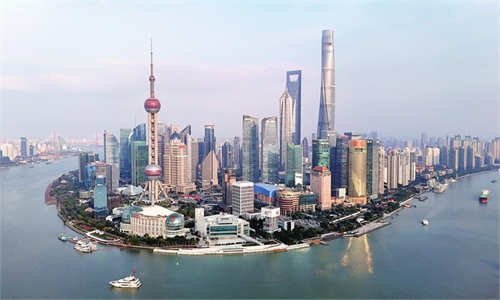

A view of Shanghai Photo: VCG

HSBC said on Tuesday that it has completed acquisition of Citi's retail wealth management business in the Chinese mainland, as the London-based bank is expanding its operations in China's wealth management market, showcasing confidence in the market's growth potential.

The acquired assets and deposits, as well as the associated customers across 11Chinese mainland cities, have been integrated into HSBC as part of the deal. Over 300 employees have also been transferred to HSBC, according to a press release the company sent to the Global Times on Tuesday.

"HSBC has confidence in the growth potential of the China market and has been making substantial investments here, in particular into the fast-growing wealth management sector," Mark Wang, President and CEO of HSBC China, was quoted as saying.

"Completion of the deal enabled us to further strengthen our competitive edge amongst foreign banks providing wealth services in the country. Going forward, we will keep supporting our clients both home and abroad to seize opportunities from connecting China and the world economy, fully leveraging our capabilities in cross-border financial services," Wang said.

HSBC and Citi first announced the transaction in October 2023.

Luke Lu, Citi Country Officer and Banking Head for China, said in a separate press release that "Citi is proud to have a long history in China, and we are intently focused on growing Citi's institutional businesses in China, serving clients in the market through our network to support their cross-border needs."

Citi said it is pursuing the establishment of a wholly-owned securities and futures company in the Chinese mainland.

These two financial firms' move come as foreign financial institutions are increasing investments in the China mainland market amid the country's high-level opening-up and stable economic recovery.

In May, US payment company Mastercard's Chinese joint venture opened for business.

In March, Standard Chartered Securities (China) Ltd announced at its grand opening ceremony that it has officially opened for business.

A couple of foreign financial institutions such as Fidelity Investment Group and global asset management company Alliance Bernstein also announced increase of the registered capital in their Chinese subsidiaries.

In recent years, China has been steadily promoting high-level opening-up in the financial sector, with more than 50 measures introduced, including allowing international investors to invest in the country's capital market via more channels and lifting ownership caps for foreign institutions of securities, futures and funds.

China will further promote high-level opening-up and ramp up efforts to introduce and utilize foreign investments, according to an action plan released by the General Office of the State Council on March 19.

Efforts will be made to expand the business scope of foreign financial institutions in the bond market, and conduct pilot investment programs for qualified foreign limited partners in China, it said.

Global Times