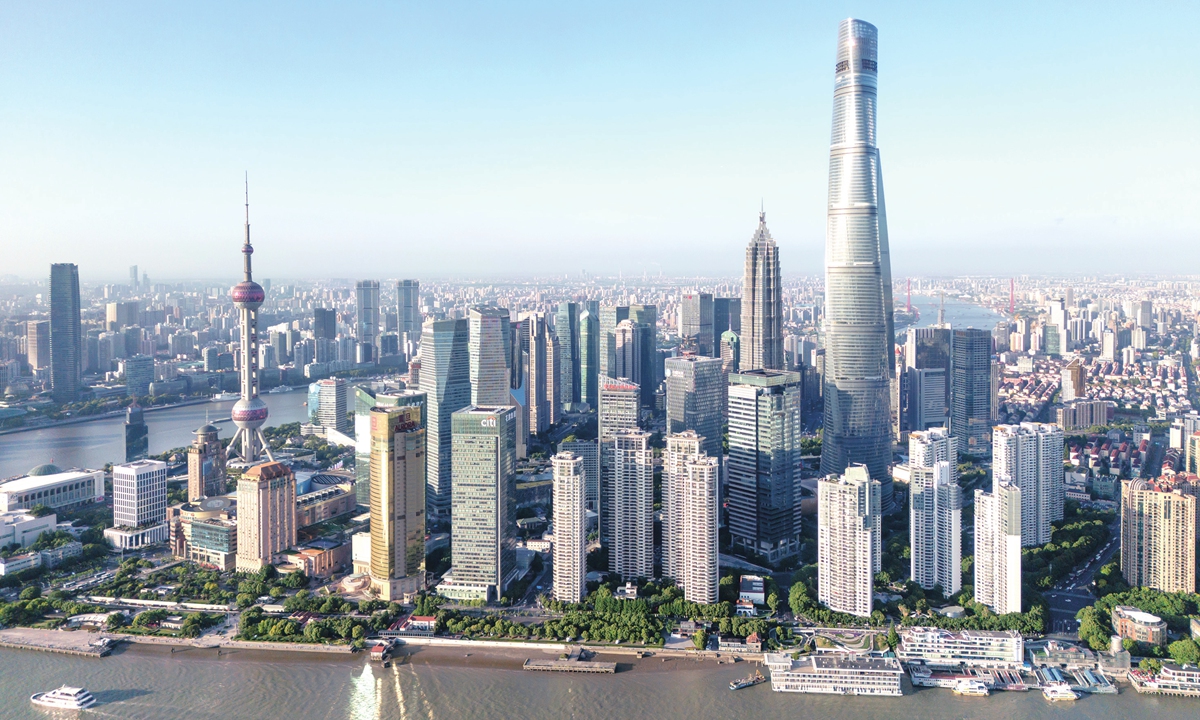

A view of Shanghai's Lujiazui area Photo: VCG

For some time, a few foreign media outlets have been seizing upon the development that individual foreign financial institutions are adjusting their business in China to trumpet the narrative of "foreign financial institutions leaving China." It is important to note that the presence of foreign financial institutions is dynamic in China, some entities entering and others exiting this market.

China's continuous commitment to accelerating high-quality opening-up of its financial sector will increasingly earn recognition from a flurry of foreign financial institutions.

Some foreign financial institutions are relocating business from China due to their global strategic adjustments and the change of their localization strategies.

If foreign financial institutions cannot timely and reasonably arrange their business operations, they may face operational issues. For example, one of the main reasons for the US fund company Vanguard Group to exit from China is the neglect of its localization strategy.

In fact, with the acceleration of China's financial industry opening-up, the scale of business for foreign financial institutions in China is rapidly expanding. By the end of 2023, the number of locally incorporated foreign banks in China had reached 41, with 116 branches and 132 representative offices, and their total assets have exceeded 3.8 trillion yuan ($524 billion).

While some foreign financial institutions have made strategic adjustment to their businesses in China, more foreign financial institutions have chosen to accelerate their expansion in this market. Since 2024, quite a few foreign institutions have applied to enter the Chinese market or establish new institutions.

China continues to expand the breadth and depth of financial opening, enhancing the confidence of foreign financial institutions. At last year's Central Financial Work Conference, it was proposed to steadily expand institutional opening-up in the financial sector and facilitate cross-border investment and financing, so as to attract more foreign financial institutions and long-term capital to invest and operate in China.

Also, the General Office of the State Council in March issued an action plan to steadily promote high-level opening-up and make greater efforts to attract and utilize foreign investment.

In addition to lifting the restrictions on the proportion of foreign ownership in financial institutions, China has also significantly lowered the threshold for market access of foreign investment, further promoting high-quality financial sector opening-up.

The trend of foreign financial institutions coming to China to expand their business shows that in the future, the main focus of foreign financial institutions in China's new business platform will be to provide more comprehensive financial services to global clients.

With the high-quality development of the Chinese economy and the accumulation of Chinese residents' wealth, the demand from Chinese investors for global asset allocation continues to grow. This is a huge market that any financial institution cannot ignore.

More importantly, China's financial opening-up is rapidly gaining pace, aided by the ever-improving financial technology. China's ability to attract global financial resources is also improving. Foreign financial institutions in China are able to provide more comprehensive and efficient financial services for global investors.

China will continue to promote high-quality opening-up of its financial sector, continuously optimizing the business environment for foreign financial institutions, and sharing development opportunities with foreign institutions and global investors. The opportunities in China are just abundant.

Cen Wei is secretary-general and Cheng Yuwei is associate research fellow of Peking University HSBC Business School Think Tank. bizopinion@globaltimes.com.cn