hopefully everyone can realize that "decoupling" from China should not be part of the game they play.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn