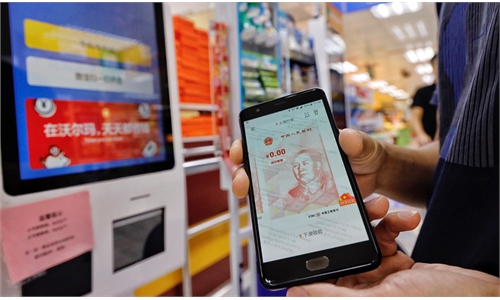

A concept photo of multi-central bank digital currency (m-CBDC) Illustration: VCG

China's first real-trade service of a multi-central bank digital currency (m-CBDC) was launched in South China's Guangdong Province on Monday, an important breakthrough in the application of digital currencies in cross-border payments.

Experts noted that compared with traditional cross-border payments, which rely on the agent model of commercial banks with time-consuming processes, m-CBDC service supports real-time trading, significantly improving efficiency and reducing costs while enhancing the transparency of cross-border transactions.

According to the Shanghai Securities News, the Guangdong Branch of the Industrial and Commercial Bank of China said on Monday that it launched the first m-CBDC business in China at the pre-minimum viable product stage under the guidance of the Guangdong branch of the People's Bank of China (PBC), the central bank, bringing new possibilities for international trade settlements.

The first enterprise to try the program was a trading enterprise in Foshan city in the province, which needed to remit money for trade in goods to a client in Hong Kong. The successful completion of digital yuan cross-boundary remittance clearing through the m-CBDC verified the feasibility and effectiveness of the service.

"The launch of the m-CBDC service marks an important milestone in China's fintech innovation," Wang Peng, an associate research fellow at the Beijing Academy of Social Sciences, told the Global Times on Monday, noting that it will promote the deep integration of the digital economy with the real economy.

It also provides a new, more efficient and convenient solution for international trade settlements, Wang said.

The m-CBDC project is the result of extensive collaboration starting in 2021 between the Innovation Hub of the Bank for International Settlements, the Bank of Thailand, the Central Bank of the United Arab Emirates, the Digital Currency Institute of the PBC and the Hong Kong Monetary Authority.

The project aims to explore a multi-central bank digital currency platform shared among participating central banks and commercial banks, built on distributed ledger technology to enable instant cross-border payments and settlements. It also aims to tackle some of the key inefficiencies in cross-border payments, including high costs, low speed and operational complexities.

The m-CBDC completed its first real-trade pilot test based on the four national or regional central bank digital currencies from August 15 to September 23, 2022.

A total of 20 commercial banks from the four regions or countries jointly participated in the digital currency bridge pilot. The total amount of central bank digital currency issued in the pilot test was equivalent to more than 80 million yuan ($11 million), realizing more than 160 cross-border payment and foreign exchange operations, with a settlement amount equivalent to more than 150 million yuan.

Wang noted that the project supports cross-border payments in a variety of central bank digital currencies, which means that cross-border payments between different countries and regions can be carried out more conveniently without currency exchanges, further promoting the facilitation of international trade.

The project will make the application of the yuan in cross-border payments more extensive and convenient, which will help enhance the international status and influence of the Chinese currency and strengthen its global liquidity.

"With the promotion and improvement of the m-CBDC business, it is expected that more countries and regions will accept the yuan as a currency for cross-border payments," the expert said.

Global Times