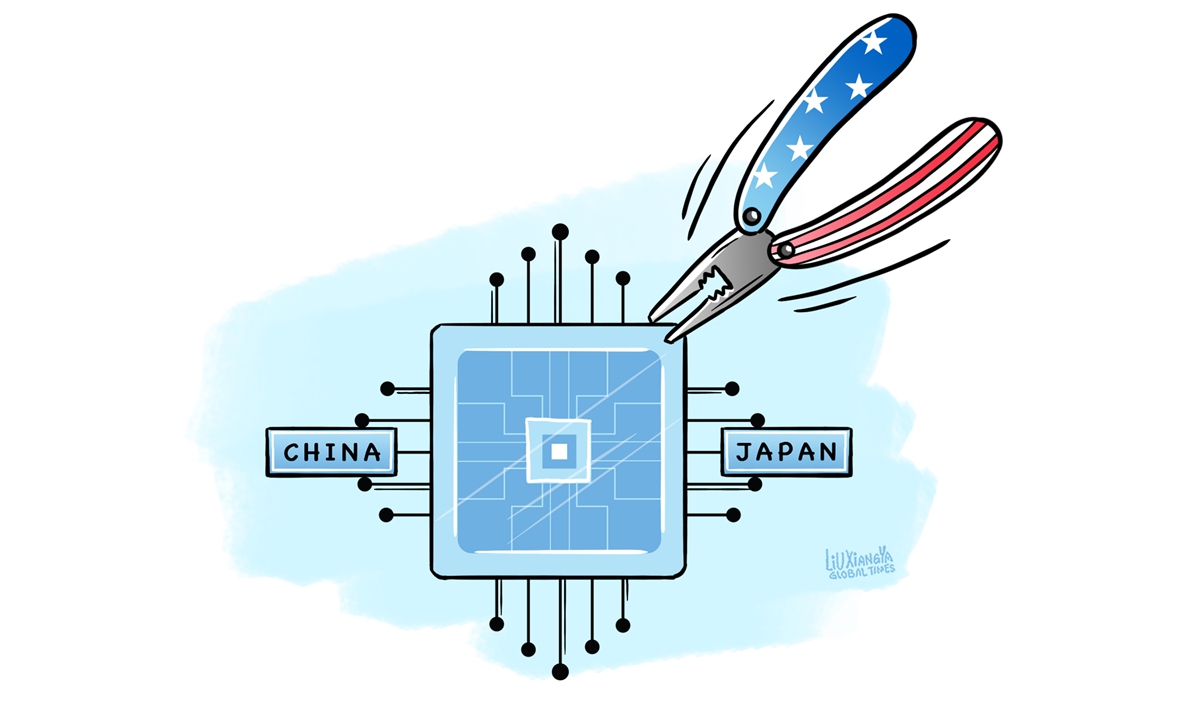

Illustration: Liu Xiangya/GT

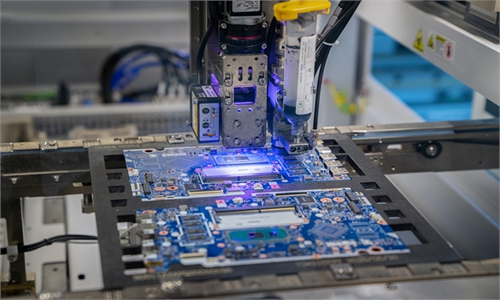

At least 50 percent of Japan's exports of semiconductor manufacturing equipment went to China for a third straight quarter in the January-March period, Nikkei Asia reported on Wednesday. The figure offers a glimpse into an increasingly complex high-tech industrial chain between China and Japan.The value of these exports to China jumped 82 percent in the first quarter to 521.2 billion yen ($3.32 billion), according to Nikkei Asia. Some analysts attribute the surge to concerns that the US may pressure Japan to strengthen controls on exports of semiconductor-related technologies to China, which has led to hoarding.

However, in our view, this cannot fully explain the increase in Japan's semiconductor manufacturing equipment exports to China. Other factors to be considered include that Japan's focus on developing its high-end manufacturing sector is likely to result in growing export demand.

The Japanese economy is recovering at a moderate pace. Some people consider semiconductors and other high-tech industries as driving forces to help lead Japan out of its deflationary malaise of sluggish growth once and for all.

In order to secure a stable semiconductor supply, Japan's government set aside a total of 4 trillion yen between fiscal 2021 and fiscal 2023 as subsidies to help companies build semiconductor plants in the country, according to the Japan Times.

Japan's semiconductor ambitions deserve attention given this context, as they demonstrate that Japan is doubling down on high-end manufacturing to reboot its economy, despite challenges.

As a result, export demand for Japan's high-end manufacturing industry is picking up. The Japanese economy doesn't have a vast domestic market like China and because of this narrow domestic market space, a large number of Japanese high-end manufacturing products had to "flow" into the world.

From an economic perspective, China's vast market makes the country an ideal place for Japanese high-end manufacturing. China is moving to promote the high-quality development of its manufacturing sector. In this process, imports of core equipment and components used in the manufacturing process have increased. It fully demonstrates the strong complementarity of the two economies, especially in the field of manufacturing equipment.

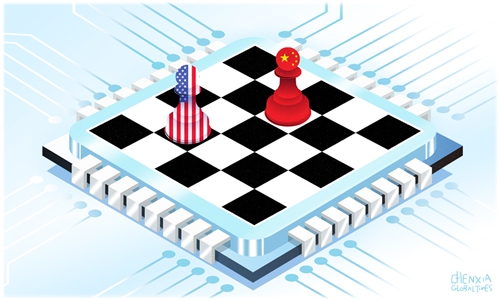

A closer look into Asian industrial and supply chains shows that at a time when the US is frequently suppressing China's high-tech industry, China is still closely connected to the Asian industrial chain, and supply chain restructuring has been accelerated.

Japan is expected to further move up the supply chain to focus more on advanced manufacturing equipment and components. In the meantime, China's manufacturing activity is shifting to more technology-intensive products. As China climbs up the value chain, some labor-intensive manufacturers are relocating part of their production to Southeast Asia.

It's no secret that Washington wants Japan to further restrict exports of advanced manufacturing equipment and components to China. Its real purpose is to curb China's growth in high-tech manufacturing industries such as semiconductors.

However, Japan should worry about the collateral damage it may suffer from America's escalating high-tech dispute with China. If Japan's exports of semiconductor manufacturing equipment are further restricted, it will have a negative impact on Japan's semiconductor industry and the upgrading of its manufacturing industry.

The manufacturing industry in Japan is undergoing a key phase in its transformation and upgrading while facing problems in the balance between supply and demand. Exports have played a crucial role in promoting manufacturing restructuring. Therefore, China and Japan have common ground while strengthening cooperation in high-end manufacturing industrial and supply chains.

Japan has a large and highly advanced manufacturing sector. While Japan is committed to stepping up the development of its chip industry, there should be frank communication and dialogue between China and Japan on how to establish a stable semiconductor supply chain and resist external interference.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn