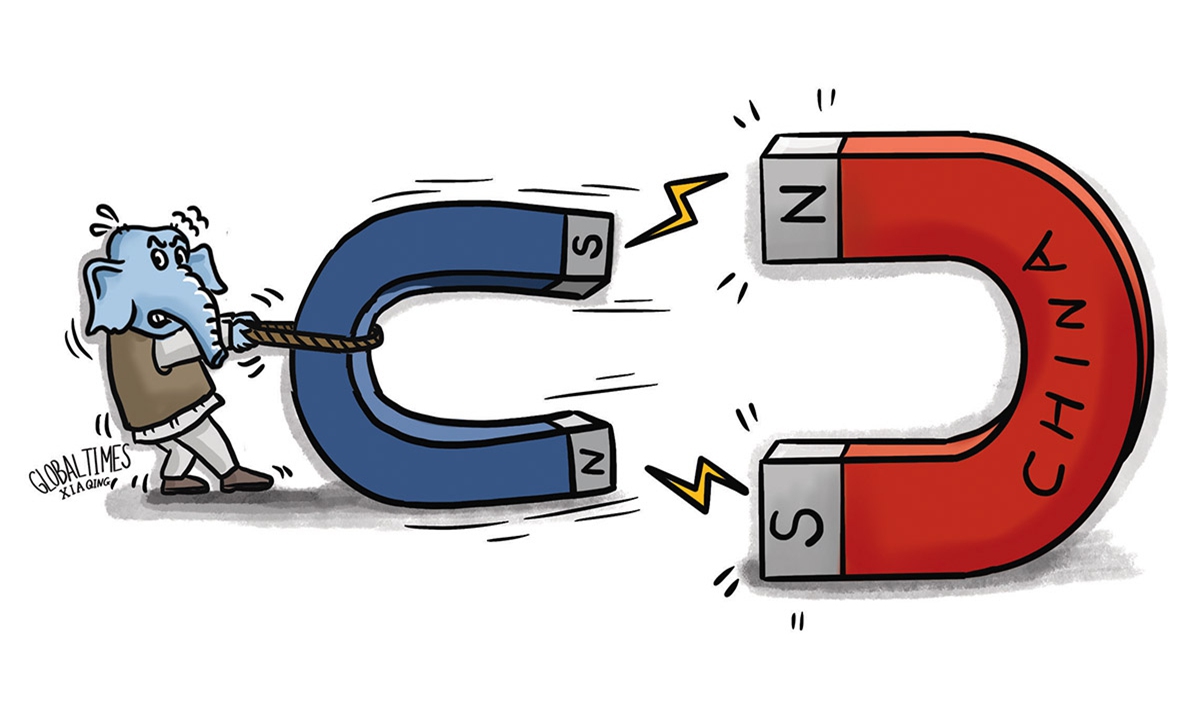

India Illustration: Xia Qing/GlT

India seems to be changing its stance to attract more Chinese investment, but the success of this policy adjustment hinges on whether India still sees China as a strategic rival in geopolitics and security, which hinders trust between the two countries.Indian Finance Minister Nirmala Sitharaman on Tuesday backed her economic adviser's suggestion to allow more Chinese investment in the country, Reuters reported.

The adviser's office works at "arm's distance" but "that doesn't mean I am disowning the suggestion," she said.

Her remarks came just one day after India's Chief Economic Adviser V. Anantha Nageswaran said in the annual economic survey that New Delhi should focus on foreign direct investment (FDI) from China to boost India's exports to the US and other Western countries, and help keep India's growing trade deficit with Beijing in check.

Given the Indian government's heavy scrutiny of Chinese companies in recent years, it is rare to see Indian officials make such a favorable suggestion on Chinese investment in India.

While this may suggest an adjustment in India's attitude toward Chinese investment, the complex geopolitical landscape and India's policies toward Chinese companies necessitate that Chinese investors proceed with caution and manage their expectations accordingly.

This potential change could be a reflection of the Indian government's proactive efforts to improve the investment climate and draw in foreign capital. India's central bank data showed that the country's net FDI inflow dropped by 62.17 percent year-on-year to $10.58 billion in 2023-24, a 17-year-low, Reuters reported. The decline indicates a significant challenge to India's ability to attract foreign investment amid global economic uncertainty, trade protectionism and geopolitical risks.

As an emerging market, India is being tested in its capacity to attract foreign investment, despite recent reforms aimed at improving the business environment. However, shortcomings in administrative efficiency, policy implementation and discriminatory restrictions on Chinese investment continue to undermine foreign investors' confidence, particularly among Chinese investors.

Against this backdrop, the ability of India to embrace a more open and proactive approach to attracting Chinese capital could serve as a litmus test for its economic development strategy. As an important trading partner of India, China has always played a significant role in driving the Indian economy through its direct investment and trade ties.

Chinese investment can bring funds to India, introduce advanced technology and management experience, and promote the upgrading of Indian industries and the optimization of its economic structure.

However, due to the influence of geopolitical factors on bilateral economic and trade relations, India still faces challenges in altering its stance and attracting Chinese investment. India's vigilant stance toward China and its zero-sum game mentality of perceiving China as a rival have impeded economic collaboration.

Its discriminatory policies toward Chinese companies have seriously dampened Chinese companies' willingness to invest in India, thereby adversely affecting economic cooperation.

If it wants more Chinese direct investment, India must show increased sincerity and fairness through tangible actions rather than just words. India needs to implement fair and transparent investment policies, enhance the investment climate, bolster intellectual property protection and ensure that Chinese companies have equal competitive opportunities.

The establishment of political mutual trust is a long and complex process, but it can be facilitated by economic and trade cooperation. Through economic collaboration, India and China can foster understanding and trust based on mutual benefit, gradually resolving political differences and uncertainties.

This partnership will benefit the economic growth of both nations and contribute to regional and global peace.