‘Decoupling’ unrealistic for China, SE Asia’s solar sectors despite US protectionist push

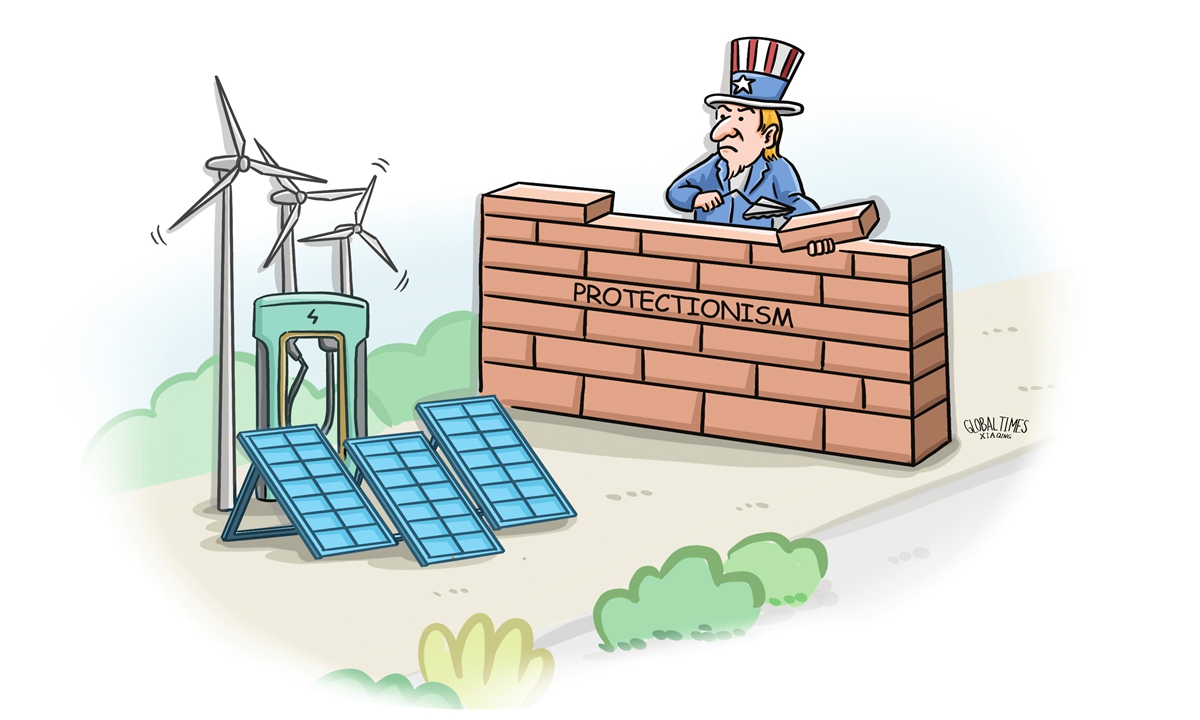

Illustration: Xia Qing/Global Times

The US' duty-free tariff treatment for solar power items from Cambodia, Malaysia, Thailand and Vietnam will end as scheduled on Thursday, according to an announcement by the White House in May. The move is seen by some as the latest sign that the US may expand its crackdown on the photovoltaic (PV) industry from China to Southeast Asian countries.The US Department of Commerce claimed in 2023 that "certain Chinese producers are shipping their solar products through Cambodia, Malaysia, Thailand, and/or Vietnam for minor processing in an attempt to avoid paying anti-dumping and countervailing duties." Obviously, the US is trying to use China as an excuse to take protectionist measures to protect its domestic industries.

US President Joe Biden in May unveiled steep tariff increases on an array of Chinese imports. The White House said in a statement that the tariff rate on solar cells, whether or not assembled into modules, would increase from 25 percent to 50 percent in 2024.

An intensified crackdown by the US and its push for "decoupling" from China are typical protectionist practices, as they disrupt the international economic and trade order.

However, in the present era of globalization, a complete economic "decoupling" is impossible. Washington's narrative claiming that Chinese companies are shipping their solar products through some Southeast Asian countries is far from the truth.

In recent years, there have, indeed, been a number of Chinese PV companies investing in Southeast Asian countries. Cross-border investments are a normal market behavior, and should not be interfered with by any third party as long as such investments are in line with the laws of China and the destination countries.

Despite ups and downs, the general trend of globalization is irreversible. Various countries including China and Southeast Asian economies have formed a closely intertwined supply chain in the world. The boundaries of nationality are, to some extent, blurry in terms of supply chains.

If the US steps up its crackdown on Chinese companies, it will have to continuously expand the scope of attack, from China to more and more countries, and even the entire global supply chain. As a result, the US economy will gradually be isolated from the international community and global supply chains, creating a parallel supply chain independent of China. In this process, the interests of the US economy will be hurt.

Hype by US officials about "overcapacity," as well as their attempts to put up trade barriers in new-energy sectors, are exacerbating the tide of anti-globalization. The US economy will be the victim of Washington's ill-intentioned protectionism.

Southeast Asian countries are active participants in globalization, and their gains outweigh their losses, even though the US duty-free tariff treatment for solar products will end.

Energy-saving inventions made by Chinese companies have sparked fierce competition among manufacturers. This, in turn, has led to a remarkable decrease in prices. In addition, some Chinese companies have sent some of their manufacturing to Southeast Asian countries, where labor costs are relatively low.

The combination of China's advantages and Southeast Asian countries' relatively low labor costs has further cut the prices of those countries' exports of solar power items. That's why recent years have seen a rise in PV exports from Southeast Asian countries to the US.

It is not surprising that the US has reinstated tariffs on solar panel imports from Southeast Asia. This shows that the US is not willing to see PV products made in Southeast Asia seize the American domestic market. Citing China as an excuse, Washington's real purpose is to attack Southeast Asia's PV industries and protect backward production capacity in the US.

Some studies have shown that prices of made-in-US PV products are higher than the global average. Amid increased anti-globalization and trade protectionist rhetoric, the long-term competitiveness of the US manufacturing industry won't be improved.

This means that more countries and regions, not only China and Southeast Asia, will have comparative advantages in the PV sector. If the US continues to expand its crackdown and wield the big stick of green protectionism, it will be increasingly isolated from the global green market and viewed by more countries as a disruptor of global trade and green development.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn