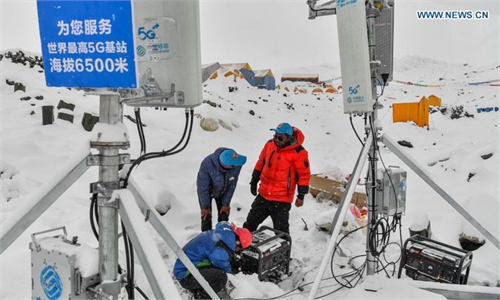

A consumer orders food at a branch of Burger King in Shanghai on Friday. Photo: GT

Competitor McDonald's is also rolling out price cuts to draw consumers, which experts and media reports suggested shows that foreign fast food brands want to expand their market share and tap into China's greater potential.

Starting on Monday, four of Burger King's signature burgers will be priced at 9.9 yuan each for four consecutive weeks. For example, the price of a fruitwood grilled chicken burger will be slashed from the original 24 yuan to 9.9 yuan. The prices of other burgers will be cut by similar levels.

The company describes this promotion as an unprecedented move, aiming to engage consumers with extended duration and competitive pricing across dine-in, delivery and e-commerce platforms, without membership restrictions, according to media reports.

This move follows Burger King's strategy of frequent low-price promotions in the second half of this year. The 9.9-yuan burgers are comparable to McDonald's recent promotion offering burgers starting at 10 yuan for 14 consecutive days, which began in early July.

It is the time for hamburgers to rapidly penetrate China's catering market, Yicai Global reported, citing Tang Junzhang, chief marketing officer of Burger King China.

Tang told thepaper.cn that because the cost of burgers is 2-2.5 times that of coffee, selling them at 9.9 yuan won't bring immediate profits. But in the fiercely competitive fast-food market, the company may not be able to survive without price promotions, he told the paper.

"In the current competitive Chinese market, consumers are keen on seeking discounts, influencing their purchasing decisions based on the best deals available," commented a McDonald's executive when evaluating the company's second-quarter performance in China.

As foreign fast-food chains unveil promotional activities, domestic brands like Wallace (Hua Lai Shi in Chinese), are expanding rapidly with low average transaction values, intensifying competition in China's fast-food chain market, the Global Times learned.

Faced with multiple challenges in the market, Burger King, positioned in the medium- to high-end segment, has been compelled to join the price competition.

Burger King's steps to expand market share in China have not stopped. At the end of last year, the company revealed plans to open more than 200 new stores in 2024. Currently, Burger King's stores are primarily concentrated in first- and second-tier cities, but the company will expand into more third- and fourth-tier cities, according to media reports.

In recent years, the overall scale of the Western fast-food market in China continued to expand. According to iiMedia Research Institute, the market was 368.78 billion yuan in 2023, up 36.3 percent year-on-year and surpassing the average development level of the entire catering industry.

It is expected that this year, the market scale will reach 427.78 billion yuan, indicating significant growth potential amid the faster-paced lifestyles of urban residents.

The price competition among Western fast-food brands is driven by multiple factors. On the one hand, competition this year is intense, calling for competitive pricing to gain market share, Zhao Jingqiao, director of the Service Economy and Catering Industry Research Center under the Chinese Academy of Social Sciences, told the Global Times on Sunday.

Zhao said that many domestic private enterprises are also rapidly expanding into the Western fast-food sector and intensifying the competitive pressure.

"On the other hand, it is evident that foreign food and beverage enterprises remain optimistic about the domestic consumption market. Given China's large population, with significant consumption potential in third- and fourth-tier cities, there are numerous opportunities in the lower-tier markets," said Zhao.