Illustration: Chen Xia/GT

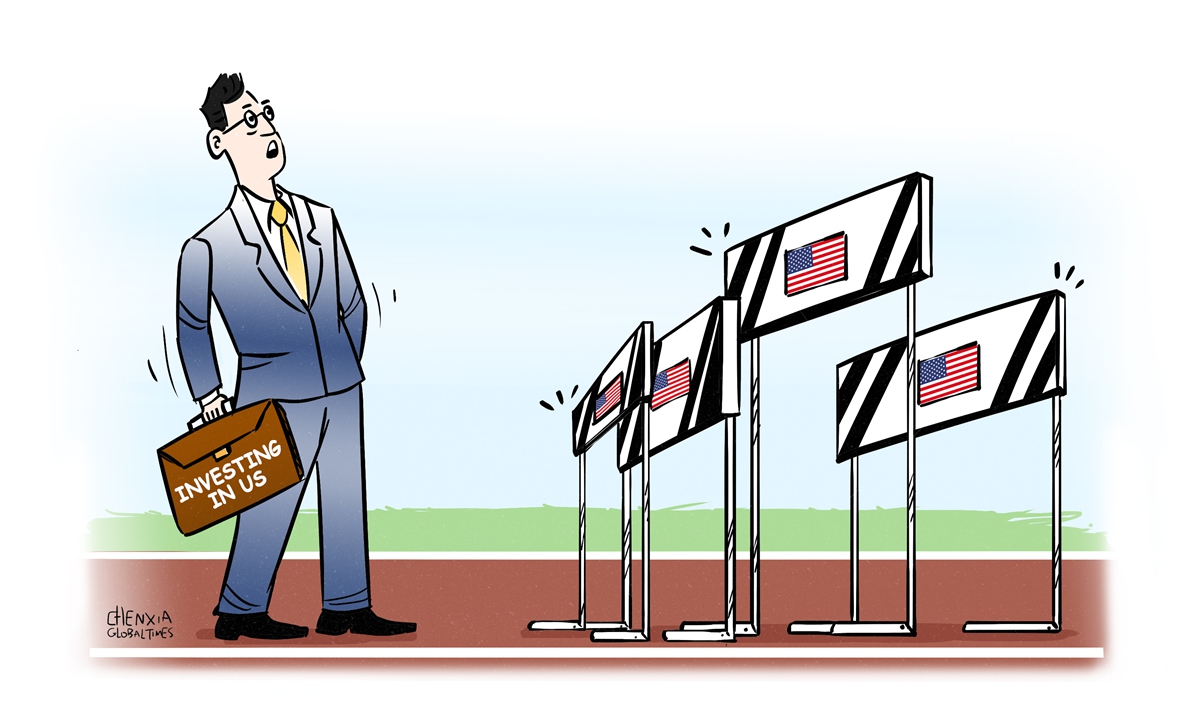

The AP published an article on Monday under a headline: "Chinese businesses hoping to expand in the US and bring jobs face uncertainty and suspicion." What the article describes is beyond regrettable and truly deplorable. "Chinese businesses are coming to the US with money, jobs and technology, only to find rising suspicion," the report said.The US has always touted itself as the world's best destination for inward foreign direct investment, but the investment environment in the US is deteriorating. In recent years, the US has generalized the "national security" concept, abused export controls and drawn up discriminatory lists aimed at cracking down on Chinese companies. In the process, Washington has come to view normal business competition through a geopolitical lens. The US is largely in a mode of zero-sum games and treats China with a lot of suspicion and even hostility. All of this will deal a serious blow to investor confidence.

An economic dilemma is brewing in the US. A zero-sum mentality has disturbed the order and atmosphere of international cooperation, and undermined foreign investors' confidence. However, the US economy urgently needs foreign investment in manufacturing and high-tech industries. This means the country needs an open environment to attract international investment.

For a long time, there has been much discussion about measures to revive manufacturing in the US, but the manufacturing sector is still facing challenges and difficulties. A measure of US manufacturing activity dropped to an eight-month low in July amid a slump in new orders. The Institute for Supply Management said last week that its manufacturing purchasing managers' index dropped to 46.8 in July, the lowest reading since November, from 48.5 in June, according to Reuters.

Instead of relying solely on persuading US manufacturers to reshore their operations from overseas to revitalize the US manufacturing sector, the country should step up efforts to attract the world's first-class manufacturers, including Chinese companies, to invest in the US.

China's manufacturing development has ranked among the top tiers in the world. Now, the country is home to a number of first-class manufacturing companies. These enterprises have advantages in fields such as the next-generation information technology industry, 5G, high-end computer numerical control machines, robots, energy conservation, new-energy vehicles and lithium batteries.

The danger for America is that by generalizing the "national security" concept, it will progressively isolate itself from the world's first-class competitive enterprises as the rest of the world continues to spare no effort to attract manufacturing investment. As America inadvertently isolates itself, it gets more frustrated. The more failed Washington's economic policy is, the more hysterical US politicians will be to politicize economic issues. That's the risk.

Expenditures by foreign direct investors to acquire, establish or expand US businesses totaled $148.8 billion in 2023, according to preliminary statistics released in July by the US Bureau of Economic Analysis. Expenditures decreased $57.4 billion, or 28 percent, from $206.2 billion in 2022 and were below the annual average of $265.6 billion for 2014-2022. It's a microcosm of the US economy, which has been losing vitality.

Some US politicians may hope their suppression of Chinese companies won't affect the confidence of investors from other countries, but those people are going to be deeply disappointed by the result. Skepticism of Chinese investment, as well as Washington's tightened suppression of Chinese companies, represent a rise of protectionism and economic nationalism in the US. This marks a deterioration in the US business climate and a step backward in economic and ideological openness, which will undermine the confidence of all foreign investors.

China and the US have one of the world's most important and complex bilateral relationships. The potential for economic cooperation is big, and US politicians obviously still value the China market. We sincerely hope Washington can provide fair treatment to Chinese companies and promote mutually beneficial cooperation between the two countries.

The author is a reporter with the Global Times. bizopinion@globaltimes.com.cn