NDRC spokesperson Li Chao hosts a press conference in Beijing on June 18, 2024. Photo: Chu Daye/GT

The economy further consolidated its expansion trend in May, with positive factors amassing, a spokesperson of the National Development and Reform Commission (NDRC) said on Tuesday.

The comment came a day after China announced economic performance data for May, indicating that the world's second-largest economy is on a steady recovery track.

The output of industrial enterprises above the designated size - industrial enterprises with annual business revenue of more than 20 million yuan ($2.76 million) - grew by 5.6 percent year-on-year, while retail sales rose by 3.7 percent, data from the National Bureau of Statistics showed on Monday, indicating a continuous expanding trend.

During the first five months, fixed-asset investment rose 4 percent year-on-year, compared with 4.2 percent in the first four months.

Commenting on a question about why retail sales and investment data are still not strong, NDRC spokesperson Li Chao told a press conference on Tuesday that China's economy is further consolidating the expansion trend seen in May, with positive factors amassing following the landing of a wide range of supportive policies.

"Although specific metrics have shown fluctuations, more improved in May compared with April," Li said, noting that production, industrial profitability, domestic demand, exports, employment and consumer prices all showed signs of improvement.

Chinese analysts said despite challenges, such as global protectionist headwinds and continuous sluggishness in the nation's property sector, the Chinese economy is expected to have shown sound development in the second quarter.

Noting that the economy faces rising complexity, austerity and uncertainty in the external environment, with difficulties lying ahead in the recovery, Li said more efforts will be given to promoting the implementation of key strategies and beefing up security capacity in key sectors with the issuance of ultra-long special treasury bonds, and further promoting equipment upgrades and trade-in programs of consumer goods.

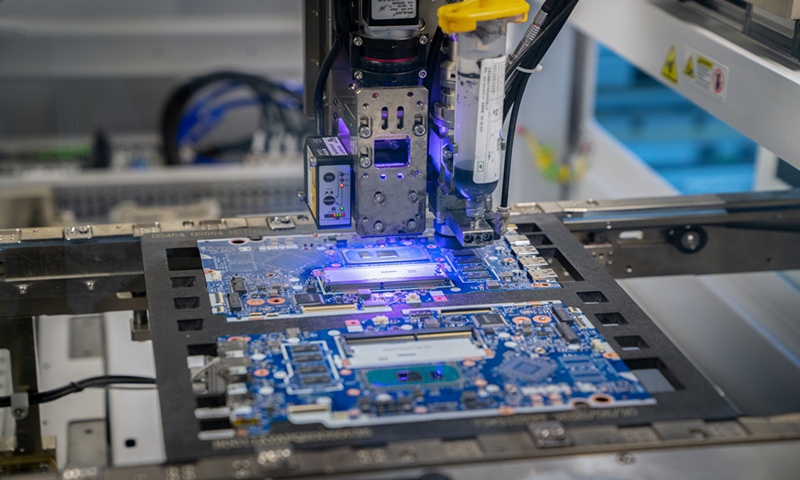

With the joint efforts of all sides, equipment upgrades and trade-ins of consumer goods have gotten off to a good start. From January to May, investment in purchasing equipment and appliances increased by 17.5 percent year-on-year, contributing more than 50 percent to total investment growth.

Meanwhile, sales revenues from trade-in programs of home appliances at major e-commerce platforms surged by more than 80 percent on a yearly basis, according to the NDRC.

Li said that steady implementation of the equipment upgrades and trade-in programs is underway. All localities have announced specific action plans and funds are in the pipeline.

The Ministry of Finance has allocated a total of 6.46 billion yuan to support car trade-ins and an additional 500 million yuan to support scrapping of aged and outdated agricultural machinery.

Li noted that construction work on 80 percent of the projects supported by the 1 trillion yuan in treasury bonds issued late in 2023 had started by end-May, up from 72 percent in mid-May.

Analysts said the projects funded by treasury bonds and massive upgrade programs, together with improving external conditions, will underpin growth in the second quarter and the second half of the year.

Wen Bin, chief economist at China Minsheng Bank, told the Global Times on Tuesday that China's export strength will continue to gain traction amid resilient global demand, and give a lift to relevant industries.

Supportive policies, with fiscal policy having ample scope, will continue to exert an effect on expanding demand, and they are expected to shore up the recovery, Wen said.

Second-quarter GDP growth could reach 5.5 percent, Wen said.

Sun Chuanwang, a professor at Xiamen University, told the Global Times on Tuesday that expanding investment, along with recovering demand and stable exports, will drive second-quarter growth.

"Large-scale equipment updates have afforded strong support for manufacturing investment growth, coupled with the leverage effect of government funds," Sun said. "Investment is set to further improve both in terms of scale and speed, positively affecting second-quarter growth."

Sun said that second-quarter GDP growth will be 0.1-0.3 percentage points higher than the first quarter.

The NDRC said that equipment upgrades and trade-ins in the cultural and tourism sectors will meet the increasing demand for high-quality travel experiences.

Investors are also keenly awaiting clues from the upcoming third plenary session of the 20th Communist Party of China Central Committee in July, to see how policymakers would press ahead with comprehensively deepening reform and further shoring up the vitality of the real economy.

China's GDP grew 5.3 percent year-on-year in the first quarter, statistics showed.