A night view of Haikou, the capital city of South China's Hainan Province. Photo: VCG

Editor's Note:

As the Chinese economy, along with the global economy, has faced considerable challenges in recent years, some Western officials and media outlets have stepped up their long-standing smear campaign against the world's second-largest economy. They cherry-pick information and distort facts to hype various specious narratives such as "Peak China," while turning a blind eye to China's considerable strengths and vast potential.

As part of the Global Times' multimedia project to set the record straight, the opinion page is publishing a series of in-depth interviews and signed articles with economists, experts and scholars from different countries who share their views on the prospects of the Chinese economy and debunk Western rhetoric.

In the third article of the series, Global Times (GT) reporter Wang Zixuan talked to Digby James Wren (Wren), an Australian scholar as well as a Senior Special Advisor and Director of the Mekong Research Centre at the Institute of International Relations, Royal Academy of Cambodia. Wren said the Chinese economy is not nearly as dangerous or precipitous, not at all in any way, shape or form. The real threat that the Americans feel is the loss of control over the markets, the standards, the regulation and the rules-based order.

GT: You have come to China many times. What do you think of China's economic situation? How do you perceive China's pursuit of high-quality development and its accomplishments in this regard?

Wren: I've studied China in depth, I lived here since 2011. Over the longer term, we can see the rise of China and its economy and how that's worked. The level of organization in China's economy is more profound than in most other economies, this is because of the sheer size of the population, the geographical size, and then the supply chains. So China has a huge advantage, which is the ability to have self-sufficiency in most important areas.

That explains a lot of why the US is not too friendly, because it cannot sustain complete supply chains for geopolitical reasons. The US could have complete supply chains if it wants, and I think it's trying to go down that road. But the problem is that the US works on alliance networks, the payoff is that its allies can access the US economy. But it also means that the US economy does not have complete supply chains, because it has to rely on Japan, Germany, France and other allies.

Another benefit of the system with Chinese characteristics is that it is always thinking about the well-being of the people, not just the wealthy people. There's a difference there. The well-being of the people is absolutely important, I think China is the model.

GT: Why is the West constantly hyping negative rhetoric regarding the Chinese economy, such as the "China collapse" or "Peak China" theories?

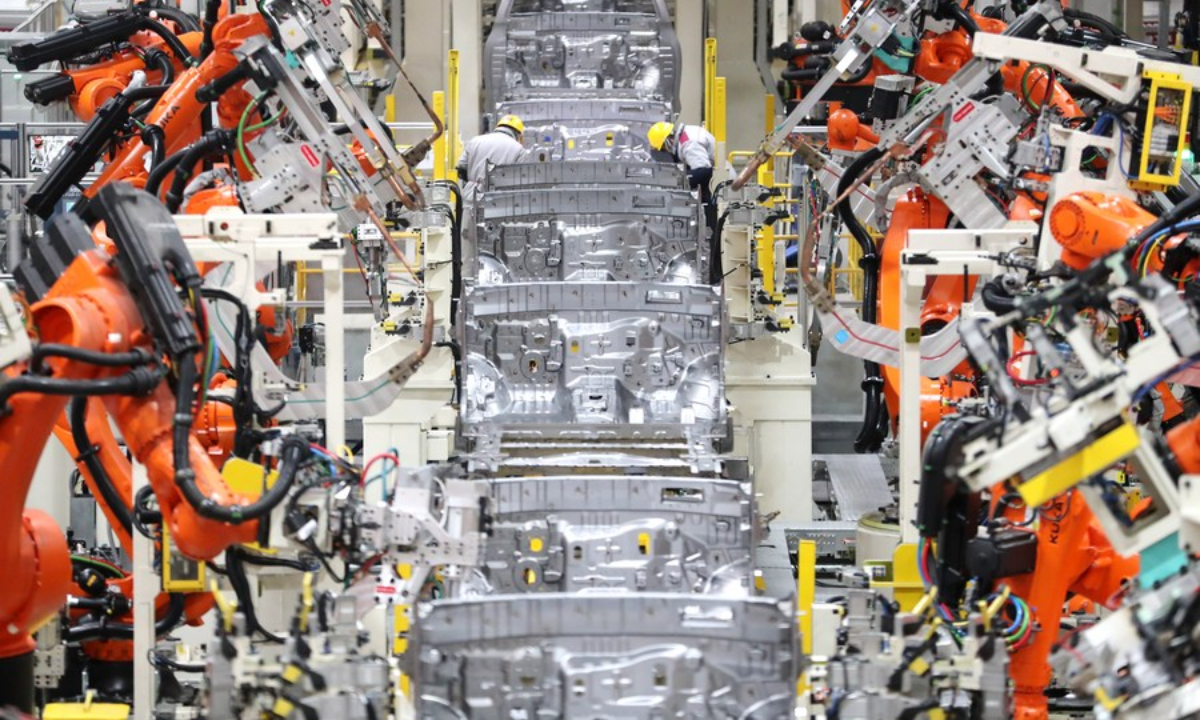

Wren: In fact, it's often misinterpreted, partly because US media or Western media try to demonize China in many ways. But the GDP is growing, manufacturing output is growing, and incomes are growing. So actually, the Chinese economy is growing, and people's lives are just getting so much better. They're all getting it wrong, and obviously, the naysayers just want to have that negative outlook. There are always people who don't see it, but they can see it if they open their eyes.

China's growth is slowing, but it's quite often framed as a sort of Chinese economy is falling, that the Chinese economy is in trouble and everything else. It's totally normal that once a country gets to a certain level of development, such as middle income and possibly passing out of middle income into higher income, which is where China is really at now, it's going to slow. So that's not nearly as dangerous or precipitous, or sort of like falling off a cliff, not at all in any way, shape or form.

The real threat that the Americans feel is the loss of control over the markets, the standards, the regulation and the rules-based order. The big thing is that China is kind of cracking that. I suppose Huawei's 5G is a perfect example. The second example is the renewable energy and the battery technology.

That's enormous competition. An enormous amount of containment against China is fundamentally related to those core economic issues. The advanced economies are basically running high inflation and high debt. They have to keep printing and pumping money back into their economies for reindustrialization or "decoupling," call it whatever you want. It can't last forever, it's just not possible. They're actually hollowing out their own economies. So they are trying to reduce China's growth speed. To be perfectly honest, if things were sort of run more openly, I think China's growth would be achieving 7 or 8 percent.

There's the only solution for that is basically to convince the Americans that what they really need to do is start integrating their economy and start learning again, instead of trying to tell everybody what to do all the time. If the US wants to maintain its real dominance or at least some kind of high level, then it has to completely restructure and reorganize its markets. I think there's a real fear that they don't know how to do that, and their system really doesn't allow them to do that.

The question is, are the advanced economies going to learn the hard way? Are they going to get smarter and start looking at the really big advantages that China has introduced? They can learn from China, and China will be perfectly happy to build factories in joint ventures with American companies in the US. That's what they need to do, instead of trying to trip everybody up, which is just a total waste of energy and time. However, Americans have chosen the negative route. They're trying to cheat in their exams. The US is doing everything to destroy its reputation by trying to trip up China all the time and trying to get everything to remain within the rules-based order, and as soon as they stop doing that, the better it'll be.

Digby James Wren Photo: Wren's X account

GT: You have talked about the electric vehicle industry in China, the US has recently been hyping up China's "overcapacity" and raised tariffs on Chinese EVs to 100 percent. What do you think of the US' moves? How will this affect the Chinese economy and world economy?

Wren: They've labeled it as overcapacity. The vast majority of all the production is domestic in China, and the exports into the US are virtually zero. I don't see how that's really a problem for the Americans.

The old dominant powers in those sectors are just begging their governments to stop China immediately, they are very scared about those EV companies in China competing with them. So they're trying to slow this whole process down, and how better to do it than to lobby the government? But to try and slow the best performer is not the right way.

I think that's a big misconception in the minds of Americans, they've been taught to think about enemies, and they've been taught to think about races and winning all the time. Nobody likes competition more than Americans. The absolute essential problem within the advanced economies is that they've come to the realization that the transition into the post-digital era has already happened, and they kind of missed it. It's not a race and there is no end. We're all in this together and we all should keep going. So I think they need to become aware that short-cycle thinking is just nonproductive, and that China is offering a really good model.

GT: Following the news that China recently has lifted an import ban on five Australian beef producers, Australian Deputy Prime Minister Richard Marles said on Sunday that Australia needs the "most productive relationship" possible with China. How do you understand the "most productive relationship" here?

Wren: Now China's export bans on beef are lifted and the tariffs on Australian wine are removed. Prime Minister Anthony Albanese made a speech in parliament a few days ago, and he touted all of that. I think Australia has a long way to go for real integration with Asia. The Regional Comprehensive Economic Partnership (RCEP) is a very good step forward, and I think over the longer term that will prove to be better. But they are kind of locked into a diminishing colonial mentality, so they need to readjust and rethink all of those things. I think they'll discover that there's real flexibility and patience in the Chinese government to accommodate and to work with Australia, which is not just in relation to China, but in relation to the entire Asia-Pacific region, and Australia will benefit enormously.