Soybean Photo: VCG

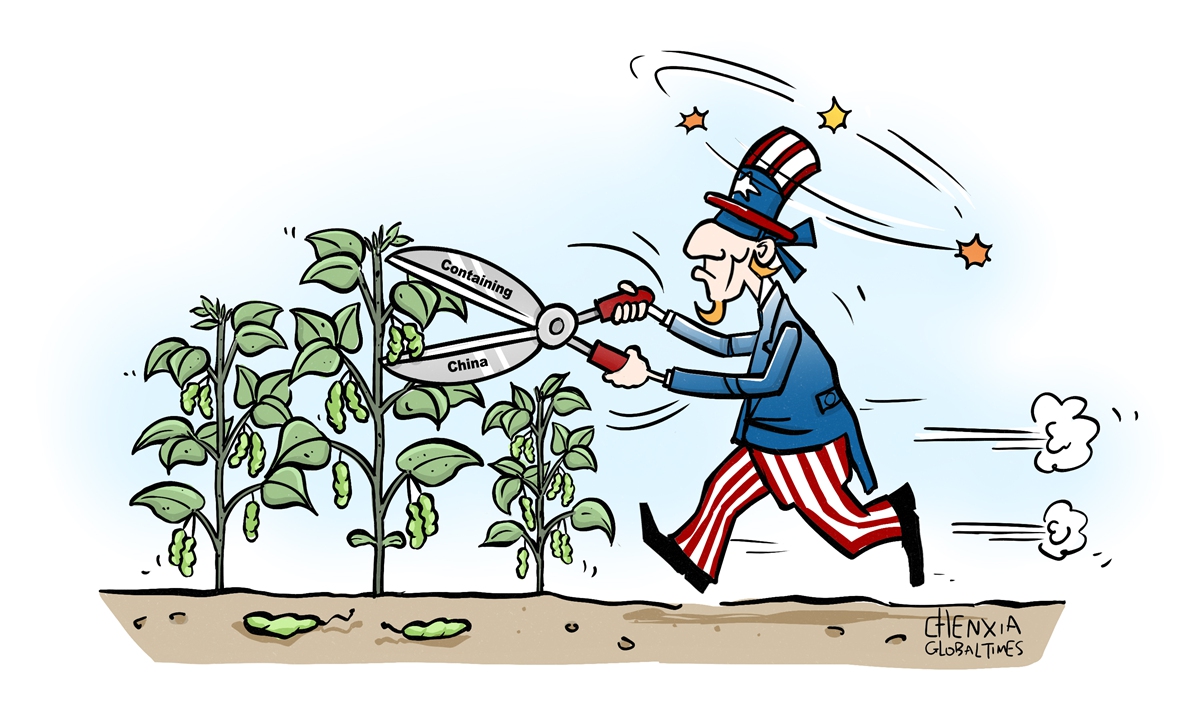

China will continue to diversify sources for soybean imports following China's reported first soybean purchase from the US in 2024, which came in about seven months late. The move aims to further safeguard a stable supply as the country still depends on soybean imports alongside its growing domestic production, observers noted.

The comments were made after the US Department of Agriculture on Wednesday local time announced that private exporters reported sales of 132,000 metric tons of soybeans for delivery to China during the 2024-25 marketing year.

The deal is reportedly China's first purchase of US soybeans for the upcoming season, which came well behind the time when China usually starts booking US soy cargoes, according to Bloomberg on Thursday. The report said that China started to buy US supplies in December 2022 for the 2023-24 year - roughly beating this year's timeline by about seven months.

China's soybean imports in 2024 are likely to remain stable or marginally increase, with the major sources concentrating in Americas including Brazil and the US, Li Guoxiang, a researcher at the Rural Development Institute, Chinese Academy of Social Sciences, told the Global Times on Thursday.

Li noted that Brazil has remained the largest soybean export for China due to the strong competitiveness of local soybeans and stable trade relationship with China, leading to a relatively low uncontrollable risk for Chinese importers.

Li said that China still needs to import soybeans from the US, while the timeline [for Chinese importers placing orders] was a result of US' volatile policy settings and risk management efforts taken by Chinese importers.

The order placed by Chinese importers was a choice made to maximize commercial interests based on market demand, Gao Lingyun, an expert from the Chinese Academy of Social Sciences, told the Global Times on Thursday.

In the first five months of 2024, Brazil, the US, Canada, Russia and Argentina remained China's top five soybean importers in terms of value. China imported $12.56 billion of soybeans from Brazil, followed by the US with $6.25 billion and Canada with $531 million, according to data from the General Administration of Customs (GAC).

Other countries including Benin, Ukraine, Uruguay, Ethiopia, and Tanzania also remained some of China's major soybean suppliers, per the GAC data.

Observers stressed the importance of China continuing to diversify soybean importers as the country still depends on the international market.

Diversifying sources will minimize the import risks for China solely relying on a few major importers, as supply may be disrupted by multiple factors such as weather, trade restrictions, as well as uncertainties resulted by changes in local industrial and supply chains, Li said.

Li expected the major trading partners for soybeans will still be in Americas, while there is potential to further explore in Africa and Europe.

Outside of promoting sustainable soybean imports, China has also been ramping up efforts in bolstering the domestic production. According to the Ministry of Agriculture and Rural Affairs, China will continue to expand the soybean planting area to above 150 million mu (10 million hectare) this year. The government will support the northeast region to develop the whole industrial chain of soybean processing and soybean-related agricultural products.