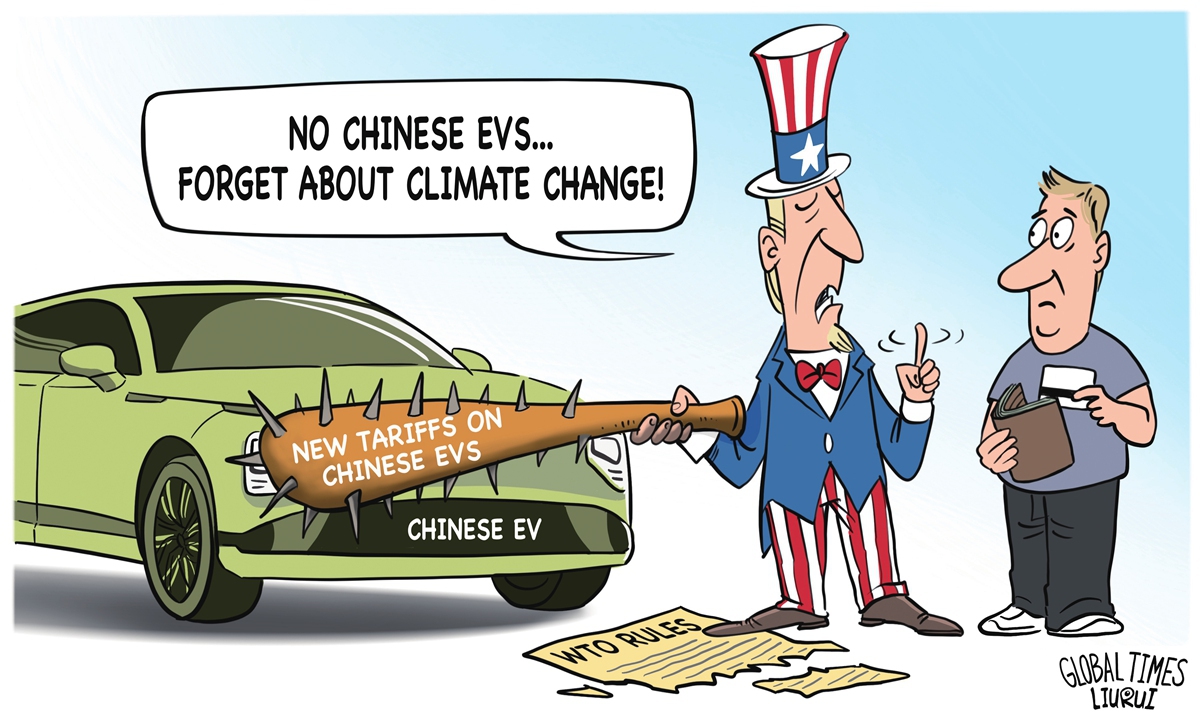

Abusing tariffs. Illustration: Liu Rui/GT

The imposition of steep extra tariffs by the US on electric vehicles (EVs) from China has sparked a chain reaction of protectionism in the emerging sector, reshaping the global auto industry by impacting not only Chinese automakers but European ones too.Volvo will postpone US deliveries of its EX30 electric vehicle (EV) due to the US tariffs on EV exports from China, a company spokesperson said on Wednesday, according to Reuters. The Swedish brand is reportedly expanding production of the EX30 SUV outside China to a plant in Belgium, with a focus on serving North America and Europe.

In the intricate trade landscape, Volvo's delayed delivery serves as a mere glimpse into the disruptions and uncertainties caused by tariff policies on multinational automakers. These policies are now playing a significant role in preventing global car manufacturers from making the most efficient decisions, compelling them to navigate tough choices and bringing new challenges for consumers and the entire industrial chain.

The high tariffs imposed by the US, although ostensibly targeting the Chinese EV industry, have actually disrupted the development pace of the EU auto industry. This may partly explain why the US imposed such high tariffs on Chinese EVs even though it does not import many, as it may be aimed at influencing the global EV industry through high-profile trade policies. As it stands, the US policy has prompted the European action against Chinese EVs and the ensuing controversy, reflecting tensions and protectionist inclinations in the current global trade landscape.

For a long time, China, with its mature supply chain and manufacturing capabilities, was once an ideal location for global car manufacturers seeking cost efficiencies and production capacity. However, due to growing protectionist policies, multinational automakers have been forced to reassess their global production distribution and reluctantly make compromises. Take Volvo as an example. While the company plans to expand part of the production to Belgium, which is essentially an attempt to bypass US tariff barriers and maintain competitiveness in the American market, such adjustment, which is not market-based, always comes at a price.

In light of the current circumstances, it is improbable that relocating production lines will enhance production efficiency; instead, it may lead to rising cost, supply chain reorganization, and a myriad of issues. Ultimately, consumers will bear the burden of these heightened costs. This not only poses a challenge to the widespread adoption of EVs in the US and Europe but also has the potential to dampen consumer enthusiasm for EVs, thereby affecting the sustainable development of the industry as a whole.

It is worth noting that this tariff-induced shift in production lines poses a significant challenge not only for any individual European brand, but also for the entire European auto industry that is already grappling with intense global competition. European automakers need to boost research and development investment and enhance production efficiency to keep pace with their Chinese counterparts in terms of competitiveness. Nevertheless, the need to redirect limited resources and energy toward the transfer and adjustment of production lines has inevitably diverted their focus from innovation and enhancing their core competitiveness.

In this sense, the EU is advised to exercise caution in following the US. The EU and China share a strong partnership in the EV industry, encompassing technology sharing, market entry and supply chain alignment. Following the US' move to hike tariffs could jeopardize these collaborations and affect the EU's own economic interests and industrial competitiveness.

Trade negotiations between China and the EU are already under way. Although there may not be significant policy changes in the short term, the EU needs to recognize that imposing extra tariffs to limit Chinese EVs could ultimately backfire and harm the EU in the long run. This is because on the one hand, concerns over China's potential retaliation may cause some European automakers to relocate. On the other hand, the US blocking of Chinese EVs has exacerbated the trade dispute with Europe over the US Inflation Reduction Act, making trade negotiations more difficult. After all, the US is the main market for many European car brands, and any tariff increase on Chinese EVs could be tantamount to encouraging the US to continue raising taxes on European auto imports.