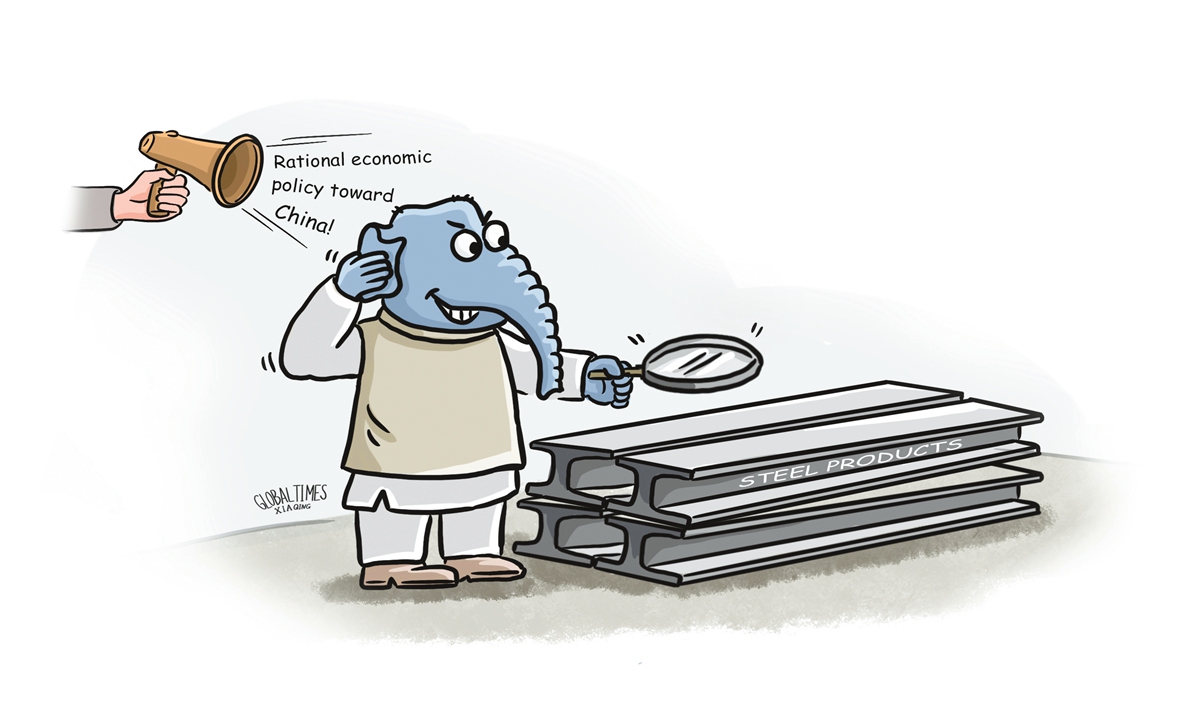

Illustration: Xia Qing/GT

India's Ministry of Steel has asked the trade ministry to investigate "cheaper steel" imports from China and Vietnam, Reuters reported on Wednesday, citing a government source directly aware of the matter. If this was true, we hope India could think twice. A protectionist investigation against imported steel will strike at foreign investors' confidence in the Indian economy.The Reuters report came at a time when debate was raging about whether restrictions on Chinese investment should be relaxed in India. In July, India's Chief Economic Adviser V. Anantha Nageswaran said in the government's annual economic survey that New Delhi should focus on foreign direct investment (FDI) from China to boost India's exports. This represents a rational voice within Indian society, showing that a few sensible people have started to speak out. Obviously, India needs foreign investment, including from China.

However, there have been opposing voices, which is regrettable. Indian Commerce and Industry Minister Piyush Goyal said on Tuesday that India is not re-thinking the issue of allowing Chinese investments into the country. His remarks risk further damaging investors' confidence and lead to concerns about a further deterioration in India's business environment.

We hope that the debate on whether India should ease restrictions on Chinese investment can continue, and more rational voices can speak up to ensure foreign investors receive fair treatment, rather than ending the discussion with Goyal's words.

At this critical moment, if India announces an investigation into steel imported from countries including China, it will exacerbate protectionism and nationalism, which is not in the interests of the Indian economy. In the meantime, it will further undermine the confidence of international investors.

India's attractiveness to foreign investment is declining, and it is necessary to boost the confidence of international investors in order to achieve the goal of attracting $110 billion in FDI annually. It is hoped that the rising rational voices in India will attract the attention of international investors and won't be drowned out by irrational decisions such as "investigating imports of steel from China."

Actually, this is not the first time India has targeted Chinese steel. Before the COVID-19 pandemic, India conducted an anti-dumping investigation and even imposed anti-dumping and anti-subsidy tariffs on some steel products from China, which significantly raised the costs of relevant products in the Indian market and affected the mutually beneficial trade cooperation between India and China in the steel industry.

After the pandemic, demand in India expanded, and with the recovery of the Indian economy, demand for Chinese intermediate products like steel further increased. In 2021, India ended some of the anti-dumping and anti-subsidy tariffs on steel products to reduce the production costs of domestic companies and promote the recovery of the domestic economy. India's imports of steel from China experienced a recovery.

This is evidently proof that increased imports of high-quality, cost-effective steel from China are beneficial for India's economic recovery from the impact of the pandemic amid multiple challenges.

India is just beginning to see momentum in its economic recovery after the pandemic, so if India were to immediately target steel imports from China, it would undoubtedly risk the good momentum of its economic recovery.

The level of urbanization in India is still relatively low. The South Asian country is undergoing an infrastructure boom. Despite India's efforts to increase steel production in recent years, there is still a significant gap between supply and the rapidly growing demand for steel. For some time, India will still need to import large amounts of affordable, high-quality steel.

With the growth of the Indian economy, the demand for steel imports from China, the largest steel producer in the world, will continue to grow. This reflects the complementarity of economic and trade relations between the two countries. It would be a rational choice if India refrained from protectionist and capricious approaches on economic and trade cooperation with China.

In recent years, India's aggressive moves to suppress industries such as Chinese smartphones through unconventional and radical means have severely dampened the confidence of Chinese businesses. Imposing more trade barriers or restrictions on Chinese steel will only further damage India's business environment, leading foreign companies to avoid such an uncertain market.

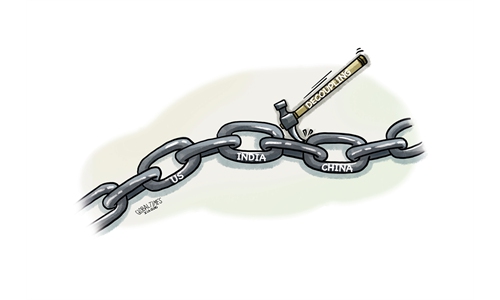

Despite India's targeted crackdown on Chinese companies involved in mobile app development and phones manufacturing, bilateral trade between the two countries has continued to rise. This growth is supported by mutually beneficial trade cooperation, especially India's imports of cost-effective industrial intermediate products like steel.

Failure on India's part to adjust its economic policies toward China, particularly in the steel trade sector, in response to shifts in domestic demand and economic regulations could have a profoundly negative impact on trade with China and the Indian economy as a whole. It is hoped that India will heed rational voices in shaping its economic and trade policies, and will continue to collaborate with China in areas of shared interest.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn